Current Issues in Finance, Economy and Politics

Theoretical and Empirical Finance and Economic Researches

Summary

Excerpt

Table Of Contents

- Cover

- Title Page

- Copyright Page

- Preface and Acknowledgments

- About the editor

- About the book

- Citability of the eBook

- Contents

- List of Contributors

- 1 Economic Growth and Current Deficit: An Analysis for OECD Countries

- 2 Determinants of Regional Economic Growth in Turkey

- 3 Determination of Public Share in the Turkish Economy and Possible Role of Wealth Fund in Investment and Financing Policies

- 4 Integration Process in Post-Soviet Eurasia: Eurasian Economic Union

- 5 Competitiveness of Turkey in the Context of International Services Trade with OECD Countries

- 6 Does The Monetary Policy of the Central Bank Lead to a Housing Bubble? Empirical Analysis for Turkish Economy

- 7 The Efficiency and Profitability of the Turkish Banking Sector

- 8 A Research on the Factors Affecting Profitability in Banks with Ridge Regression Analysis

- 9 Examination of Islamic Banks Operating in Turkey in Terms of Efficiency and Productivity According to Multi-criteria Decision-Making Methods

- 10 Credit Risk in the Turkish Banking Sector: A Study on 1990–2017 Period

- 11 Shadow Banking, Leverage Cycles, and the Great Recession

- 12 Globalization 4.0 and Banking Sector

- 13 An Alternative Way of Financing for Entrepreneurs: Crowdfunding

- 14 Consequences of Money Laundering: An Audit and Governance Perspective

- 15 The Relationship between Exchange Rates and Interest Rates: The Case of Turkey

- 16 Inflation-Exchange Rate Relationship: The Case of Turkey

- 17 Theoretical Modeling Basis of TL/US Dollar Exchange Rate: An Econometric Practice

- 18 Testing of Overconfidence Hypothesis in Borsa Istanbul

- 19 Long Memory Model: BIST 100 Index

- 20 Underpricing in Initial Public Offerings: Turkey, 2011–20131

- 21 Dividend Policy Studies in Turkey

- List of Figures

- List of Tables

Ahmet Aydın

Assoc. Prof., Bandırma Onyedi Eylul University, aaydin@bandirma.edu.tr

Alban Hetemi

Ph.D., TEB SHA Department Manager/Compliance Division at TEB Bank hetemi.alban@gmail.com

Aytaç Pekmezci

Asst. Prof., Muğla Sıtkı Koçman University, aytac0803@mu.edu.tr

A. Gamze Aytekin

Asst. Prof., Balikesir University, aysegamze@balikesir.edu.tr

A. Rutkay Ardoğan

PhD Student, Ege University, rutkay@gmail.com

Berna Serener

Asst. Prof., European University of Lefke, berna_serener@hotmail.com

Burçay Yaşar Akçalı

Asst. Prof., İstanbul University, burcayy@istanbul.edu.tr

Dilek Demirhan

Assoc. Prof., Ege University, dilek.demirhan@ege.edu.tr

Engin Kurun

Assoc. Prof., Piri Reis University, ekurun@pirireis.edu.tr

Hale Kırer Silva Lecuna

Asst. Prof., Bandırma Onyedi Eylül University, hkirer@bandirma.edu.tr

Haydar Karadağ

Asst. Prof., Recep Tayyip Erdoğan University, haydar.karadag@erdogan.edu.tr

H. Levent Korap

Asst. Prof., Kastamonu University, lkorap@kastamonu.edu.tr

Kurtuluş Bozkurt

Asst. Prof., Aydın Adnan Menderes University, kurtuluş.bozkurt@adu.edu.tr

Mehmet Güçlü

Assoc. Prof., Ege University, mehmet.guclu@ege.edu.tr

M. Kenan Terzioğlu

Assoc. Prof., Trakya University, kenanterzioglu@trakya.edu.tr

Mehmet Sabri Topak

Asst. Prof., Istanbul University, msabri@istanbul.edu.tr

Mehmet Özer

Ph.D., Expert at Capital Markets Board of Turkey, mozer@spk.gov.tr

Melike Torun

Res., Asst. Dr., Istanbul University, meliket@istanbul.edu.tr

Muhammed Mustafa Tuncer Çalışkan

Asst. Prof., Bandırma Onyedi Eylül University, mcaliskan@bandirma.edu.tr

Muhittin Tolga Özsağlam

Asst. Prof., European University of Lefke, mozsaglam@eul.edu.tr

Mustafa Şit

Asst. Prof., Harran University, msit@harran.edu.tr.

Onur Duygu

Senior Manager at Odeabank, onurduygu@odeabank.com.tr

Ozan Gülhan

Ph.D., TEB SHA, Head of Compliance Division, ozan.gulhan@teb-kos.com

Ömer Faruk Rençber

Asst. Prof., Gaziantep University, ofrencber@gantep.edu.tr

Özlem Kuvat

Asst. Prof., Balikesir University, ohasgul@balikesir.edu.tr

Sefer Uçak

Asst. Prof., Balikesir University, seferucak@balikesir.edu.tr

Serçin Şahin

Dr., Yildız Technical University, sesahin@yildiz.edu.tr

Serpil Altınırmak

Assoc. Prof., Anadolu University, saltinirmak@anadolu.edu.tr

Yahye Hassan Abdi

Finance Master/Anadolu University

Yasemin Dumrul

Asst. Prof., Kayseri University, ydumrul@erciyes.edu.tr

Zerrin Kılıçarslan

Asst. Prof., Kayseri University, zkaan@erciyes.edu.tr

Kurtuluş Bozkurt and Aytaç Pekmezci

1 Economic Growth and Current Deficit: An Analysis for OECD Countries

Highlights: Together with globalization, especially last quarter century, one of the most discussed subjects in literature of economy is effects of unbalanced current accounts on macroeconomic variables. Integration of developing countries in process of globalization, effects of liberal economy politics applications based on balance of payments on economic growth is the subject discussed on literature of economy. In this chapter, the author will use the OECD countries’ data for 2005:01–2017:04 time interval. With this, panel data set will be formed. And this study will search if there is any causation relationship between current accounts balance and economic growth and analyse that.

Keywords: Economic growth, current deficit, panel data, OECD countries

Introduction

With the globalization process, especially in the last quarter of centuries, one of the most discussed issues in the economic literature has been the effects of current account imbalances on macroeconomic variables. The effects of liberal economic policies applied in the context of the integration of developing countries into the globalization process on the economic growth processes through the balance of payments are one of the most discussed topics in the economic literature. Again, the theoretical approaches, which try to explain the economic crises and are defined as the third-generation crisis models, attach great importance to the current account balance (Üzümcü et al., 2015).

The analysis of the relationship between the current account balance and economic growth has shown that different results have been achieved for the long term using a different sample, period and method. While some studies have found a cointegration relationship in the long term, some studies have not found the same.

On the one hand, when we look at the causality analyses made for the short term, it is seen that some studies have determined a single or double causality relationship between the current account deficit and economic growth in the short term. However, in some of these analyses, a causal relationship has been determined from the current deficit to economic growth and in some from ←13 | 14→economic growth to the current deficit. On the other hand, in some studies, it is seen that no causality relationship can be determined for the short term.

The main objective of this study is to empirically analyze the theoretical relationship between economic growth and current deficit for 32 OECD countries, including Turkey within the framework of 2005:1–2017:4 period and which can be reached to accurate data. For this purpose, the relationship between economic growth and current deficit for OECD countries will be analysed empirically using time series and panel data analysis.

2 Literature

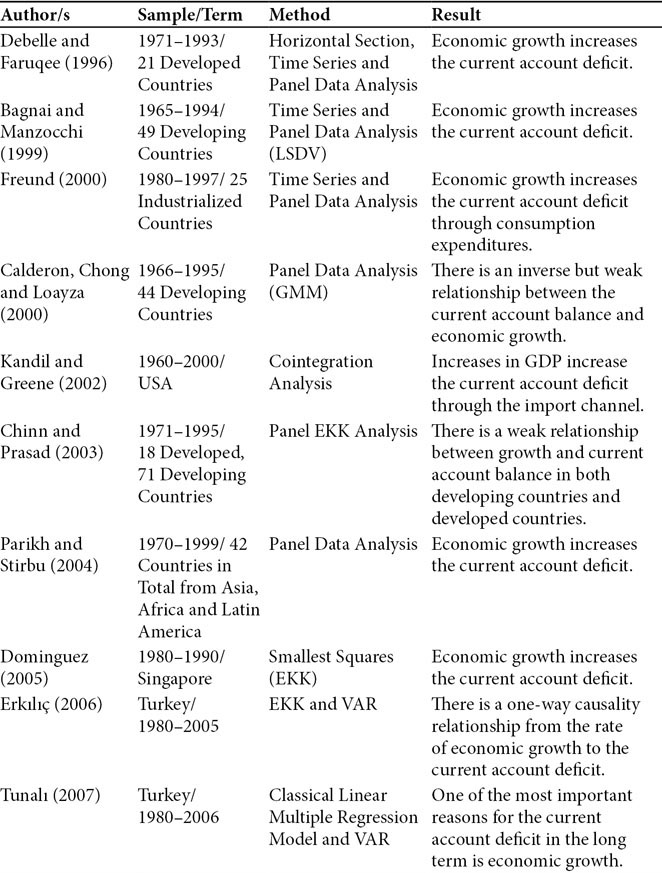

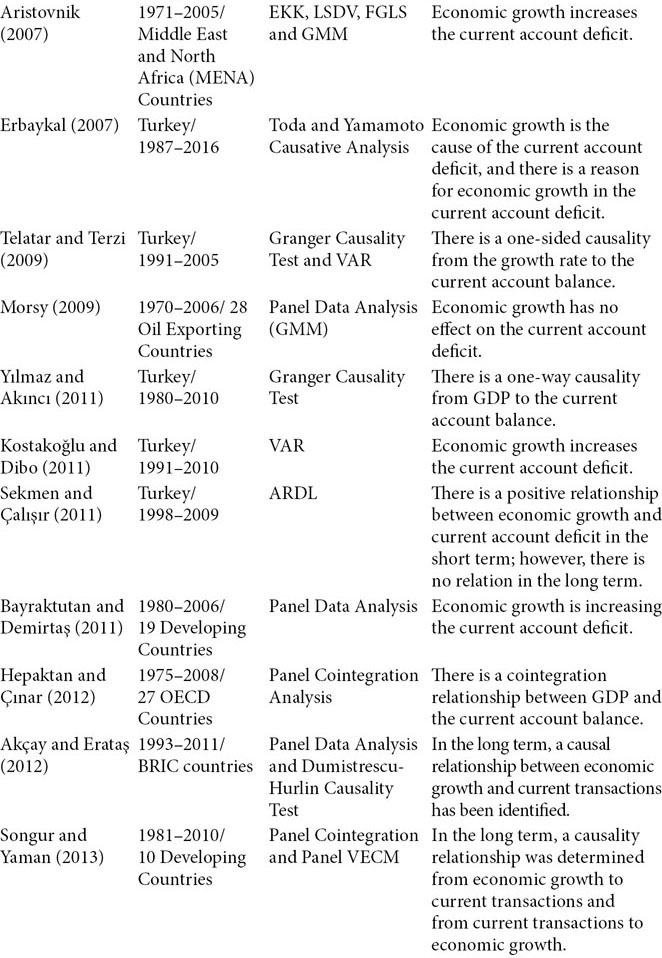

When the literature is analyzed, it is seen that the relationship between economic growth and the current deficit is tested by using different data, sample, period and method, and many studies have been done in this regard. These studies have reached different application results for different samples and periods.

A summary of applied literature on relevant studies examining the relationship between economic growth and the current account deficit is given in Tab. 1.1.

Tab. 1.1: Summary of Applied Literature

3 Material and Method

In the time series, the most important assumption that is required to obtain meaningful relationships between the variables studied is that the variables must be stable. This assumption is necessary for effective and consistent estimates (Gujarati, 2005). In addition, the long-term relationship between the series is determined by the analysis of cointegration. When Xt and Yt are the first (I (1)) error term (ut) I (0) obtained from the regression model of the two-time series, these two variables are called co-integrated series. Finally, the direction of the relationship between the variables is determined by Granger causality analysis.

Johansen developed the Largest Eigenvalue (lmax) and Trace (ltrace) tests as calculated in Equation 1 based on the maximum likelihood method with the vector autoregressive (VAR) model in estimating the multiple cointegration vector between two or more variables. The r in equality shows the maximum number of cointegration vectors among the variables. ltrace tests the number of cointegrated vectors, and lmax tests the significance of the coherent vectors (Enders, 1995).

Details

- Pages

- 348

- Publication Year

- 2019

- ISBN (Softcover)

- 9783631801321

- ISBN (PDF)

- 9783631804100

- ISBN (ePUB)

- 9783631804117

- ISBN (MOBI)

- 9783631804124

- DOI

- 10.3726/b16226

- Language

- English

- Publication date

- 2020 (June)

- Keywords

- Risk Profitability Banking Sector Stock Prices Economy Politics Economic Growth

- Published

- Berlin, Bern, Bruxelles, New York, Oxford, Warszawa, Wien, 2019. 348 pp., 26 fig. b/w, 108 tables.

- Product Safety

- Peter Lang Group AG