Studies on Interdisciplinary Economics and Business - Volume I

Summary

Excerpt

Table Of Contents

- Cover

- Title Page

- Copyright Page

- Foreword

- About the author

- About the book

- Citability of the eBook

- Contents

- An Empirical Analysis on the Relationship between Financial Development and Economic Growth: The Case of Turkey (1980–2014)

- 1 Introduction

- 2 Literature

- 2.1 Theoretical Literature

- 2.2 Empirical Literature

- 3 Financial System and Economic Growth in Turkey

- 4 Model and Data Set

- 5 Econometric Methodology and Findings

- 5.1 Unit Root Analysis

- 5.2 Cointegration Analysis

- 5.3 Granger Causality Test

- 6 Conclusion and Assessment

- References

- The Relationship between Special Consumption Tax and Current Account Deficit in Turkey1

- 1 Introduction

- 2 Effects of Special Consumption Tax on Current Account Deficit

- 3 Literature Review

- 4 Econometric Application

- 4.1 Data and Method

- 4.2 Empirical Findings

- 4.2.1 Unit Root Test

- 4.2.2 ARDL Model

- 4.2.3 Toda Yamamoto Causality Analysis

- 4.3 Evaluation of Empirical Findings

- 5 Conclusion

- References

- Active Labor Market Policies and Unemployment: Evidence from Panel Cointegration

- 1 Introduction

- 2 Theoretical Perspective and Related Literature

- 3 Data and Econometric Methodology

- 4 Analysis Results

- 5 Concluding Remarks

- References

- Challenges for Managers in the Near Future

- 1 Introduction

- 2 Industry 4.0

- 3 Generation Z

- 4 Conclusion and Suggestions

- References

- A Research on Comparative Advantages in Germany’s Technology-Intensive Exports

- 1 Introduction

- 2 Methodology

- 3 Literature Review

- 3.1 Analysis by SITC Technology Classification

- 3.2 Analysis by ISIC Rev. 3

- 4 Conclusion

- References

- Factors behind R&D Expenditures and Export Decision: Evidence from Turkish Firms

- 1 Introduction

- 2 Literature Review

- 3 Data, Model, and Methodology

- 4 Empirical Results

- 5 Conclusion

- References

- Just in Time (JIT) Production System

- 1 Introduction

- 2 Just In Time (JIT) Production System

- 2.1 Quality at the Source

- 2.2 Levelling of Production

- 2.3 Cellular Production (Group Technology)

- 2.4 Pull System, Kanban and Machine Preparation Times

- 2.5 Relations with Supplier

- 3 Conclusion

- References

- The Effect of Innovation Culture on Creative Performance: A Research in the Chemical Sector

- 1 Introduction

- 2 Conceptual Framework

- 3 Method

- 4 Data Collection Tool

- 5 Data Collection Method

- 6 Sample of Research

- 7 Models and Hypotheses of Research

- 8 Analysis of Data

- 9 Findings

- 10 Result

- References

- The Effect of Tax Wedge on Youth Unemployment: A Panel VAR Approach

- 1 Introduction

- 2 Theoretical Framework and Literature Review

- 3 Data and Methodology

- 4 Empirical Results

- 5 Conclusion

- References

- Digital Marketing Channels of Businesses and Digitalization in Tourism Sector

- 1 Introduction

- 2 Digital Marketing

- 2.1 The 4E’s of Digital Marketing

- 2.2 The Most Popular Digital Marketing Tools

- 3 Digital Marketing Examples on Tourism

- 4 Conclusion

- References

- Whistleblowing in Terms of Turkish Labor Law1

- 1 Introduction

- 2 Concept

- 3 Whistleblowing in Terms of Labor Law

- 3.1 Responsibility of Loyalty of an Employee

- 3.2 Confidentiality Obligation of Employee

- 4 Conclusion

- References

- Customer Focused New Product Design Process

- 1 Introduction

- 2 New Product Design

- 3 Tools for New Product Design Process

- 3.1 Target Costing

- 3.2 Quality Function Deployment

- 3.3 Other Techniques

- 4 Approaches to New Product Design

- 4.1 Traditional New Product Design Process

- 4.2 Customer Focused New Product Design Process

- 4.3 Customer-Focused New Product Development Steps

- 4.3.1 Organizing the Customer-Focused New Product Development Team

- 4.3.2 Determination of Target Customer Segment

- 4.3.3 Determination of Customer Demands and Needs

- 4.3.4 Determination of Target Sales Price

- 4.3.5 Determination of Target Profit Margin

- 4.3.6 Determination of Product Level Target Cost

- 4.3.7 Determination of Component Level Target Cost

- 4.3.8 Priority of Customer Demands and Needs

- 4.3.9 Create Product Concept on Quality Home

- 4.3.10 Comparison of the Percent Importance of Each Business Functions and Component Level Target Costs

- 4.3.11 Industrial Design of Product

- 4.3.12 Cooperation with Suppliers

- 4.3.13 Production Decision-Making

- 5 Conclusion

- References

- Basel IV: Reform or a New Era?

- 1 Introduction

- 2 Why We Needed to BASEL

- 2.1 Basel I

- 3 Why We Reformed Basel?

- 3.1 Basel I Criticism

- 3.2 Basel I Market Risk Management

- 4 BASEL II

- 5 BASEL III

- 6 Section III BASEL IV a Reform or a New Era

- 6.1 Basel IV What Is Next?

- 6.2 BASEL IV Outlines

- References

- Comparative Analysis of Web-Based Investor Relations of Companies in the Telecommunication Sector Traded in Istanbul and New York Stock Exchanges

- 1 Introduction

- 2 Investor Relations

- 3 The Importance of Internet in Investor Relations

- 4 Telecommunication Sector

- 5 Data and Methodology

- 6 Findings

- 6.1 Examination of Annual Reports

- 6.2 Examination of Financial Disclosures

- 6.3 Evaluation of Websites

- 7 General Overview

- 8 Conclusion

- References

- Industry 4.0: What about Human Resources?

- 1 Introduction

- 2 Industry 4.0

- 3 Human Resources X.0 Loading

- 3.1 Awareness

- 3.2 The Need for Self-Realization

- 3.3 The Desire for Continuous Learning and Self-Development

- 3.4 Homo-Digitalis

- 4 Conclusion

- References

- Macroeconomic Determinants of Economic Growth in Latin American Countries

- 1 Introduction

- 2 Macroeconomic Indicators in Latin American Countries

- 2.1 Gross Domestic Product

- 2.2 Employment

- 2.3 Gross Capital Formation

- 2.4 Exports

- 2.5 Imports

- 2.6 Foreign Direct Investment

- 3 Panel Data Analysis for Latin American Countries

- 4 Conclusion

- References

- Impact on Economic Growth of Military Expenditures: An Application Turkey

- 1 Introduction

- 2 Basic Characterıstıcs of Relatıonshıp between Defense Expendıtures and Economıc Growth

- 3 Literature Search

- 4 Empirical Approach and Data

- 4.1 Research Method

- 5 Empirical Results

- 6 Conclusion

- References

- Industry 4.0 and Energy Politics

- 1 Introduction

- 2 Industry 4.0 and Energy 4.0

- 2.1 Industry 4.0 and Renewable Energy Resources

- 2.2 Industry 4.0 and Energy Efficiency and Energy Saving

- 3 Conclusion

- References

- Approach of Theory of Constraints in Production Process of Enterprises

- 1 Introduction

- 2 Theory of Constraints

- 2.1 Fundamental Principles and Steps of Theory of Constraints

- 3 Theory of Constraints in Production Management

- 3.1 Process Management

- 3.2 Capacity Management

- 3.3 Inventory Management

- 3.4 Quality Management

- 4 Conclusion

- References

- The Impact of Generic Competition Strategy on Performance: A Research in Car Rental Sector

- 1 Introduction

- 2 Conceptual Framework

- 2.1 Cost Leadership Strategy

- 2.2 Differentiation Strategy

- 2.3 Focusing Strategy

- 2.4 Stuck in the Middle

- 3 Research Methodology

- 3.1 Model of the Research

- 4 Findings of the Research

- 4.1 Demographic Findings of the Research

- 4.2 Measurement Model Findings

- 4.3 Testing of Structural Model and Hypothesis

- 5 Conclusion and Assessment

- References

- Organizational Change and Leadership

- 1 Introduction

- 2 Conceptual Framework

- 2.1 Change, Organizational Change and Change Management

- 2.2 Leadership

- 2.3 The Role of Leadership in Organizational Change

- 3 Conclusion and Discussion

- References

- Prediction of the Gold Price per Ounce Using Artificial Neural Networks

- 1 Introduction

- 2 Literature Review

- 3 Artificial Neural Networks Model

- 4 Results

- 5 Conclusion

- References

- The Activity Audit as Approach to Improved Operations and Profitability: Literature Review

- 1 Introduction

- 2 Activity Audit

- 3 The Objective of Activity Audit

- 4 The Scope of Activity Audits

- 5 Elements of Activity Audits

- 6 Time of Activity Audit

- 7 The Process of Activity Audits

- 8 Results and Conclusions

- References

- Social Sustainability in Businesses

- 1 Introduction

- 2 Social Sustainability Dimension of Sustainable Development

- 3 Principles and Characteristics of Social Sustainability

- 4 Social Sustainability Dimension of Corporate Sustainability

- 5 Conclusion

- References

- Subliminal Advertising

- 1 Advertisement

- 2 Subliminal Advertisement

- 3 Subliminal Message Techniques

- 3.1 The 25th Frame Technique

- 3.2 Fovea Centralis

- 3.3 Tachistoscope

- 3.4 Eye-Tracking Techniques

- 4 Subliminal Advertisement Examples

- References

- Industry 4.0: Its Development and Pioneers

- 1 Introduction

- 2 Industry 4.0 and Its Components

- 2.1 Internet of Things

- 2.2 Cyber Physical Systems

- 2.3 Big Data Analytics

- 2.4 Cloud Computing

- 2.5 Integrated Systems (Horizontal and Vertical System Integration)

- 2.6 Autonomous Robots and Smart Factories

- 2.7 Augmented Reality and Simulation

- 2.8 Data Mining, Artificial Intelligence (AI) and Machine Learning

- 2.9 Additive Manufacturing and 3D Printers

- 3 Pioneers of Industry 4.0 Transformation

- 4 Conclusion

- References

Salih Özturk1 and Hatice Surun2

1 Introduction

The technological, industrial and economic developments that have emerged with the industrial revolution have also led to progress and development in financial markets. Especially, together with technological improvements, countries have been focused to prosperous growth and development. In this context, it has begun to develop in financial markets and the increase in per capita income has been one of the most decisive factors in terms of the indicator of economic growth. If how advanced are financial markets in a country, it means that the country is also economically developed.

The relation between financial development and economic growth, first mentioned by British journalist Walter Bagehotin his “Lombard Street” article in 1873, examining the effects of banking sector to industrialization process. The Bank of England even accepted the “Bagehot Principle” in the sense that a middle way between “Currency Principle” and “Stand-by” theories (Serin, 1987, 55). In particular, along with industrialization from the 1960s on inflation increased in all countries, particularly mainly in the USA. Depending on the rise in inflation, changes in the financial markets also propelled to change and development of the financial system. On the other hand, the introduction from the fixed exchange rate to flexible exchange rate system (Bretton Woods) in international markets at the beginning of the 1970s brought changes into the financial system. Schumpeter stated that changes of the time and developments brought financial innovations along itself and development of technology contributed to the development of the financial system in this context.

Most economists have stated that there is a positive causality relationship between financial market development and economic growth. As the financial ←11 | 12→developments increase, they claim that the production of goods and services in that economy and the GNP would increase. Another opposite view is that, the relationship between the two variables is not clear. Defenders of the first view in this context defend the supply-side hypothesis. Economists who claim to have a negative impact on the economy also defend the demand-side hypothesis. It is widely accepted that financial development in economics literature drives economic growth.

The next sections of the study consist of four sections. In the first part, the theoretical and empirical literature on the relation between financial development and economic growth has been searched. In the second part the financial sector and economic growth relationship in the context of Turkey’s economy is mentioned. In the thirdpart, information about econometric model and data set have been given. In the fourthpart, econometric tests (unit root, cointegration and causality tests) used in the study and the findings have been presented. Finally, with an assessment the study has ended.

2 Literature

2.1 Theoretical Literature

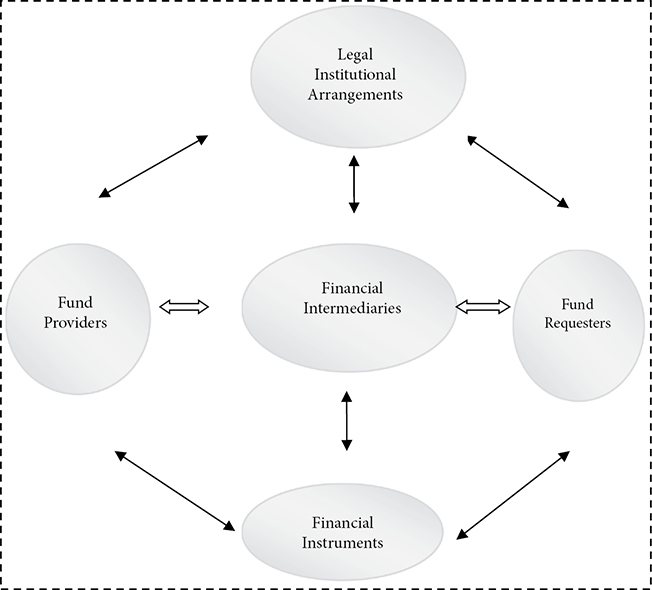

Financial markets and institutions form the basis of the financial system. Financial markets are financial instruments are the places where the purchase and sale of financial instruments are made, that is, they are the markets fund supply and demandare formed. Financial markets are the markets where there are transactions that provide and regulate the flow of funds. Financial institutions are the institutions that act on these processes. Financial markets are also wider than the money and capital markets, and these are the markets that include these markets. The financial market consists of savings owners, consumers, investors, investment and financing instruments.

Financial intermediation institutions, while the funds are transferred to those who need them from the savings owners, contribute to the economy (Parasız, 1997, 54). In this context, there are contributions such as reducing the risk in the market, directing savings more effectively and reducing the tendency to bury. Again financial markets also balance savings and demand.

Financial markets have three important roles: Providing liquidity, providing information and risk sharing (Erdoğan and Orhan, 2015, 29). The functions of the financial markets mentioned above also increase the efficiency of the markets same time. Thanks to its ability to provide liquidity saving owners try to maximize their profitability by choosing lower-cost, higher-return vehicles. Having information about the market they also get rid of the problem of reverse asymmetry.←12 | 13→

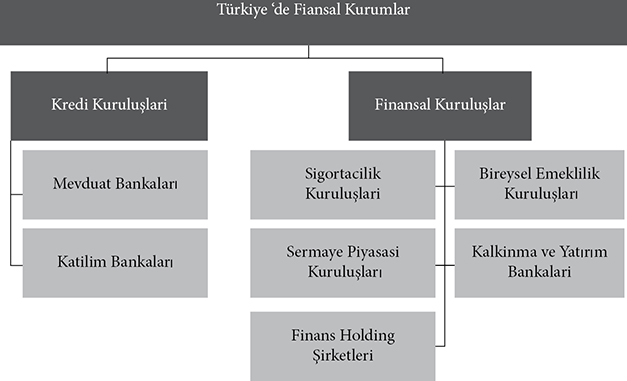

Insurance companies, banks (lenders), companies engaged in securities transactions and social security institutions are the financial intermediation institutions. Financial institutions effectively activate the market as institutions regulating the purchase and sale of funds in the market. Financial intermediaries also play an active role in the money supply in the economy. The financial intermediation function allows individuals to invest their funds in confidence and to borrow these funds for the firm to process the borrowing and giving process smoothly in the economy (Arslan, 2009, 77). They help reduce risks. They provide economies of scale for saving owners. Financial intermediary institutions also provide funds and investment opportunities to the individuals or institutions they are intermediary with less cost. Fig. 1 summarizes the functions of financial intermediaries.

Fig. 1: Structure of Financial System

The financial system has functions such as reducing risks, generating resources, providing investment information, and directing savings. In this context, the financial system contributes to the effective allocation of funds, It also prevents asymmetric information problems that impede the transfer to investment of savings. As a result, it will also provide efficient distribution of resources which is the main aim of economics.

The role on economic growth of the financial sector have been studied and discussed in the literature for a long time. The concept of financial development can be described as follows: 1) Strengthening financial contracts, 2) The emergence of types certain specific financial contracts, 3) Increase of volume of financial contracts, 4) Increase in the number and size of financial intermediaries (Levine, 2004, 4).

Joseph Schumpeter (1912), who pioneered the issue, emphasized the impact of the financial sector on growth (Schumpeter, 1932). Where Robinson (1952), argued that financial development is an output or a secondary product of economic growth only in the real sense of the economy, and that there is only one-way causality between variables. If economic growth is provided, the financial sector will also grow at the same rate.

According to Hugh T. Patrick (1966), there is a bi-directional relationship between financial development and economic growth (Patrick, 1966, 174–189). The first is the demand-side hypothesis, the other is the supply-side hypothesis. The demand-side hypothesis is towards economic growth from financial development. The supply-side hypothesis defends the effectiveness of financial markets by stating that the financial sector is an engine for economic growth.

In the 1970s the literature emphasized the importance of mobilization of domestic resources in particular. Especially, McKinnon (1973) and Shaw (1973) ←13 | 14→suggested that liberalization in the financial sector should be abolished all kinds of constraints in the financial sector.

Towards the end of the 1980s, Paul Romer, Robert Lucas and Robert Barro talked about the internal growth factor in their work. Lucas (1988) stated that financial developments are not exactly a decisive criterion of economic growth in the long run. With it, Stern (1989) argues that there can be no causal relationship between financial development and economic growth in the long run (Çeştepe, 2016, 16).

Robert G. King and Ross Levine (1993) determined the relationship between financial development and economic growth in their study made in 80 countries between 1960–1989 by analyzing with per capita GDP and economic growth data together with various variables years. (King, Levine, 1993). They have come ←14 | 15→to the conclusion that financial services are positively influencing economic growth by increasing capital efficiency.

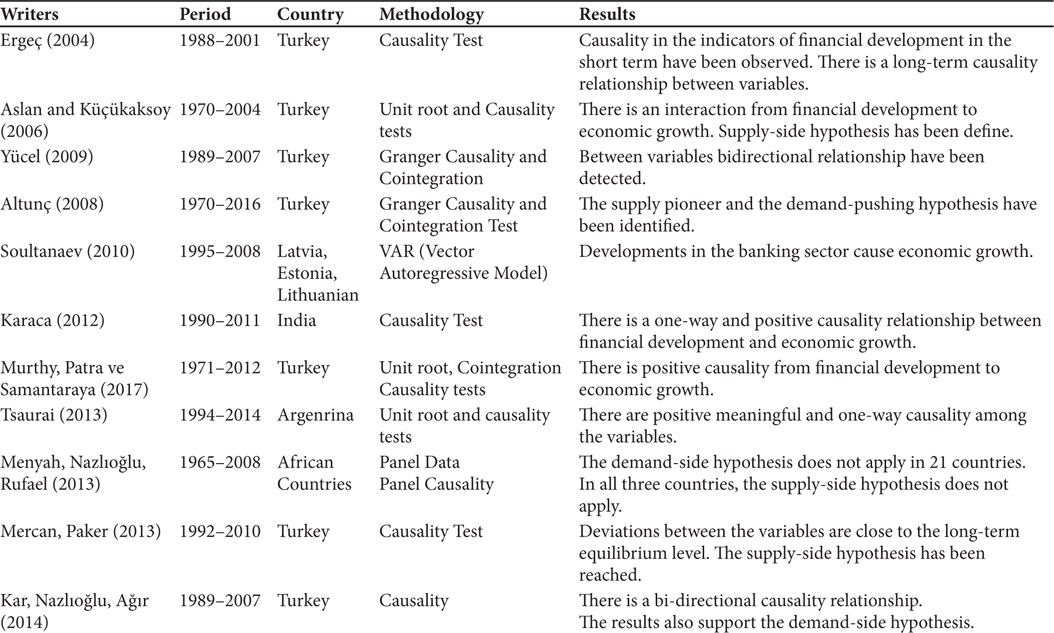

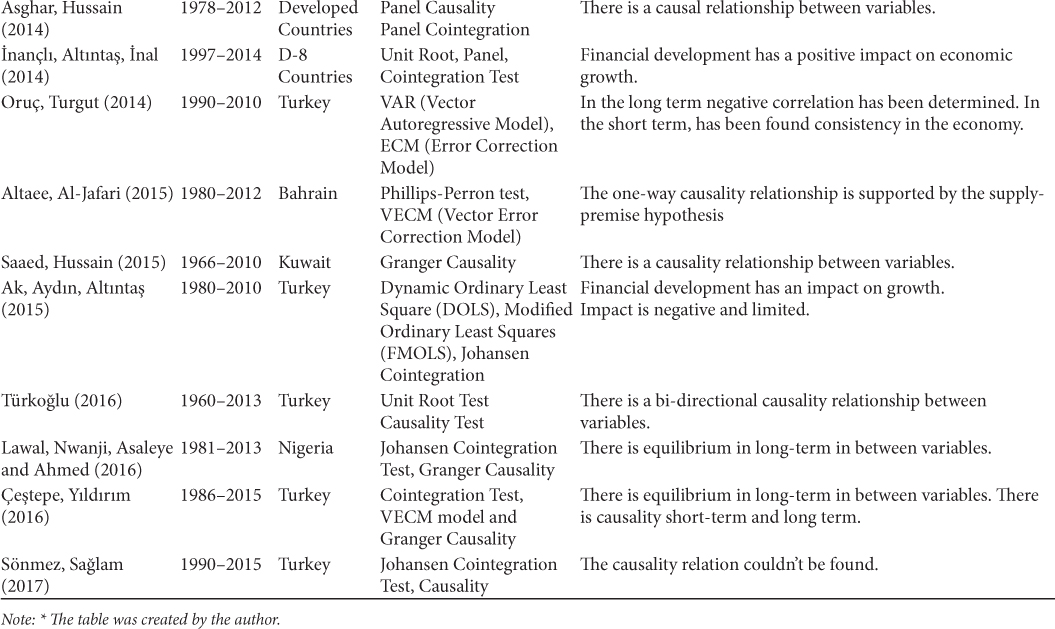

2.2 Empirical Literature

In the literature investigating the relationship between financial development and economic growth, together with financial development and economic growth, has been made in the analysis about the concept of trade openness. Findings in the analyses are separated from each other with different results. The studies that support the supply-side hypothesis that Schumpeter advocates are as follows: According to the work done by Aslan and Küçüksoy (2006), Soultanaev (2010), Altıntaş and Ayrıçay (2010), Karaca (2012) and Mercan and Peker (2013), Tsaurai (2013), Al-Jafari (2014) and Murthy, Patra and Samantaraya (2017) the financial developmentsupports economic growth.

There also were carried out studies supporting the demand-side hypothesis that Robinson defends. Examples of these studies: They are studies of Kar (2010), Menyah, Nazlıoğlu and Rufael’s (2013). Altaee and Al-Jafari (2015) examined the relationship between financial development, outward openness and economic growth in Bahrain. As a result, Causality relationship from financial development and trade openness to economic growth were determined.

According to Altunç (2008), Yücel (2009), there is a two-way causality relation between financial development and economic growth. Similarly to Turkoglu (2016), he determined a two-way causality relationship between economic growth and financial development in his work. Soultanaev (2010) has analyzed that the developments in the banking sector leading to economic growth. Results related to similar studies have been explained as detailed in Tab. 1.

Tab. 1: Some Empirical Studies on the Relationship between Financial Development and Economic Growth*

3 Financial System and Economic Growth in Turkey

When examining the financial system in Turkey it has been in the same period with developments in the world financial system and development. Turkey has been implementing a trade-oriented development strategy since 1980. And living through the process of financial liberalization since 1989. Our country in this context, despite the fact that it faced serious economic problems from 1994 until 2000 had an impressive growth performance until 2010. This growth momentum of Turkey’s economy, brought along the need for examination of a causal link between financial development and economic growth.

Financial institutions in the functioning of the financial system are divided into two as financial and loaning institutions. If we define financial institutions, ←16 | 17→←15 | 16→←17 | 18→according to the legislation lender institutions are deposits and participation banks. Financial institutions consist of financial holding companies, development & investment banks and institutions’ activating in insurance, private pension and capital market that are out credit institutions (Developments in Financial Stability in Turkey, 2015, 2) (Fig. 2).

Fig. 2: Financial Institutions in Turkey. Source: Central Bank Publications, 2015, 5

4 Model and Data Set

In this part of our study, relationship between financial development criterion and economic growth by considering data of Turkey economy is examined. In this context, firstly, appropriate variables are included in the model to relate the financial development variable to economic growth. And the cointegration and the causality relation between the variables has been analyzed through econometric estimation methods.

In our study, data based on the period between 1980 and 2014 has been used. In many of the studies examined, economic growth variable has been taken as level values to per capita gross domestic product. For this reason, in order to express economic growth, firstly the per person real GDP (Y1) level values was tried to be analyzed by taking the primary difference of the data. Per capita GDP has been taken as a dependent variable in the study. Other variables used in ←18 | 19→the study are domestic credit provided by financial sector (X1), domestic credit to private sector (X2), domestic credit to private sector by banks (X3). All data used in the study were compiled from the World Bank data sheet. Our model is as follows:

(1)

(1)

(2)

(2)

(3)

(3)

Y1: Gross Domestic Product (GDP per capita)

X1: Domestic Credit Provided By Financial Sector

X2: Domestic Credit To Private Sector

X3: Domestic Credit To Private Sector By Banks

Hypotheses have been developed to analyze the relationship between financial development and economic growth in the study. The purpose of the hypothesis test is to arrive at a conclusion as to whether the proposed hypothesis is valid. The hypotheses determined move from here are as follows.

H0: Financial development is not the reason for economic growth.

H1: Financial development is the cause of economic growth.

The first phase for to be examined of the relationship between financial development and economic growth is the determination of whether the stationary of series in data set. The stationary of the economic growth variable, which is the dependent variable, will be analyzed by the unit root test. In the same way The Augmented Dickey Fuller (ADF) unit root test will be carried for stationary the independent variables.

5 Econometric Methodology and Findings

5.1 Unit Root Analysis

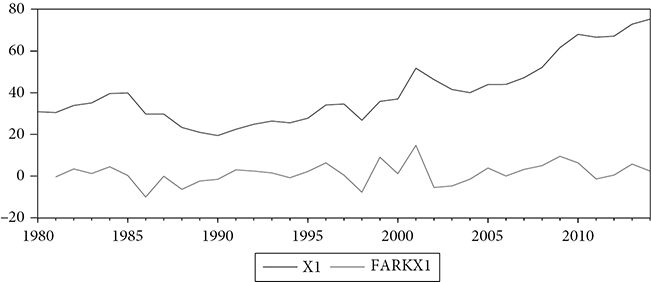

The Augmented Dickey Fuller (ADF) unit root test is a commonly used test that investigates the presence of unit root in time series. In order for a time series to be stationary, the mean and variance must not change over time, and the covariance between the two periods must depend on the distance between only two periods, not the return calculated by this covariance (Gujarati, 1999: 713). The data we used in Tab. 2 are the unit root test results.

Tab. 2: Unit Root Test Findings (ADF) for Variable Domestic Credit Provided By Financial Sector (X1)

|

Level of Significance |

Critical Values (level)) |

Critical Values (1st difference) |

|

0,01 |

–3.639407 |

–3.646342 |

|

0,05 |

–2.951125 |

–2.954021 |

|

0,10 |

–2.614300 |

–2.615817 |

|

DF statistic |

0.413715 |

–5.436133* |

The stationary of variable domestic credit provided by the financial sector in our study was examined by the ADF test. As can be seen from Tab. 2, according ←19 | 20→to the findings obtained, it was determined that the variable was not stationary in the level stage. The first difference of variable has been taken for the stationary of the variable. Critical values determined at significance levels of 0.01, 0.05 and 0.10 are also shown in Tab. 2. The line graph of the level and first difference series for the X1 variable has been given in Graph 1. In the first difference of the series appears to be stationary.

Graph 1: X1 Series Level and First Difference Line Graph

In Tab. 3, the analysis was continued with the Domestic Credit To Private Sector variable. Unit root test results are as follows.

Tab. 3: Unit Root Test (ADF) Findings for Domestic Credit To Private Sector (X2) Variable

|

Level of Significance |

Critical Values (level) |

Critical Values (1st difference) |

|

0,01 |

–3.639407 |

–3.646342 |

|

0,05 |

Details

- Pages

- 332

- Publication Year

- 2018

- ISBN (Softcover)

- 9783631771747

- ISBN (PDF)

- 9783631782279

- ISBN (ePUB)

- 9783631782286

- ISBN (MOBI)

- 9783631782293

- DOI

- 10.3726/b15308

- Language

- English

- Publication date

- 2019 (February)

- Keywords

- Economics Business Public Finance Special consumption tax policies Probit and Tobit models

- Published

- Berlin, Bern, Bruxelles, New York, Oxford, Warszawa, Wien, 2018. 332 pp., 34 fig. col., 80 tables, 7 graphs

- Product Safety

- Peter Lang Group AG