Factors and Actors

A Global Perspective on the Present, Past and Future of Factoring

Summary

The collaborative Factors & Actors project has been developed and fleshed out step by step. It has never been restricted to any particular region of the world, or any particular context or product. The collective work offered to the reader includes 30 contributions from 37 contributors who, each in their own way, cast a different eye over the birth of the global organization, the origins of such a type of financing, its 50 years of emergence and its future development against a backdrop of ever stricter regulation, compliance and risk management and in an environment of increasing technological innovation.

The objective of this project is to increase awareness about a very special financing activity and its numerous virtues supporting the real economy, via both history and geography. Today factoring stands at the crossroads. Ten years after the start of an unprecedented financial crisis, the time is ripe to promote this new form of sound, secure and innovative financing.

Excerpt

Table Of Contents

- Cover

- Title

- Copyright

- About the author

- About the book

- This eBook can be cited

- Table of Contents

- Table of Abbreviations

- Introduction: Factoring at a Crossroads (Patrick de Villepin)

- Prologue: Strength of a Multilateral Organisation (Patrick de Villepin)

- 1. FCI, a New Chain for Tomorrow (Peter Mulroy)

- 2. IFG, Developing the Factoring Industry Worldwide (Erik Timmermans)

- 3. EU Federation, Defending Factoring and Commercial Finance in Europe (John Gielen / Erik Timmermans)

- 4. New Trends in Worldwide Factoring (Daniela Bonzanini)

- Part I: Past – Factoring Roots and Evolution (3rd Century BC to 20th Century AD)

- Introduction (Patrick de Villepin)

- A – Roots

- 5. Factoring: Origins Rooted in Ancient Times (Damien Agut / Véronique Chankowski / Laetitia Graslin-Thomé)

- 6. Getting Cash from Receivables in Ancient Rome (Gérard Minaud)

- 7. Factors in the Middle Ages, Credit and Society at the Dawn of a New Profession (Armand Jamme / Enza Russo)

- B – Evolution

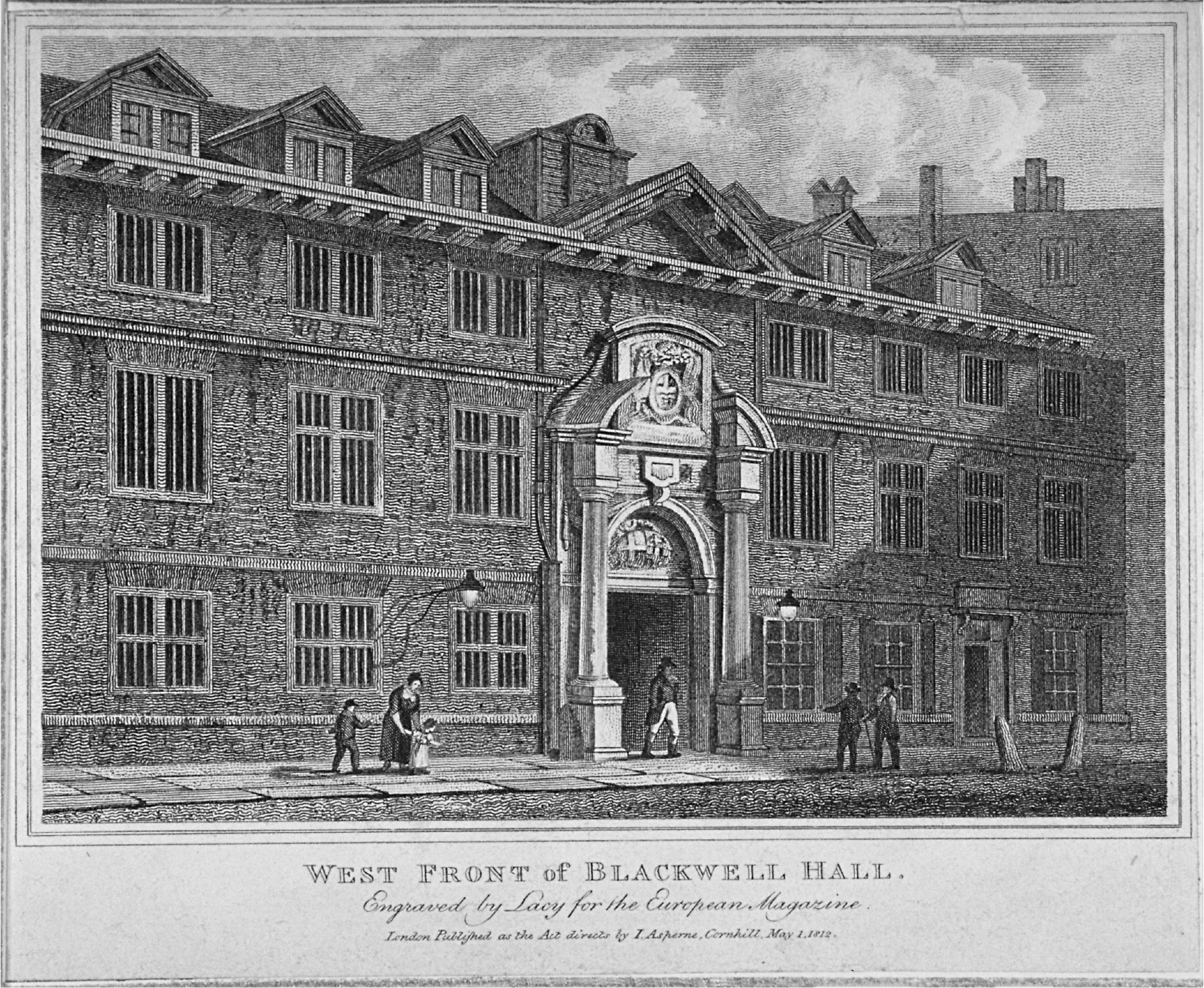

- 8. Blackwell Hall Factors in England, the Beginning of the Story (Michael Bickers)

- 9. Early Growth of Factoring in America from 1628 to 1960 (David B. Tatge / Jeremy B. Tatge)

- Part II: Present – Emerging of Modern Factoring (1960s to Present)

- Introduction (Patrick de Villepin)

- A – Anglo-Saxon Base

- 10. Factoring in the UK, the Rise of Invoice Finance and ABL in Europe’s Most Mature Market (Jeff Longhurst)

- 11. Factoring in the United States since 1960 (Stuart Brister / Brian Martin)

- B – Enlarging to Continental Europe

- 12. Secured and Highly Regulated, the French Factoring Model (Patrick de Villepin)

- 13. Prussian Thinking as the Basis of Made in Germany (Joachim Secker)

- 14. The Italian Way, a Creative Business under Legal and Regulatory Constraints (Mario Petroni / Liliana Innocenti)

- Part III: Future – Factoring Tomorrow (The 21st Century)

- Introduction (Patrick de Villepin)

- A – Globalisation

- 15. Factoring in Asia, a Promising Future (Ilyas Khan)

- 16. Factoring in China, an Ambitious Tiger (Jiang Xu)

- 17. Future Trends for Factoring and Commercial Finance in America (Andrew Tananbaum)

- 18. Factoring in Latin America and the Caribbean, a Sleeping Region (Alberto Wyderka)

- 19. Factoring in Russia, a Self-Sufficient Market (Mikhail Treyvish)

- B – Emerging Countries

- 20. Factoring in Emerging Countries (Margrith Lütschg-Emmenegger)

- 21. Turkey, Bridging the Continents via Factoring (Çağatay Baydar)

- 22. Factoring in Maghreb and the Middle East, Still a Limited Market (Fatma Bouraoui / Alexandre de Fournoux / Haitham Al Refaie)

- 23. Factoring in Africa, an Emerging Continent (Benedict Oramah)

- Epilogue: Disruption and New Environments in a Dangerous World (Patrick de Villepin)

- A – Disruption

- 24. Factoring vs. Invoice Discounting (Adrian Rigby)

- 25. Reverse Factoring and Confirming (Josep Sellés)

- 26. Asset Based Lending (ABL) (John Brehcist)

- 27. Fintech, Between Innovation and Regulation (John Brehcist)

- B – New Environment

- 28. From National Laws to European Supervision, Factors in a Varied and Changing Regulatory Landscape (Diego Tavecchia / Magdalena Wessel)

- 29. Compliance, a Necessary Constraint (Peter Ball)

- 30. Risk Awareness to Tackle Fraud (Patrick de Villepin / Peter Mulroy)

- Conclusion: Ten Proposals to Promote Factoring (Patrick de Villepin)

- Appendices

- Factoring History at a Glance

- FCI at a Glance

- 1. FCI Annual Meetings

- 2. FCI Chairpersons

- 3. FCI Secretary General

- Glossary

- Bibliography

- Authors’ Biographies

- Photo Credits

- Acknowledgments

Global Head of Factoring, BNP Paribas

This book is meant to fill a significant gap: there are no works that are both historical and global in nature, across all continents, covering the profession of factoring, neither old nor recent. My book in French, La Success Story du Factoring (2015), acted as a first milestone and gave me the idea of an ambitious project. I suggested to the directors of Factors Chain ← 15 | 16 → International* (FCI, the global association of the 400 factors active in 90 countries) that the 50th anniversary of FCI might be commemorated in an original manner:

– by bringing together excellent historians with the top experts in the field;

– by unifying these specialists around a common purpose – both academic and professional – reaching out over space and time;

– by producing a single vision of past legacies, current developments and future possibilities.

As a result, the Factors and Actors project was born. From the very outset, it has been collaborative, and the plan has been developed and fleshed out step by step. It has never been restricted to any particular region of the world, nor any particular context or product. It took shape, continued to develop and finally exploded into a professional production of reflection and progress.

The collective work offered to the reader now includes 30 contributions from 37 contributors who, each in their own way, cast a different eye over the genesis of the origin of a different type of financing, its last 50 years of evolution and future development.

The objective of this project is to increase awareness about a very special financing activity and its numerous virtues supporting the real economy, via both history and geography. 50 years after its inception, today factoring stands at a crossroads. Ten years after the start of an unprecedented financial crisis, the time is ripe to promote this sound form of secure and innovative financing.

Above and beyond the history of words and semantics, factoring deserves to be looked at from all of its product and trade components. In matters of finance, guarantees, or management of invoices, the client experience requires a genuine “factoring factory”. From old-line factoring (or full notification factoring) to multiple types of short-term financing (with or without recourse, credit insurance and collection), from a domestic base to cross-border transactions, the technical sophistication and complexity of the methods involved highlight the ← 16 | 17 → many developmental issues of a not-very-well understood financing solution. Initiation into the arcane mysteries of factoring therefore requires a few definitions.

Origins of the Words “Facteur”, “Factor” or “Factoring”

Derived from the substantive form “factum” of the Latin verb “facere”, “factor” denotes a doer, and, by extension, “someone who does something on behalf of someone else”.

Initially recorded in 1326, the French word “facteur” is a phonetical mutation from Latin. It denotes an intermediary who trades for the benefit of a third party. The term flourished during the time of Jacques Cœur, King Charles VII’s Finance Minister (1430-1450): his 300 “facteurs”, who had to travel to far-off lands to sell all sorts of merchandise, were correspondents of the various trading posts, or “factoreries”.

During the Hundred Years’ War (1337-1453), the word “factor” appeared in England, subsequently finding a home in France by means of personal contact. It was not just on the battlefield that words in English and French confronted one another. In Aquitaine, Burgundy and right across the kingdom, the Plantagenets set their distinguishing mark on the language. Such a long period of time encouraged a specific lexical transmigration. Porosity between languages spread at the same time as trade and its vocabulary. Even today, it makes its presence felt in business language, in particular, with the words budget and asset;

– budget: a small leather pouch used for carrying coins, the “bougette” (in French) became “bowzette” in England in 1432, then “boget” a century later and eventually “budget” from 1611 onwards. In return, the French borrowed the word “budget” no later than 1764;

– asset: from the Latin “satis” (sufficiently), colloquial Latin created “adsatis”, which gave rise to the old French “asez” and the modern French “assez”.1 It is from this mutation that the English “assets” derives. Before referring to the shareholders of a company, since ← 17 | 18 → 1531 the term “assets” denotes the ability of an individual to fulfil his obligations, in other words, to have sufficient resources (“assets”) to pay his debts.

Less well-known, the word “factor” developed along similar lines. Emerging in the middle of the 15th century, it was mentioned in the English (1563)2 and Scottish (1565)3 dictionary in the form of “factour”, which was obviously derived from the French “facteur”. “Factor” belongs to that group of words which circulate, transmigrate and adapt themselves, in times of both war and peace, contingent upon the needs of the moment, be they military or economic. The English “factor” is an agent, a doer, a designation which can be traced back to its ancient roots in the Latin “factor”: “facere” in Latin, and “to do” in English. In England, therefore, a factor is “a doer or transactor of business for another; one who buys and sells goods for others on commission”.4 In this respect, it is very close to the French “facteur”.

The “factor” carries out a “factorage” as part of his “factorship”. In Diderot & D’Alembert’s Encyclopédie, “factorage” corresponds to the factor’s or the commissioner’s salary.5 In English, a commercial factor is given an invoice, which is seen as “a particular account” or “a list of the particular items of goods shipped or sent to a factor, consignee, or purchaser, with their value or prices, and charges”.6

During the 16th century, this “invoice” crossed over from France to England via the word “envoy”, an old practice of sending a shipment letter to accompany the merchandise. Ironically, the French “facture” (invoice) maintained a semantic link with the Latin “factor”, via the ← 18 | 19 → “facteur”, a commercial agent.7 Following a number of lexical journeys back and forth, English language gained the words “factor” and “invoice”. Imported from England at the beginning of the 17th century, “factor” had established itself in the United States by the middle of the 19th century. True to Latin etymology, the Americans simply anglicised it in the second half of the 20th century. Adding the suffix -ing onto the end of the past participle of a verb, or, by implication, of a common noun, expresses an action that is currently being carried out. In this particular case, the words “action” and “doing” constitute a redundancy. The word “factoring” emits such power that it is difficult to imagine that, decades ago, it could have had negative connotations!

The Full Factoring Triangle

At the heart of inter-company relationships and the real economy, modern day factoring is based on a triangular relationship between three economic players, brought about in order to work together within the context of financing the operating cycle:

– the factor;

– the seller, the factor’s client;

– the buyer, the seller’s debtor.

The factor can, to a greater or lesser extent, be partly or totally involved in the three main services likely to be incorporated into the contract signed between the factor and its client:

Details

- Pages

- 436

- Year

- 2018

- ISBN (PDF)

- 9782807606845

- ISBN (ePUB)

- 9782807606852

- ISBN (MOBI)

- 9782807606869

- ISBN (Hardcover)

- 9782807606838

- DOI

- 10.3726/b14098

- Language

- English

- Publication date

- 2018 (June)

- Published

- Bruxelles, Bern, Berlin, New York, Oxford, Wien, 2018. 436 p., 5 fig. en n/b, 12 fig. en couleurs, 3 tableaux.