FINANCIAL SYSTEM, FINANCIAL DEVELOPMENT AND FIRM SURVIVAL:

PERSPECTIVES FROM TURKISH FINANCIAL SYSTEM AND GLOBALIZATION

Summary

Excerpt

Table Of Contents

- Cover

- Title Page

- Copyright Page

- Foreword

- About the editors

- About the book

- Citability of the eBook

- Contents

- Contributors

- Chapter One: Marketing Finance, Infrastructure, and Entrepreneurship

- Chapter Two: The Relationship of Financial Development and Export; the Case of Turkey: A Literature Review

- Chapter Three: Interactıve Effects of Remıttances and Financial Development on Turkey’s Economıc Growth

- Chapter Four: Credit Ratings, Credit Rating Agencies, and Sovereign Credit Ratings

- Chapter Five: Financialization and Income Inequality

- Chapter Six: Pricing System in National and Global Markets

- Index

- List of Figures

- List of Tables

Adnan Kara

Bayburt University, Economics and Administrative Sciences Faculty, Bayburt, Turkey

Bülent Günsoy

Anadolu University, Economics Faculty, Eskişehir, Turkey

Derya Yalçin

Nişantaşı University, Vocational High School, Logistics Programme, İstanbul, Turkey

Yılmaz Onur Ari

Bayburt University, Economics and Administrative Sciences Faculty, Bayburt, Turkey

Özgür Bayram Soylu

Kocaeli University, Economics and Administrative Sciences Faculty, Kocaeli, Turkey

Ramazan Sayar

Bayburt University, Economics and Administrative Sciences Faculty, Bayburt, Turkey

Ümit Yıldız

Bayburt University, Economics and Administrative Sciences Faculty, Bayburt, Turkey

Adnan Kara

Chapter One: Marketing Finance, Infrastructure, and Entrepreneurship

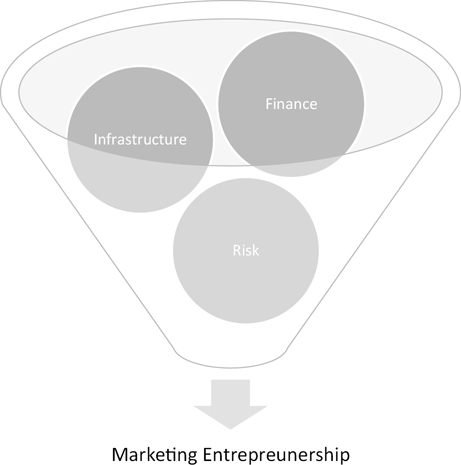

Abstract: This chapter examines the relationship between marketing finance, infrastructure, and entrepreneurship. The aim of the study is to show that countries’ financial development improves infrastructure, reduces risks, and increases entrepreneurship. Marketing finance is the provision and management of monetary funds in order to carry out marketing activities. Marketing infrastructure is the existence of physical systems such as logistics, advertising agencies and research companies that carry out marketing activities. Marketing entrepreneurship is the transformation of innovative ideas into economic activities in coordination with marketing process management. In conclusion of the study, the development of the financial system affects the competitiveness. Thus, more marketing investments are made in a more competitive environment.

Keywords: Marketing entrepreneurship, marketing finance, marketing infrastructure, marketing risk

Introduction

Marketing helps raise standards in society and develop distribution channels. In the economic system supported by advanced distribution channels, suitable environments for entrepreneurship are created.

As seen on Fig. 1, marketing entrepreneurship is conclusion of risk, infrastructure, and finance. In high-risk environments, marketing entrepreneurs maximize profit and minimize risk. Sophisticated infrastructure and financial system facilitate this marketing task.

1 Marketing Finance

Marketing mostly focuses on intangible assets such as brand, image, and promotion. Finance, on the other hand, focuses on short-term cash flows. Finance can be expressed as a common branch of economy and business that allows individuals and institutions to invest. Price instability, weakness of financial contracts, inability to protect intangible assets, and inadequate technologic improvements are the characteristics of undeveloped financial systems (Braun, 2003). These factors are indicative of how the development of the financial system may affect marketing. For example, in a politically unstable country, uncertainties about ←11 | 12→the future are very high. Therefore, any company's financial department will be reluctant to invest in a long-term brand name.

Marketing finance includes the provision and management of the money and credit required to be used in the activities carried out to get the goods into the hands of consumers (Tenekecioğlu & Ersoy, 1999). Marketing that does not have the necessary financial funds will not develop enough in the economy. Economies of countries with a strong financial system are developed, and thus their marketing infrastructure is improved.

In terms of marketing, venture capital is an important source of funding. Because it encourages the emergence of innovative ideas to respond to changing customer demands. However, an important feature of undeveloped capital markets is predominantly reserving tangible assets to allocation of financial funds (Braun, 2003). This situation, which leads to a limited relationship between the entrepreneur and the investor, makes access to capital difficult.

Venture capital is long-term investments made by investors with surplus capital funds for the formation and operation of companies with high development potential. The aim of the venture capital investment is to obtain the profit from ←12 | 13→the increase in efficiency of the project-based technologic initiatives. In addition to providing funds for venture capital, it also provides consultancy support from the investor in strategy, finance, marketing, and management (Fig. 2).

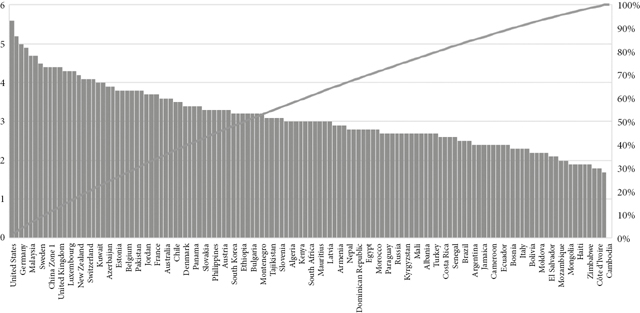

It can be said that marketing has a key role in providing competitive environment which is important for consumers. The task of marketing is to determine the needs and desires of the market and to effectively fulfill them. The task of production is to efficiently convert inputs into outputs in line with marketing decisions. Basically, without production capabilities, marketing cannot fulfill its duties. One of the major inputs of production is capital. In this respect, economies with advanced financial system are superior in terms of high-scale production capabilities. According to a study conducted with panel data of 65 countries for 30 years, the proportion of goods produced in the Domestic National Product is high in the countries with advanced financial system; and produced goods constitute a high proportion of total exports (Beck, 2002). Economies with advanced financial system are also successful in marketing due to their high production capabilities. The best examples of these are that countries such as Japan and China first succeed in production productivity and technological development, and then release their global brands.

An undeveloped financial system presents many problems for enterprises. Especially financial crises are a big obstacle for marketing. Developments in financial markets are also hampered by crises. Financial crisis arises as a result of the sudden depreciation of a large part of the financial services institutions or ←13 | 14→assets. Financial crisis, a subspecies of economic crises, has many causes. Some reasons are speculative attacks, weaknesses in financial structure, deterioration in the structure of the economy, increase in interest rates, excessive fluctuations in capital movements, global financial situation, deterioration of financial sector balance sheets and increased uncertainties (anapara.com, 25.06.2019). According to the surveys conducted with managers within the scope of the global competitiveness index survey prepared by the World Economic Forum (WEF), access to finance is one of the biggest obstacles in doing business in most economically underdeveloped countries. Due to the cash shortage experienced during crises that restrict access to finance, the majority of firms cut their marketing budgets. Therefore, marketing is one the most affected by crises.

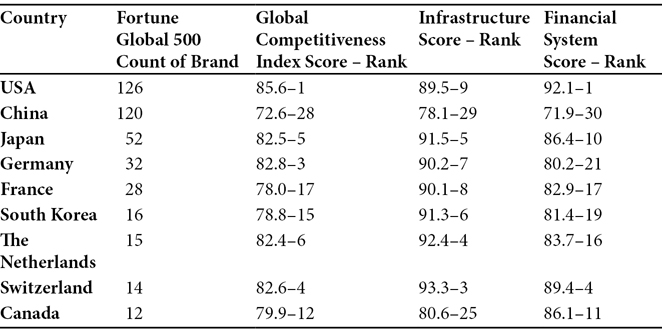

Each year, the world’s largest publicly traded global companies are listed on the Fortune Global 500 list. A total 87.5% of the companies in the Fortune Global 500 2018 list are from only nine countries (www.gfmag.com, 15.07.2019). Table 1 shows the countries’ WEF global competitiveness index scores and the number of brands in the Fortune Global 500.

Tab. 1: Comparison of Countries’ Global Brand Quantities and Competitiveness Index

Details

- Pages

- 118

- Publication Year

- 2019

- ISBN (Softcover)

- 9783631806319

- ISBN (PDF)

- 9783631814635

- ISBN (ePUB)

- 9783631814642

- ISBN (MOBI)

- 9783631814659

- DOI

- 10.3726/b16834

- Language

- English

- Publication date

- 2020 (February)

- Published

- Berlin, Bern, Bruxelles, New York, Oxford, Warszawa, Wien, 2020. 118 pp., 13 fig. b/w, 8 tables.

- Product Safety

- Peter Lang Group AG