Summary

Excerpt

Table Of Contents

- Cover

- Title

- Copyright

- About the author

- About the book

- This eBook can be cited

- Preface

- Contents

- List of Contributors

- Comparison of Tax Revenue Forecasting Models for Turkey: (Hamza Erdoğdu and Recep Yorulmaz)

- Examination of Tax Administration by Digitalization: Taxation of Sharing Economy; Country Examples and Evaluation of Turkey: (Burçin Bozdoğanoğlu)

- Tax Incentives Provided to Green Bonds in Financing of Energy Efficiency and Its Importance for Turkey: (Ayşe Yiğit Şakar)

- The Importance of Tax Literacy in Tax Compliance: (Güneş Çetin Gerger, Feride Bakar Türegün, and Adnan Gerçek)

- The Concept of Collective Investment Institution and Specific Tax Advantages Provided for These Institutions and Their Investors in Turkey: (Filiz Keskin)

- The Impacts of Digitalization of Tax Administration on the Complexity of Tax System: OECD Countries Example: (Filiz Giray)

- Empirical Findings on Macro Determinants of Pharmaceutical Spending in Selected OECD Countries: (Pelin Varol İyidoğan, Eda Balıkçıoğlu, and H. Hakan Yılmaz)

- Example of Internal Tax Bleeding: “Tax Expenditures”: (Nevzat Saygılıoğlu)

- The Size of the Public Sector and the Armey Curve: The Case of Turkey: (Cihan Yüksel)

- Okun’s Law: Turkey Case: (Nedim Mercan and Özay Özpençe)

- An Evaluation of Subsidies Granted to the Private Educational Institutions within the Framework of Turkish Tax System: (Aslıhan Özel Özer, Buğra Özer, and Sercan Akın)

- Artificial Intelligence: If It’s Taxed, But How?: (Özgür Biyan and Güneş Yılmaz)

- List of Figures

- List of Tables

List of Contributors

Sercan Akın

Manager for Mavişehir Science Private Educational Courses, Turkey, akinsercan1@gmail.com

Eda Balıkçıoğlu

Assoc. Prof., PhD., Kırıkkale University, Turkey, edabalikcioglu@kku.edu.tr

Özgür Biyan

Assoc. Prof. PhD., Bandırma Onyedi Eylul University, Faculty of Economics and Administrative Sciences, Department of Public Finance, Turkey, ozgurbiyan@hotmail.com

Burçin Bozdoğanoğlu

Assoc.Prof. PhD., Bandırma Onyedi Eylul University, Faculty of Economics and Administrative Sciences, Department of Public Finance, Turkey, burcindogan@gmail.com

Hamza Erdoğdu

Assist. Prof. PhD., Harran University, Faculty of Economics and Administrative Sciences, Department of Econometrics, Turkey, hamzaerdogdu@harran.edu.tr

Güneş Çetin Gerger

Assoc. Prof. PhD., Manisa Celal Bayar University, Turkey, gunes.cetin@hotmail.com, (corresponding author)

Adnan Gerçek

Prof. PhD., Bursa Uludağ University, Department of Public Finance, Turkey, agercek@uludag.edu.tr

Filiz Giray

Prof. PhD., Bursa Uludağ University, Department of Public Finance, Turkey, giray@uludag.edu.tr

Pelin Varol İyidoğan

Assoc. Prof., PhD., Hacettepe University, Turkey, pelinv@hacettepe.edu.tr (corresponding author)

Filiz Keskin

Prof. PhD, Istanbul Arel University, Faculty of Economics and Administrative Sciences, Department of Political Science and Public Administration, Turkey, av.filizkeskin@gmail.com, filizkeskin@arel.edu.tr

Nedim Mercan

PhD. Student, Pamukkale University, Turkey, nedimmercann@gmail.com

Aslıhan Özel Özer

Assist. Prof., PhD., Manisa Celal Bayar University, Ahmetli Vocational College, Tax and Accounting Applications Program, Turkey, aslihanozel@yahoo.com

Buğra Özer

Assoc. Prof., PhD., Manisa Celal Bayar University, Faculty of Economics and Administrative Sciences, Department of Political Science and International Relations, Turkey, bugraozer@gmail.com

Özay Özpençe

Assoc. Prof. PhD., Pamukkale University, Turkey, oozpence@pau.edu.tr

Ayşe Yiğit Şakar

Prof. PhD., Istanbul Arel University, Faculty of Economics and Administrative Sciences, Department of Business Administration, Turkey, aysesakar@arel.edu.tr, ayseyigitsakar@gmail.com

Nevzat Saygılıoğlu

Prof. PhD., Atılım University, Faculty of Business Administration, Turkey, nevzat.saygilioglu@atilim.edu.tr

Feride Bakar Türegün

Assist. Prof. PhD., Bursa Uludağ University, Department of Public Finance, Turkey, feridebakar@uludag.edu.tr

H. Hakan Yılmaz

Prof., PhD., Ankara University, Turkey, hhyilmaz@politics.ankara.edu.tr

Recep Yorulmaz

Assist. Prof. PhD., Ankara Yıldırım Beyazıt University, Faculty of Political Sciences, Department of Public Finance, Turkey, ryorulmaz@ybu.edu.tr

Cihan Yüksel

Assist. Prof. PhD., Mersin University, Department of Public Finance, Turkey, cihanyuksel@mersin.edu.tr

Güneş Yılmaz

Assoc. Prof. PhD., Alanya Alaaaddin Keykubat University, Faculty of Business Administration, Department of International Trade, Turkey, gunes.yilmaz@alanya.edu.tr

Hamza Erdoğdu and Recep Yorulmaz

Comparison of Tax Revenue Forecasting

Models for Turkey

Abstract The objective of this study is to compare the performance of three forecasting tax revenue models for Turkey throughout 2006:01 to 2018:12. Three different time series forecasting techniques such as Random Walk, SARIMA (Seasonal Autoregressive Integrated Moving Average), and BATS (Exponential Smoothing State Space Model with Box-Cox Transformation, ARMA Errors, Trend and Seasonal Components) are used in the study. At the beginning of the analysis, the data set was apportioned into two parts: training and testing. The training period is from 2006:01 to 2014:12, and the testing part is from 2015:01 to 2018:12. Based on different evaluation criteria, forecast points of 36 months are obtained for each forecasting model. We find that using the BATS model, rather than classical (SARIMA) in forecasting series of monthly tax revenues of Turkey, provides more accurate forecasts. The empirical findings of this study help the experts in the preparation process of the government’s budgets.

Keywords: Forecasting, Tax Revenue, BATS, SARIMA, Turkey

JEL Codes: C1, C5, H20

1 Introduction

Tax revenues are considered amongst the fundamental sources of government budget planning. Governments collect taxes not only to finance their expenses but also aiming of stabilization, distribution, and allocation in the economy. They use taxes to stabilize the employment levels, the balance of payments, and/or prizes. They might try to intervene with the income and wealth distribution by playing with the tax structure. Further, they might want to use taxes to the allocation of resources in the economy by using their allocative effects on certain goods (Brown and Jackson, 1986, p. 297).

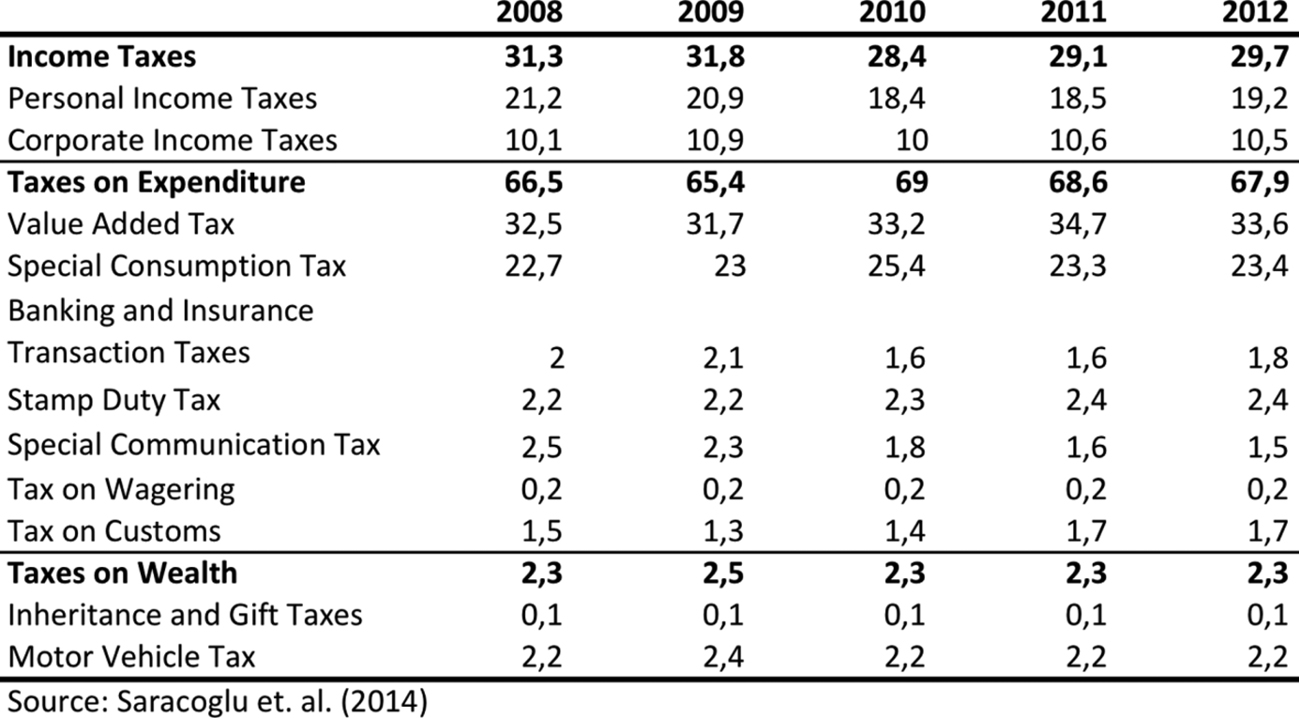

There are three fundamental classifications in the Turkish tax system. These are income taxes, taxes on expenditure, and taxes on wealth. The relative importance of these taxes in the Turkish tax system is presented in Tab. 1. Income taxes are classified as individual income and corporate income taxes. Income taxes yield about 30% of total revenues in the Turkish tax system.

Taxes on expenditures, on the other hand, contain approximately 68% of total revenues in the Turkish tax system. Taxing expenditures are considered the standard and easy way to collect taxes for governments. Hence, that significant ←13 | 14→amount of taxes is comprised of expenditures in Turkey. Finally, taxes on wealth only yield approximately 2% of total revenues. Tax analysis and forecasting of tax revenues for governments are crucial to ensure stability in tax and expenditure policies (Jenkins et al., 2000).

Budgetary uncertainties directed governments to rely heavily on economic analysis in recent decades. Because of the extent of these fiscal problems forecasting tax revenues is essential for governments to manage their budget planning process. Recent fiscal problems of governments created reliability issues on economic and revenue forecasting. Hence, there are plenty of methods that are used to forecast tax revenues by policymakers (Fullerton, 1989). Transparency and accuracy are the critical components while determining the method for forecasting. Potential manipulation of forecasts might create government problems.

Furthermore, inaccurate forecasts might hinder the abilities of policymakers to make accurate budget planning and harm levels of productivity in the economy (Kyobe and Danninger, 2005; Cirincione et al., 1999). It is considered that countries with high-income levels and relatively small central government tend to have high formality, accuracy, and transparency forecasts (Kyobe and Danninger, 2005).

Government revenue forecasting studies for Turkey are rare in the literature; hence, this study aims to fill this gap. The rest of the study is organized as follows. Section II outlines the significant studies that make forecasting analysis ←14 | 15→in the literature. Furthermore, Section III describes the methodologies of the forecasting techniques applied and the data that are used in the study. Section IV provides the outcomes of selected forecasting methods in the study. Finally, Section V contains the conclusion and discussions.

2 Literature

Majority of forecasting studies focused on the private sector in the literature so far, hence the studies focused on government revenue are relatively less than private-sector studies. For instance, Gajewar and Bansal (2016) conducted a forecasting analysis for the private sector using machine-learning algorithms. Accurately, they performed ARIMA, ETS (Exponential Smoothing), STL (Seasonal and Trend Decomposition using Loess), and Random forest machine-learning algorithms to obtain revenue forecast for Microsoft. They suggested that using machine-learning algorithms methods would increase the accuracy of quarterly revenue forecasting.

Many researchers also focused on state and/or municipal revenue forecasting analysis so far. Fullerton (1989) analyzed sales tax revenues using a composite forecasting model for Idaho. Using a time series model and econometric models, he examined the capability of the composite forecasting model. He found that the composite forecast model is more effective than baseline forecasts. The combined model was also found more accurate than previous forecast attempts for Idaho.

Hambor et al. (1974) used an econometric forecasting method using a simple revenue structure for Hawaii. They forecasted state revenues, including; excise, personal income, corporate income, and other state tax revenues, for a single fiscal year of Hawaii. Furthermore, Kyobe and Danninger (2005) analyzed the revenue forecasting practices in 34 low-income countries, focusing primarily on institutional prospects. They claimed that there are three critical factors on forecasting practices, such as “formality, organizational simplicity, and transparency”. They empirically found that countries’ levels of corruption are associated with formality and transparency of forecasting. Accordingly, they found that high levels of corruption are related to less formal and transparent forecasts.

Cirincione et al. (1999) examined the impact of using time series models, the length, and the frequency of the data on non-tax general fund revenue forecasting for the municipalities of Connecticut. They found that exponential smoothing models are most effective on bimonthly data in which they claim local governments should rely on rather than monthly or quarterly data.

←15 | 16→As we pointed above, there are plenty of methods that were used to forecast the private sector or government/state/municipal revenues in the literature. It is also essential to analyze the methods used in these studies. In the case of the Box-Jenkins Auto-Regressive Integrated Moving Average Model (ARIMA), researchers found different results in the effectiveness of the ARIMA model. For instance, Makridakis and Hibon (1995) claimed that the ARIMA model performs relatively weak than other models. In doing so, Makridakis et al. (1979) found the reason for this poor performance of the ARIMA model as the usage of differencing in order to find stationary in the mean of the series.

Similarly, in a series of studies that focused on local government revenue forecasting for the municipalities of Florida, researchers found similar results. They claimed that the Box-Jenkins ARIMA model performs poorly than other methods such as time series models, which produce lower forecast errors. Furthermore, they found that trend fitting by regression generated more forecast errors than its counterpart methods (Frank and Gianakis, 1990; Gianakis and Frank, 1993).

It is important to point out that the studies that found poor performance for the ARIMA method mainly focused on municipal government revenue forecasting. Differently, Downs and Rock (1983) found evidence that the multivariate Auto Regressive Moving Average (ARMA) method is more effective than univariate techniques using the ARMA model for municipal government revenue forecasting.

While most of the forecasting studies examine the relative performance of various methods so far, only a few researchers tested the impact of data quality on the performance of forecasting methods. Gianakis and Frank (1993), which is one of these studies, claimed that the length of the data does not have any impact on the accuracy of forecasting techniques. However, some scholars suggested that at least fifty observations are necessary to implement the Box-Jenkins ARIMA method. On the other hand, scholars have kept using this method with fewer numbers so far (Lorek et al., 1976).

Details

- Pages

- 212

- Publication Year

- 2019

- ISBN (Softcover)

- 9783631810743

- ISBN (PDF)

- 9783631813492

- ISBN (ePUB)

- 9783631813508

- ISBN (MOBI)

- 9783631813515

- DOI

- 10.3726/b16603

- Language

- English

- Publication date

- 2020 (March)

- Keywords

- Economic growth Public finance Tax literacy Tax expenditures Digitalization and taxation Taxation

- Published

- Berlin, Bern, Bruxelles, New York, Oxford, Warszawa, Wien, 2019. 212 pp., 13 fig. b/w, 35 tables.

- Product Safety

- Peter Lang Group AG