Studies on Interdisciplinary Economics and Business - Volume II

Summary

Excerpt

Table Of Contents

- Cover

- Title Page

- Copyright Page

- Foreword

- About the editor

- About the book

- Citability of the eBook

- Contents

- List of Contributors

- Causality between Economic Growth, Electrical Energy Consumption and Carbon Emission: An Analysis on Chosen EU Countries1

- Foreign Direct Investment and Economic Growth: Evidence from BRICS Countries

- The Relation between Foreign Direct Investment and Economic Growth in Turkey (2003–2018)

- Long-Term Relationship between Economic Growth and External Debt Stock in Turkey

- Do Loans Contribute to the Macro Economy? The Case of Turkey

- An Empirical Note on Uncovered Interest Parity Condition with Turkish Evidence

- The Stability of the Demand for Money in Turkey

- A Review of the Role of Fixed Exchange Rate Regime, Excessive Credit Growth and Deposit Insurance in Financial Crises: Examples from Emerging Market Economies

- The Effect of Globalization on Foreign Trade: The Case of BRICS Countries

- Theoretical Framework of Asset Prices Channel

- Does Value Added Created in Industrial Sector in Turkey Trigger Export? ARDL Analysis

- Sadrettin Tosbi’s Overview of the Turkish Economy and Suggestions for Solution

- 1295 R. (1879 M.) Year August Investigation of Records of Salary Payments in the Ottoman Government Ceyb-i Humayun

- A Conceptual View to Corruption and Broken Windows Theory Approach”

- Working Women’s Perceptions of GenderBased Discrimination

- Sister Cities and Tourism: The Case of Turkey

- Sustainable Tourism Policy of World Tourism Organization

- The Probabilistic View of the Impact of Past Experience on Intention to Purchase in White Goods

- Analysis and Comparison of Business Merger and Acquisition Transactions in Turkey and in the World1

- Assessment of Service Quality in Logistics Sector Using AHP and TOPSIS Methods

- Sustainable Production: Evaluation of Turkish Automotive Sector

- Statistical Analysis of Corporate Sustainability in the TRNC Banking Sector after the Crisis

- A New Concept in Accounting Profession: Cloud Accounting

- IFRS Adoption in Europe: The Case of Industrial Sectors

- Impact of HRM Practices and Leadership on Internal Branding

- ISIS as a Terrorist Organization: Its Effort of Statehood1

- Development of Minimum Wage in Turkey: A Critical Evaluation

- List of Figures

- List of Tables

Gulsah Sezen Akar

Ph.D., Assistant Professor, Aydin Adnan Menderes University, Department of International Trade and Finance, gsezen@adu.edu.tr

İbrahim Al

Ph.D., Assistant Professor, Karadeniz Technical University, Department of Economics, ibrahimal@ktu.edu.tr

Ali Apali

Ph.D., Assistant Professor, Mehmet Akif Ersoy University, aapali@mehmetakif.edu.tr

Bahar Arabaci

Lecturer, Kırklareli University, Lüleburgaz Vocational School, bahararabaci@klu.edu.tr

Metin Bas

Ph.D., Assistant Professor, Dumlupinar University, Department of Econometrics, metin.bas@dpu.edu.tr

Abdulbaki Bilgin

TKDK (Agricultural Development Agency), Communication Expert, abdulbaki.bilgin@tkdk.gov.tr

Selahattin Bozkurt

Ph.D., Assistant Professor, Kütahya Dumlupinar University, History of the Republic of Turkey, selahattin.bozkurt@dpu.edu.tr

Serif Canbay

Ph.D., Assistant Professor, Düzce University, Akçakoca Bey Faculty of Political Sciences, Department of Economics, serifcanbay@duzce.edu.tr

Tansel Cetinoglu

Ph.D., Assistant Professor, Kütahya Dumlupinar University, Departmant of Accounting, tansel.cetinoglu@dpu.edu.tr

Ayşe Nur Ciftci

Ph.D Program Student, Kırklareli University Institute of Social Sciences Department of Labor Economics and Industrial Relations

Aysegul Cimen

Ph.D., Research Assistant, Dokuz Eylul University Faculty of Economics and Administrative Sciences, aysegul.cimen@deu.edu.tr

Useyd Citlak

Master of Science

←11 | 12→Yavuz Selim Düger

Ph.D., Assistant Professor, Kütahya Dumlupinar University, Department of International Trade and Finance, yselim.duger@dpu.edu.tr

Selami Erdogan

Ph.D., Assistant Professor, Kütahya Dumlupınar University, Faculty of Administrative and Economics Sciences, Department of Public Administration, selami.erdogan@dpu.edu.tr

İskender Gumus

Ph.D., Assistant Professor, Kırklareli University Faculty of Economics and Administrative Sciences Department of Labor Economics and Industrial Relations, igumus@gmail.com

Yusuf Kaya

Ph.D., Assistant Professor, Pamukkale University, Department of Banking and Insurance, ykaya@pau.edu.tr

Dilek Kayakiran

Ph.D., Assistant Professor, Nisantasi University, Departmant of Logistic, dilek.kayakiran@nisantasi.edu.tr.

Ali Kestane

Research Assistant, Kilis 7 Aralık University, Department of Business Administration, alikestane@kilis.edu.tr

Esra N. Kilci

Ph.D., Assistant Professor, Istanbul Arel University, Faculty of Economics and Administrative Sciences, Department of International Trade and Finance, esrakilci@arel.edu.tr,

Ali Konak

Ph.D., Assistant Professor, Karabuk University Faculty of Economics and Administrative Sciences Department of Economics, alikonak@karabuk.edu.tr

Levent Korap

Ph.D., Assistant Professor, Kastamonu University, Faculty of Economics and Administrative Sciences Department of Economics, lkorap@hotmail.com

Niyazi Kurnaz

Ph.D., Assistant Professor, Kütahya Dumlupinar University, Department of Business Administration, niyazi.kurnaz@dpu.edu.tr

Derya Mercan

Ph.D., dmercan@gmail.com

Yavuz Odabasi

Ph.D., Assistant Professor, Kutahya Dumlupinar University, Faculty of Economics and Administrative Sciences, Department of Economics, yavuz.odabasi@dpu.edu.tr

Adil Oguzhan

Ph.D., Professor, Trakya University, Faculty of Economics and Administrative Sciences, adiloguzhan@trakya.edu.tr

←12 | 13→Yuksel Oksak

Ph.D., Assistant Professor, Bursa Uludag University, Inegöl Faculty of Business, yukseloksak@uludag.edu.tr

Özer Özçelik

Ph.D., Assistant Professor, Kütahya Dumlupinar University, Department of Economics, ozer.ozcelik@dpu.edu.tr

Eda Ozen

Ph.D., Assistant Professor, Bilecik Şeyh Edebali University, Department of Economics, eda.ozen@bilecik.edu.tr

Derya Ozturk

Ph.D., Associate Professor, Ordu University, Ünye Faculty of Economics and Administrative Sciences, Department of Business, deryaozturk@odu.edu.tr

M. Engin Sanal

Ph.D., Associate Professor, Trakya University, Faculty of Economics and Administrative Sciences, enginsanal@trakya.edu.tr

Ugur Saylan

Ph.D., Assistant Professor, Kütahya Dumlupinar University, Tourism Management, ugur.saylan@dpu.edu.tr

Figen Taskin

Ph.D., Assistant Professor, Ordu University, Department of Political Science and Public Administration, figentaskin@odu.edu.tr

Bengu Tosun

Ph.D., Student, Atatürk University, Department of Economics, bngtosun@gmail.com

Selim Tuzunturk

Ph.D., Assistant Professor, Bursa Uludağ University, Department of Econometrics, selimtuzunturk@uludag.edu.tr

Mehmet Utku

Ph.D., Assistant Professor, Pamukkale University, Department of Business Administration, mutku@pau.edu.tr

Ahmet Uyaniker

Ph.D., Assistant Professor, Ardahan University, ahmetuyaniker@ardahan.edu.tr

Ayla Yazici

Ph.D., Assistant Professor, Anadolu University, Department of Economics, Faculty of Economics and Administrative Sciences, ayazici@anadolu.edu.tr

Resul Yazici

Ph.D., Assistant Professor, Bilecik Şeyh Edebali University, Department of Economics, Faculty of Economics and Administrative Sciences, resul.yazici@bilecik.edu.tr

←13 | 14→Gizem Akbulut Yildiz

Ph.D., Assistant Professor, Gümüşhane University, Department of Economics, gizemakbulut@gumushane.edu.tr

Baris Yildiz

Ph.D., Assistant Professor Gümüşhane University, Department of Public Finance, barisyildiz61@gmail.com

Yavuz Odabasi and Useyd Citlak

Causality between Economic Growth, Electrical Energy Consumption and Carbon Emission: An Analysis on Chosen EU Countries1

1 Introduction

Energy can be defined mostly with some examples like the gasoline put in car or the power entering the house through electric cables that made a television work. However, this term actually has a much wider meaning. In fact, energy is the essence of life in the universe, and the supply of energy is a key to mankind progress (Degunther, 2009: 25). The reason for the considerable economic growth experienced by the world in the last 200 years is the mankind’s ability to generate and store energy. Asimov and White concluded that the ability to control energy, whether by making a fire or establishing a power plant, is a prerequisite for civilization (Covary, 2006: 7).

Energy can be used for different purposes and is derived from many different sources. Common types of the energy usage are doing work, heating buildings, cooking (this is a special use of heat), transportation and communication (Towler, 2014: 3). Today, none of the economies in the globalized world are able to produce goods and services without energy input. Undoubtedly, the most important nutritional source that feeds the production is electric energy. None of the mass production facilities can deliver its final good without electrical energy to their customers. Even the raw materials or the agricultural products that are produced by the most primitive methods are being delivered through the vehicles that have accumulator facilities. In these facilities, those products pass through various processes (barcoding, registration on computer, invoicing, etc.) by utilizing electrical energy and then are ready to dispatch.

As it is understood, electrical energy is one of the indispensables of production and thus of economic growth. Each one unit increase in the Gross Domestic ←15 | 16→Product (GDP) of a country will bring an increase in electricity consumption evenly. This increase will be fed by electricity generation and thus one of the elements that have huge importance for sustainable economic growth will be secured.

In addition to the positive results arising from this bidirectional relationship, there are also the negative results arising to deal with. Because, the consumption and generation of energy plays a major role in some sustainability problems worldwide. For example, carbon dioxide emissions from fossil energy combustion form the main cause of anthropogenic climate change. In addition, emissions from both fossil and conventional biofuel combustion are the main cause of air pollution in regional, urban and indoor areas (Ruijven, 2008: 5).

Since approximately 1850, global use of fossil fuels (coal, oil and gas) has increased to supply the energy demand, and this action caused a rapid growth in carbon dioxide emissions (Intergovernmental Panel on Climate Change – IPCC, 2012: 7). Today, a large part of the electricity supply is still generated not via renewable energy sources, but by burning fossil fuels (oil, gas, coal, etc.) in many countries. In this circumstance, there will be an extra carbon emission value in addition to the existing carbon emission value that is caused by goods and services production, and because of this there will be a constant increase trend on carbon emission values.

It is obvious that there is a causal relationship between economic growth, electricity consumption and carbon emission parameters. Therefore, in this study, it is aimed to examine and interpret this causality relationship between economic growth, electricity consumption and carbon emission parameters by panel data analysis. For this purpose, 20 European Union member countries that generate electricity with combusting fossil fuels intensively were selected. The economic growth, electrical energy consumption and carbon emission values of these countries between 1995 and 2014 were analyzed.

In the study, a short review of the literature, description of the materials and methods used, results and discussions, conclusions and recommendations are given, respectively.

2 Literature Review

There are many local and foreign studies related to this study. It is possible to summarize some of the studies on this subject and to present some clues about it as follows.

Pao and Tsai (2011) aimed to investigate the relationship between economic growth, energy consumption, carbon emission and foreign direct investment. ←16 | 17→For this purpose, they used the multivariate Granger causality analysis and benefited from the data between 1980 and 2007. According to their findings, there is a bidirectional causality relationship between economic growth and carbon emission, direct foreign investment and carbon emission and economic growth and energy consumption, respectively. On the other hand, they observed that there is a one-way causality relationship from economic growth to foreign direct investment, from energy consumption to foreign direct investment and carbon emission.

Durgun (2013) aimed to investigate the causality relationship between economic growth and electricity consumption for Turkey in his study. For this purpose, data between 1980 and 2010 were used. According to his results, he observed that there is a one-way causality relationship between economic growth and electricity consumption.

Polat (2014) aimed to examine the relationship between carbon emissions, economic growth and electricity consumption for the Organization for Economic Cooperation and Development (OECD) countries in his study. In this context, the data between 1980 and 2010 belonging to OECD countries and Dumitrescu-Hurlin panel causality analysis were used. On the other hand, the countries which are the members of the OECD were examined separately as seven developed countries (G7) and rest of the 23 OECD countries. Results obtained for G7 countries show that there is a bidirectional causality relationship between economic growth, and carbon emissions. Also, there is a bi-directional causality relationship between economic growth and electricity consumption. In addition, it was determined that there is a one-way causality relationship from electricity consumption to carbon emission. According to the results obtained for the remaining 23 OECD countries, it is seen that there is one-way causality relationship from carbon emission to economic growth and electricity consumption to carbon emission. On the other hand, no causality relationship between economic growth and electricity consumption could be determined.

Rufael (2014) aimed to examine the relationship between electricity consumption and economic growth for 15 transition economies in his study. In this context, data between 1975 and 2010 were selected and bootstrap panel causality analysis was used. According to the results, for some countries, one-way causality relationship is observed from electricity consumption to economic growth and for some from economic growth to electricity consumption, while for some there is no causality relationship.

Usta (2015) aimed to analyze the impact of the sectoral and regional energy consumption on economic growth of Turkey in his study. And he also aspired to determine the direction of the relationship, if there is any. In order to determine ←17 | 18→the direction of this relationship, he benefited from the annual data from the period 1970–2012 and used Toda-Yamamoto causality analysis. According to the results obtained in the study, it is concluded that there is a bi-directional causality between transportation and industrial sectors’ energy consumption and economic growth. In addition, it was observed that agricultural and residential energy consumption had no effect on economic growth.

Salahuddin et al. (2016) aimed to examine the relationship between internet use, economic growth, financial development, trade openness and carbon emissions in OECD countries. For this purpose, the annual data of the OECD countries for the period 1991–2012 and Dumitrescu-Hurlin panel causality analysis were used. According to the findings, it is observed that there is no causality relationship between internet usage and carbon emission. On the other hand, there is a two-way causality relationship has been determined between financial development, economic growth and carbon emission. In addition, bidirectional causality relationship between economic growth, internet use, trade openness and financial development has been determined. Also, there is a bidirectional causality relationship between trade openness, economic growth and internet usage too. Finally, one-way causality from carbon emission to trade openness was observed, but no causality was observed between internet use and carbon emissions.

Saidmurodov (2016) aimed to investigate the relationship between economic growth, electricity consumption and foreign direct investment in Central Asian countries. For this purpose, data were used between 1992 and 2014, and three different models were established in the light of these data. The results obtained according to these models are presented and evaluated in this study. According to the first model used in the study, one-way causality relationship from economic growth to electricity consumption, and two-way causality relationship between electricity consumption and foreign direct investment was determined. In addition, no causality relationship between economic growth and foreign direct investment has been observed. In the second model, while a causality relationship between electricity consumption and economic growth and between direct foreign investment and economic growth was not reached, a one-way causality relationship from direct foreign investment to electricity consumption was determined. In the third model, one-way causality relationship from economic growth to electricity consumption was observed, while there was no causality relationship between economic growth and foreign direct investment and between electricity consumption and foreign direct investment.

←18 | 19→3 Material and Methods

3.1 Data and Sample

In this study, it is aimed to examine the causal relationship between economic growth, electricity consumption and carbon emission. The study contains the years between 1995 and 2014. GDP (constant 2010$) variable is used as the economic growth variable. For electric energy consumption variable, total electric energy consumption (ELCON) (billion Kwh) variable is used. Finally, carbon emission (kt) variable is used for CO2 emission. The GDP and CO2 emission data of these variables are retrieved from the World Development Indicators (WDI) in the World Bank database. Electricity consumption data is retrieved from the U.S. Energy Information Administration (EIA) database. All variables have used with their logarithmic values. Among the countries of the European Union, which are subject to the analysis, the countries that generate electricity by using fossil fuels intensively are chosen for the purpose of the study. These countries are ranked as follows: Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Germany, Greece, Hungary, Ireland, Italy, Latvia, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Spain and the United Kingdom.

3.2 Panel Unit Root Test

The concept of stationarity, which can be expressed as the mean, variance and autocovariance of a series over time, means that the series is approaching a value in the long term or fluctuated around an expected value. Working with non-stationary panel data models leads to a spurious regression problem as in time series (Tatoglu, 2017: 1–2). In order to determine the stationary of the series, it must be checked whether the series contains unit roots. If the series contains root, it means that it is not stationary. On the contrary, the series is stationary if it does not contain root. For this reason, as in time series, the unit root tests are also used in panel data for testing the stationary of the series. The panel unit root test type to be used for the determination of stationary is determined according to the cross-sectional dependency. First-generation panel unit root tests are used in cases where there is no cross-sectional dependency and second-generation panel unit root tests are used in cases where there is a cross-section dependency.

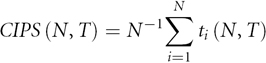

CIPS test, one of the second-generation panel unit root tests, was used in the study. The CIPS (Cross-Sectionally Augmented IPS) statistics is formulated as follows:

←19 | 20→

In the CIPS test, in addition to the hypothesis that there is no unit root in the series, an alternative hypothesis is established that there is no unit root in the series (i.e., it is stationary). The CIPS statistics value is compared to the critical table values determined by Pesaran (2007). If the CIPS test statistic values are higher than the critical table values (as absolute value), the absence hypothesis is rejected, and the panel series are considered to be all stationary.

3.3 Pedroni Panel Cointegration Test

Tests with non-stationary series cause spurious regression. Therefore, differences of the series are taken in order to ensure the stability of non-stationary series. However, in this case, the shocks in which the variables are affected by the past period are eliminated and this situation causes the long-run relationships which may be outside of the shocks to be lost. For these reasons, the concept of cointegration has developed. This concept suggests that the series of economic variables may be stationary (in some combinations) even if they are not stationary. These combinations, which are stationary, show that the variables have a long-run equilibrium relationship (Tari, 2008: 405).

When working with non-stationary panel data, spurious regression problems occur as in time series. In such a case, the statistical tests for the established regression model have deviant results and also the R2 values give misleading results. On the other hand, despite the permanent shocks affecting the system, it is possible to have an equilibrium relationship between the variables in the long term (Tatoglu, 2017: 189). The existence of this probable relationship is tested by using panel cointegration tests.

Pedroni panel cointegration test was used in this study. Pedroni’s (1999) panel cointegration test is based on a null hypothesis that assumes no cointegration between the panel series and suggests seven different tests for testing this hypothesis. Four of these tests are called intra-group and three of them are called inter-group test statistics. While a common autoregressive coefficient can be estimated in intra-group statistics, a common autoregressive coefficient is not estimated in the inter-group tests. This is the most important difference between intra-group and inter-group tests (Sak, 2015: 269).

In addition, intra-group tests are derived for homogeneous panels, and inter-group tests are for heterogeneous panels and these tests can be used in both ←20 | 21→cases. Pedroni panel cointegration test can be used in the series that are stationary in the first difference, i.e., I (1).

The model used for this test, includes mean and trend, is defined as follows:

Here, the variables  and

and  are I (1), i.e., the first-order stationary series. On the other hand,

are I (1), i.e., the first-order stationary series. On the other hand,  refers to the mean,

refers to the mean,  is the trend for each unit,

is the trend for each unit,  refers to the coefficients of the independent variables and

refers to the coefficients of the independent variables and  is the error term. The hypotheses tested in both cases with this model are as follows:

is the error term. The hypotheses tested in both cases with this model are as follows:

For intra-group tests:

For inter-group tests:

In these hypotheses given for both groups, the null hypothesis refers to ‘there isn’t any cointegration’ and the alternative hypothesis refers to ‘there is a co-integration’.

3.4 Dumitrescu-Hurlin Panel Causality Test

The concept of causality was first derived in 1969 by Granger to determine the causal relationship between variables. Because determining the direction of the relationship between the variables will provide more economic information than the existing relationship.

In this context, the definition of causality proposed by Granger is expressed as “when predicting the value of a dependent variable, if the independent variables’ past values are more successful than the present values, this independent variable is the Granger cause of the dependent variable” (Emirmahmutoglu, 2011: 84). In this way, the independent variable becomes the cause while the dependent variable is becoming the result and the direction of the relationship between the variables can be determined.

This causality approach, which was first proposed by Granger for time series, was examined by many researchers from different perspectives and different methods were developed. In these methods developed within the panel data, the first developed tests are presented under the assumption that the parameters in the panel data model are same for each unit. However, the researches show that the results are not reliable when the parameters are not homogeneous. For this purpose, a test was developed by Dumitrescu and Hurlin (2012), which ←21 | 22→considers the heterogeneity of the parameters (i.e., the parameters are not the same for each unit) in the panel data model and the cross-sectional dependency.

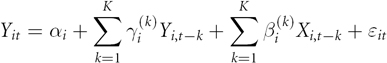

Dumitrescu and Hurlin (2012) model for panel causality testing is formulated as follows:

,

,  ,

,  and

and  show, respectively, the lag length, autoregressive parameter, slope coefficient and the error term in this formula. In addition, the autoregressive parameter and the slope coefficient differ from unit to unit.

show, respectively, the lag length, autoregressive parameter, slope coefficient and the error term in this formula. In addition, the autoregressive parameter and the slope coefficient differ from unit to unit.

In this test, the null hypothesis is established as ‘there is no causality relationship in all units of the panel data set’, while the alternative hypothesis is established as ‘at least one of the units of the panel data set has a causality relationship’.

4 Results and Discussions

4.1 Cross-Sectional Dependency and CIPS Panel Unit Root Tests

The cross-sectional dependency between the variables in the study was tested using Lagrange Multiplier (LM) method. The test results are shown in Tab. 1.

Tab. 1: Cross-Sectional Dependency Test Results

|

|

Breusch-Pagan LM Test |

|

|

Chi-square |

Prob. |

|

|

Test Statistics |

1756.089*** |

0.0000 |

*** significant at 1 % significance level.

When the test results are examined, it is seen that the chi-square test statistics has a probability value of less than 0.05. So, H0 hypothesis that assumes there is no cross-sectional dependence was rejected and H1 hypothesis was accepted. In other words, there is a cross-sectional dependency in the data and therefore the second-generation panel unit root tests have to be used.

The results of the CIPS test, which is one of the second-generation panel unit root tests, are shown in Tab. 2.

Details

- Pages

- 348

- Year

- 2019

- ISBN (PDF)

- 9783631804131

- ISBN (ePUB)

- 9783631804148

- ISBN (MOBI)

- 9783631804155

- ISBN (Softcover)

- 9783631797297

- DOI

- 10.3726/b16227

- Language

- English

- Publication date

- 2019 (October)

- Keywords

- Financial development Special consumption tax policies R&D expenditures Probit and tobit models Basel IV Industry 4.0

- Published

- Berlin, Bern, Bruxelles, New York, Oxford, Warszawa, Wien, 2019. 348 pp., 8 fig. b/w, 99 tables, 14 graphs