Interdisciplinary Public Finance, Business and Economics Studies– Volume IV

Summary

economics, public finance and business written by researchers from several different

universities. It also includes a wide range of topics concerning issues in economics,

public finance and business. This book is aimed at educators, researchers and

students interested in these fields.

Excerpt

Table Of Contents

- Cover

- Title

- Copyright

- About the editor

- About the book

- This eBook can be cited

- Foreword

- Table of Contents

- List of Contributors

- The Covid-19 Crisis Impact on Turkey’s Economy (Metin Kılıç and İnci Merve Altan)

- Impact of Covid-19 Crisis on Unemployment in Turkey (Hicran Kasa)

- Labour Markets and Employment Policies in the World and Turkey during the Covid-19 Process (Ahmet İnkaya and Özgür Aydoğuş)

- Impact of Covid-19 on E-Commerce (Belkıs Önel)

- Effects of Contagious Diseases on Tourism: COVID-19 and Tourism (Uğur Saylan)

- Energy Security Dilemma and Rentier States (Arzu Al and Nur Aslan)

- Importance of a Favourable Ecosystem in the Financing of Terror: PKK’s Drug Trafficking in Europe (Bilgin Birlikseven and Meral Balcı)

- Does the Shadow Economy Increase Environmental Pollution in Turkey? (Salih Türedi and Vildan Yavuz)

- Innovation Trends in the Contemporary World: Technology – Innovation Systems and Policies in Selected Countries (Esra Balli and Muammer Tekeoglu)

- Youth Unemployment Problem: Macro and Micro Causes in the European Union (Çiler Sİgeze)

- Relationship between Profit and Export Intensity in Turkish Manufacturing Sub-Sectors (Nuran Coşkun)

- Inflation and Economic Growth Nexus in Rwanda (Wilkista Lore Obiero and Mehmet Şengür)

- Importance of Energy Security in Sustainable Development Process: An Assessment for Turkey (Cem Gökce)

- A Sequential Study on the Adaptation of Merchandising and Anchoring Theory: An Experimental Study Examining the Effects of the Dark Triad in Stores (Mahmut Nevfel Elgün and Hüseyin Çağatay Karabıyık)

- An Empirical Analysis on World Almond Markets1 (Muhammet Yunus Şişman)

- Asymmetric Information and Adverse Selection Problems in the Semantic Evolution of Rationality Concept (Oğuzhan Sungur)

- Transformation of Labour in the Digitalization Process of Capitalism (Hüseyin Sevgi)

- Principal Views of Ibn Khaldun on Commerce (Mohammad Maghaminia)

- Problems Encountered in the Application of the Gravity Model and Proposed Solutions (Murat Mere and Mahmut Masca)

- The Effect of China on Turkey’s Foreign Trade: An Anaylsis with the Gravity Model* (Oğuzhan Özçelik)

- An Examination of the Recidivism Provisions in Turkish Tax Criminal Law (Şebnem Ekeryılmaz)

- Assessment of the Economic Effects of the Covid-19 Pandemic in European Union Countries from the Perspective of the Maastricht Criteria (Adil Akinci)

- Financial Structure Evaluation of Global Airline Companies during the COVID-19 Pandemic (Berna Dombekci Ozcelik)

- Testing Effective Market Hypothesis in Weak Form: Fourier Evidence from Borsa Istanbul (BIST) (Metin Yiğituşağı and Erkan Alsu)

- Cryptocurrency and Behavioural Finance (Şaban Onur Viga)

- A Multivariate Statistical Study on the Relationship between Tourist Experiences and the Intention to Recommend (Selim Tüzüntürk)

- Accounting-Based Earnings Manipulation: Manipulation Methods, Techniques Related to Determining Manipulation and Literature Review (Tansel Çetinoğlu)

- Çanakkale Industry (1927–1935) (Edip Durmaz)

- Investigation of Executive Management Style Generation Y: The Example of Turkey (Nihat Onur Aşikoğlu)

- Modern Management Approaches and Expectatıons from a Modern Leader (Nuran Varışlı and Münevver Bayar)

- Evaluation of the Approach to the Uses and Gratifications in Digital Media Regarding Public Relations Research (Müge Bekman)

- Examination of Academic Performance Evaluation (Güler Yanık)

- E-manufacturing and Web-Based Enterprise Resource Planning (Tuğba Tunacan and Cemalettin Hatipoğlu)

- Literature Review on the Green Innovation Concept (Ahmet Gümüş)

- Research on Women on the Board of Directors in Group 1 Companies (Comparison with Group 2 Companies) (Yasemin Durmaz)

- The Importance of Bankıng Industry in the Risk Management of Enterprises in Turkey (Serkan Varsak)

List of Contributors

Adil Akinci

Ph.D., Assoc. Prof., Bilecik Şeyh Edebali University, Faculty of Economics and Administrative Sciences Department of Public Finance, adilakinci@gmail.com, ORCID: 0000-0002-2181-6952

Ahmet Gümüş

Ph.D., Assist. Prof., Ağrı İbrahim Çeçen University, Faculty of Economics and Administrative Sciences, Department of Public Relations and Advertising, agumus@agri.edu.tr, ORCİD: 0000-0001-7089-5936.

Ahmet İnkaya

Ph.D., Assist. Prof., Afyon Kocatepe University, Faculty of Economics and Administrative Sciences, Department of Economics, inkaya@aku.edu.tr, ORCID: 0000-0002-9426-8193

Özgür Aydoğuş

Research Assistant, Afyon Kocatepe University, Faculty of Economics and Administrative Sciences, Department of Economics, ozaydogus@aku.edu.tr, ORCID: 0000-0002-9747-9390

Arzu Al

Ph.D., Assoc. Prof., Marmara University, Faculty of Political Science, Departmant of International Relations, arzu.al@marmara.edu.tr, ORCID: 0000-0002-3287- 3661

Nur Aslan

PhD., Marmara University, Institute of Social Sciences, Department of International Political Economy, nur.aslan.8489@gmail.com, ORCID: 0000- 0002-1397-7641

Belkıs Önel

Instructor, Istanbul Esenyurt University, Foreign Trade Program, belkisonel@esenyurt.edu.tr, ORCID: 0000-0001-8574-9915

Berna Dombekci Ozcelik

Ph.D., Assist. Prof., Kırklareli University, Social Sciences Vocational School, Accounting Program, dombekci@klu.edu.tr, ORCID: 0000-0003-1269-4014

Ph.D.Candidate, Marmara University, Institute of Social Sciences, Department of International Relations, bilgin.birlikseven@hotmail.com, ORCID: 0000-0002-4844-4079

Meral Balcı

Ph.D., Assoc. Prof., Marmara University, Faculty of Political Sciences, Department of International Relations, mbalci@marmara.edu.tr, ORCID: 0000-0003-3638-5339

Cem Gökce

Ph.D., Assist. Prof., Afyon Kocatepe University, Faculty of Economics and Administrative Sciences, Department of Economics, cgokce@aku.edu.tr, ORCID: 0000-0001-7805-6977

Çiler Sİgeze

Ph.D., Cukurova University, Faculty of Economics and Administrative Sciences, Department of Econometrics, csigeze@cu.edu.tr, ORCID: 0000-0001-5329-5066

Edip Durmaz

Ph.D., Assist. Prof., Kırklareli University, Faculty of Arts and Sciences, Department of History, edipdurmaz@klu.edu.tr, ORCID: 0000-0003-1479-4190

Esra Balli

Ph.D., Assist. Prof., Erzincan Binali Yildirim University, Faculty of Economics and Administrative Sciences, Department of Economics, esra.balli@erzincan.edu.tr, ORCID: 0000-0001-6993-9268

Muammer Tekeoglu

Ph.D., Professor, Cukurova University, Faculty of Economics and Administrative Sciences, Department of Economics, toglu@cu.edu.tr, ORCID: 0000-0001-8270-3858

Güler Yanık

Ph.D., Assist. Prof., Recep Tayyip Erdoğan University, Faculty of Economics and Administrative Sciences, guler.yanik@erdogan.edu.tr, ORCİD: 0000-0002-5228-2981

Hicran Kasa

Ph.D., Assist. Prof., Türk Hava Kurumu University, Ankara Aeronautical Vocational School Of Higher Education, hkasa@thk.edu.tr, ORCID: 0000-0001-7266-0313

Ph.D., Kırklareli University, Faculty of Economics and Administrative Sciences, Department of Labor Economics and Industrial Relations, hsevgi@gmail.com, ORCID: 0000-0003-0295-0723

Mahmut Nevfel Elgün

Ph.D., Assist. Prof., Necmettin Erbakan University, Faculty of Political Sciences, Department of Business Administration, melgun@erbakan.edu.tr, ORCID: 0000-0002-8380-886X

Hüseyin Çağatay Karabıyık

Ph.D., Assist.Prof., Ankara Medipol University, Faculty of Administrative and Social Sciences, Department of Business Administration, h.cagataykarabiyik@gmail.com.tr, ORCID: 0000-0002-1898-5907

Metin Kılıç

Ph.D., Assoc. Prof., Bandırma Onyedi Eylül University, Faculty of Economics and Administrative Sciences, mkilic@bandirma.edu.tr, ORCID: 0000-0002-5025-6384

İnci Merve Altan

Ph.D., Assist. Prof., Bandırma Onyedi Eylül University, Bandırma Vocational School, ialtan@bandirma.edu.tr, ORCID: 0000-0002-6269-7726

Metin Yiğituşağı

Ph.D., Gaziantep University, Faculty of Economics and Administrative Sciences, Department of Business, metinyigitusagi@hotmail.com, ORCID: 0000-0002-2360-2202.

Erkan Alsu

Ph.D., Assoc. Prof., Gaziantep University, Faculty of Economics and Administrative Sciences, Department of Business, alsu@gantep.edu.tr, ORCID: 0000-0001-6102-1786.

Mohammad Maghaminia

Ph.D., Assist. Prof., Gümüşhane University, Faculty of Economics and Administrative Sciences, Department of Commercial Law, m.magami@gumushane.edu.tr, ORCID: 0000-0002-8571-7638

Ph.D., Istanbul University – Cerrahpaşa, Technical Sciences Vocational School, Department of Civil Aviation Cabin Services, mugebekman@yahoo.com, ORCID: 0000-0002-8400-0993

Muhammet Yunus Şişman

Ph.D., Assist. Prof., Dumlupınar University, Faculty of Economics and Administrative Sciences, Department of International Trade and Finance, myunus.sisman@dpu.edu.tr, ORCID: 0000-0002-2187-4327

Murat Mere

Lecturer, Afyon Kocatepe University, Başmakçı Vocational School of Higher Education, Department of Foreign Trade, meremurat@aku.edu.tr

Mahmut Masca

Ph.D., Professor, Afyon Kocatepe University, Faculty of Economics and Administrative Sciences, Department of Economics, mmasca@aku.edu.tr

Nihat Onur Aşikoğlu

Ph.D., Research Assistant, Afyon Kocatepe University, Faculty of Economics and Administrative Sciences, Department of Business Administration, noasikoglu@gmail.com, ORCID: 0000-0002-7153-7839

Nuran Coşkun

Ph.D., Research Assistant, Mersin University, Faculty of Economics and Administrative Sciences, Department of Economics, ncoskun@mersin.edu.tr, ORCID:0000-0002-7803-7968

Nuran Varışlı

Ph.D., Expert, Republic of Turkey Social Security Institution, gulmennuran@hotmail.com, ORCID: 0000-0002-0657-756X

Münevver Bayar

Ph.D., Manager, Republic of Turkey Social Security Institution, munevverbayar@hotmail.com, ORCID: 0000-0002-8077-2160

Oğuzhan Özçelik

Ph.D., Kırklareli University, Bababaeski Vocational School, oguzhanozcelik@klu.edu.tr, ORCID: 0000-0001-6666-8976 *This book chapter was derived from ←14 | 15→my doctoral thesis named ‘Turkey’s Foreign Trade in Consideration of Economic Integrations Theory and China Impact’.

Oğuzhan Sungur

Ph.D., Assist. Prof., Recep Tayyip Erdogan University, Faculty of Economics and Administrative Sciences, Department of Economics, oguzhan.sungur@erdogan.edu.tr, ORCID: orcid.org/0000-0001-6897-4926

Şaban Onur Viga

Ph.D., Assist. Prof., Istanbul Esenyurt University, The School of Physcical Education and Sport, Head of Sports Management Departmant, onurviga@gmail.com, ORCID: 0000-0002-1676-7850

Salih Türedi

Ph.D., Assoc. Prof., Recep Tayyip Erdogan University, Faculty of Economics and Administrative Sciences, Department of Economics, salih.turedi@erdogan.edu.tr, ORCID: 0000-0001-6294-1007

Vildan Yavuz

Ph.D., Assist. Prof., Recep Tayyip Erdogan University, Faculty of Economics and Administrative Sciences, Department of Economics, vildan.yavuz@erdogan.edu.tr, ORCID: 0000-0003-3232-8265

Şebnem Ekeryılmaz

Ph.D., Assist. Prof., Bilecik Seyh Edebali University, Faculty of Economics and Administrative Sciences, Department of Public Finance sebnem.ekeryilmaz@bilecik.edu.tr, ORCID: 0000-0001-6033-2574.

Selim Tüzüntürk

Ph.D., Assoc. Prof., Bursa Uludağ University, Department of Econometrics, selimtuzunturk@uludag.edu.tr, ORCID: 0000-0002-8987-2280

Serkan Varsak

Ph.D., Assist. Prof., Bilecik Seyh Edebali University, Faculty of Economics and Administrative Sciences, Department of Economics, serkan.varsak@bilecik.edu.tr, ORCID: 0000-0002-5894-1490

Tansel Çetinoğlu

Ph.D., Assoc. Prof., Kütahya Dumlupinar University, Kütahya Faculty of Applied Sciences, Department of Accounting and Finance Management, tansel.cetinoglu@dpu.edu.tr, ORCID: 0000-0003-4380-5653

Ph.D., Assist. Prof., Bolu Abant İzzet Baysal University, Faculty of Engineering, Department of Industrial Engineering, tugbatunacan@ibu.edu.tr,, ORCID ID: 0000-0002-3207-8932

Cemalettin Hatipoğlu

Ph.D., Assist. Prof.,Bilecik Şeyh Edebali University, Faculty of Economics and Administrative Sciences, Department of Management Information Systems, cemalettin.hatipoglu@bileck.edu.tr, ORCID ID: 0000-0002-3129-9725

Uğur Saylan

Ph.D., Assist. Prof., Kütahya Dumlupinar University, Tavşanlı Faculty of Applied Sciences, Departmant of Tourism Management, ugur.saylan@dpu.edu.tr, ORCID: 0000-0001-5761-2399

Wilkista Lore Obiero

Eskisehir Osmangazi University, Institute of Social Sciences, Department of Economics, lwilkista@gmail.com

Mehmet Şengür

Ph.D. Assoc. Prof., Eskisehir Osmangazi University, Faculty of Economics and Administrative Sciences, Department of Economics, msengur@ogu.edu.tr

Yasemin Durmaz

Lecturer, Dumlupınar University, Domaniç Vocational School of Higher Education, yasemin.durmaz@dpu.edu.tr, ORCID: 0000-0002-9299-609X

Metin Kılıç and İnci Merve Altan

The Covid-19 Crisis Impact on Turkey’s Economy

1 Introduction

Although there have been many epidemics in the twenty-first century, the Corona virus (Covid-19) epidemic that started in Wuhan, China on 31 December 2019 affected the entire world and was declared as a pandemic by the World Health Organization on 11 March 2020. The number of sudden deaths and large population losses disrupted daily life; the measures taken to combat the virus disturbed production and activities, and had a negative impact on the economies and financial markets of many countries (Gürsoy, Tunçel and Sayar, 2020: 21; Duran and Acar, 2020: 55).

Unlike crises where the major causes are the result of economic and financial factors, the Covid-19 crisis was a pandemic that endangered human life. According to the IMF, the reasons that distinguish the COVID-19 crisis from other crises are explained by the following three items (IMF, 2020):

i.The economic and financial shock is enormous because of production losses due to quarantines and restrictions, applied to take measures against the virus threatening human life, were much greater than in other global crises.

ii.Similar to a war or a political crisis, uncertainty about the duration and the intensity of the crisis prevails.

iii. Pandemic conditions make it difficult to formulate policies regulating the economy.

The Covid-19 crisis has simultaneously affected supply and demand negatively and reduced the working hours of people, affected business production, consumption demands, opportunities for societies, and investments in businesses (Loayza and Pennings, 2020). The Covid-19 crisis escalated as a result of the measures taken by governments against the virus, which directly affected the global economy. The most important criterion to compete at the global level is based on success in the field of economics. Therefore, to determine the effects of the Covid-19 crisis on Turkey’s economy is very important, both in terms of enhancing the welfare of the people and providing the opportunity to sustain public confidence. Accordingly, this study aims to evaluate the performance of the Turkey’s economy in Covid-19 crisis conditions.←17 | 18→

The study consists of four parts. In the first, general information about the Covid-19 crisis and financial performance evaluation has been explained. In the second part, studies about the effects of financial crises on the economy in the literature are examined. In the third part, the Grey Relational Analysis using the Mastricht criteria (an economic success criteria used by the European Union) is used to examine the impact of the Covid-19 crisis on Turkey’s economy during the period 2010–2020. Finally, in the fourth part; the findings obtained are interpreted.

2 Literature

As a result of the measures taken by countries in order to prevent the pandemic, the disruptions in the production and activities of enterprises have directed the attention of researchers to the impact that the Covid-19 virus has had on the economy. When the studies in the fields of economy and finance are examined, it is seen that the effects of Covid-19 on the monetary policy of Covid-19 (Cochrane, 2020), labour supply, risk premium of countries, production by sector, consumption demand, government spending, oil prices, tourism and travel (Arezki and Nguyen, 2020); supply and demand in trade; trade (Baldwin and Weder di Mauro, 2020); banks (Ersoy, Gürbüz and Fındıkçı Doğan, 2020; Cecchetti and Schoenholtz, 2020); loss of GDP (McKibbin and Fernando, 2020); economic anxiety (Fetzer, Hensel, Hemle and Roth, 2020) and financial markets (Acar, 2020; Şenol, 2020; Zeren and Hizarci, 2020; Barut and Yerdelen Kaygın, 2020; Zhang, Hu and Ji, 2020; Feng, Bao, Wang, Meng, Xia and Zhang, 2020) are analysed.

Many studies were conducted to examine the effects of the financial crisis in other national economies (Göcen, 2017; Urfalıoğlu and Genç, 2013; Tvrdon, Tuleja and Verner, 2012; Özden, 2012; Porter, 2010; Karabulut, Ersungur and Polat, 2008; Eleren and Karagül, 2008; North, 1994). In these studies, the effects of the crisis on national economies have been analysed and interpreted by considering the effects of the 2008 global crisis on macro variables (Caldara, Gagnon, Martínez-García and Neely, 2020; Coleman and Feler, 2015; Cheilari, Guillen, Damalas and Barbas, 2013).

Examining the effects of the financial crises on other country’s economies is very important for both investors and countries. The studies mostly conducted were in relation to the 2008 Global Crisis. The Covid-19 crisis, which has greater impact and more uncertainty than other economic and financial-based crises, escalated after the measures taken against the virus were implemented. Thus, determining the effect of the Covid-19 crisis on the performance of Turkey’s ←18 | 19→economy is important to ensure a competitive advantage on a global level. Therefore, this study is intended to evaluate the effect of the Covid-19 crisis on the performance of Turkey’s economy.

3 Model and Finding

A literature review on the impact of crises on the performance of countries’ economies has been presented in the previous chapters and a theoretical framework has been introduced in this context. In this section, in order to examine the effects of the Covid-19 crisis on Turkey’s economic performance during the period 2010–2020, a grey relational analysis was performed using the criteria declared as the economic performance indicators by the General Directorate of Budget and Financial Control. Growth rate, current account deficit/GNP, budget balance/GNP, CPI, total debt/GNP, public debt interest rate, unemployment rate and the exchange rate of the dollar were used as criteria Growth rate, current account deficit/GNP, budget balance/GNP, CPI, total debt/GNP, public debt interest rate, unemployment rate and the exchange rate of the dollar were used as criteria . The criteria used in the study are presented in Tab. 1.

Criteria |

Target | |

|---|---|---|

K1 |

Growth Rate |

Max |

K2 |

Exchange Rate of Dollar |

Min |

K3 |

Current Account Deficit / GNP |

Min |

K4 |

CPI |

Min |

K5 |

Budget Balance / GNP |

Max |

K6 |

Total Debt / GNP |

Min |

K7 |

Public Debt Interest Rate |

Min |

K8 |

Unemployment Rate |

Min |

3.1 Research Method

The grey relational analysis, which is one of the multi-criteria decision-making methods, is a method that reveals the interaction between the analysed decision variables allowing analysis on many independent decision criteria in an environment of uncertainty (Yıldırım, 2015; Kao and Hocheng, 2003: 256). The grey relational analysis method was developed by using the grey system theory, which measures the degree of relationship of the parameters. It helps to fill the gaps ←19 | 20→within statistical regression when the experiments are uncertain or the experimental method cannot be fully performed. In this method, performance optimization is transformed into a single grey relational degree optimization for multi-criteria performance measurement. The optimal level of decision points is formed at the highest grey associative degree level. With grey relational analysis, the optimal combination of the analysed decision points can be predicted (Abhang and Hameedullah, 2012: 16).

The grey relational analysis consists of a number of steps – revealing the reference sequence, determining the grey relational coefficients and reaching the grey relational degrees, respectively (Türe, 2019: 318). The grey relational analysis method consists of the following steps (Yıldırım, Bal and Doğan, 2020: 10; Yıldırım, 2015: 229; Wu, 2006: 211; Morán, Granada, Migues and Porterio, 2006: 126):

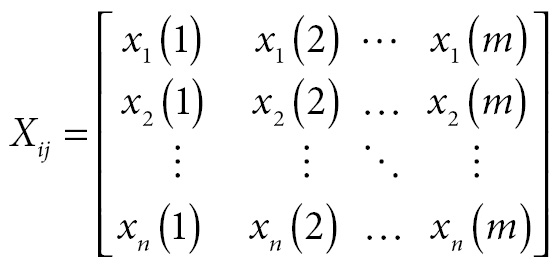

Step 1: Creating the decision data matrix:

In this step, the X matrix table consisting of criteria and decision alternatives should be created in order to create the necessary matrix in data analysis:

(1)

(1)n is the decision alternatives, m is criteria and xi(j) is value of i. alternatives j. criteria.

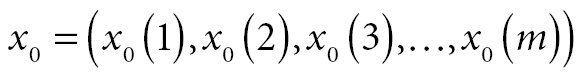

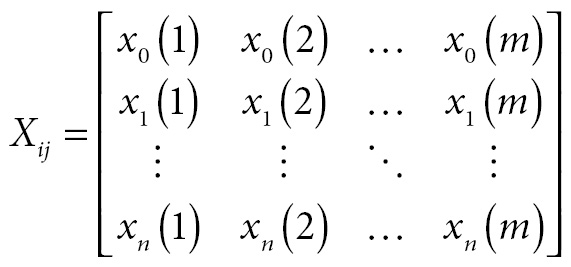

In the X decision matrix, there are investigated values for the analysed problem. Next, a reference series created from the decision matrix is defined. These defined series are created by taking the best value of each criterion in the decision matrix. The reference series is given in equation (2), and by the decision matrix in equation (3).

(2)

(2) (3)

(3)Step 2: Normalization process and creation of normalization matrix:

In the application of grey relational analysis method, the criteria in the matrix in equation (1) must be made independent of the unit of measure. After the normalization process, the values in the decision matrix take values between 0 and 1. The normalization process is expressed as grey relational generating (Tsai et al., 2003: 47). Three different methods are used when calculating the value in the normalization process. These methods are calculation methods in which high value, low value and ideal value are used.

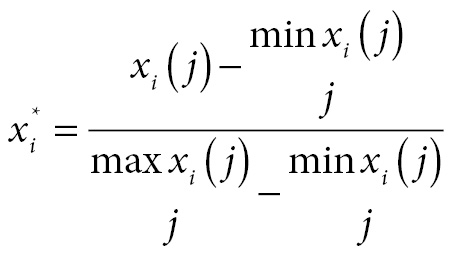

i.If the targeted criterion value in the research method is needed to be high;

(4)

(4)ii.If the targeted criterion value in the method is needed to be low;

(5)

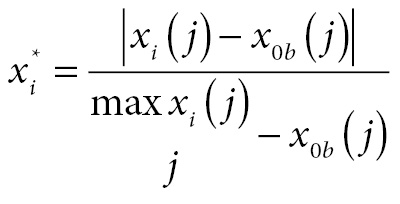

(5)iii. If the criterion value is needed to be an ideal value;

(6)

(6)In Eq. 6,

is the target value of the j. criterion and

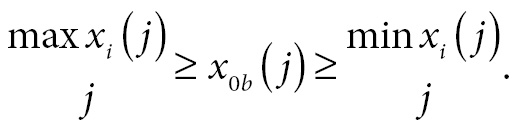

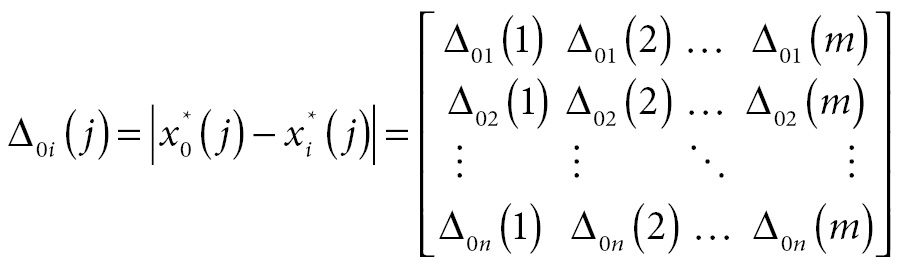

Step 3: Creating the absolute value matrix:

Coefficient differences are calculated according to the characteristics of the analysis criteria. The coefficient difference is the absolute difference between the analysed value and the reference value (Yıldırım, 2015: 230).

(7)

(7)

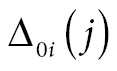

: is the absolute difference expression between x0 and xi for element j.

: is the absolute difference expression between x0 and xi for element j.

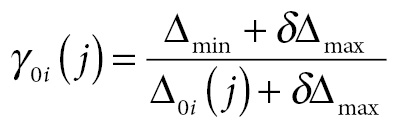

Step 4: Calculation of the grey relational coefficient matrix:

The grey relationship coefficient is calculated with the following equation (8).

(8)

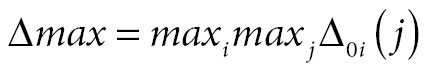

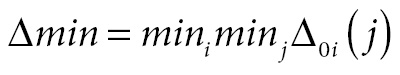

(8)In Eq. 8,

,

,

and δ ∊ [0,1]. In the literature, δ = 0,5 is taken.

and δ ∊ [0,1]. In the literature, δ = 0,5 is taken.

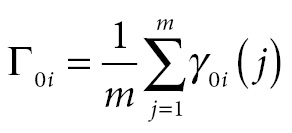

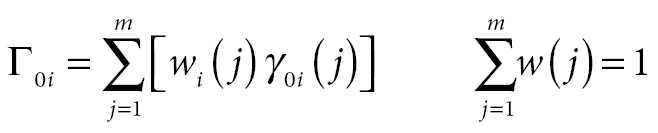

Step 5: Determining the grey relational grades:

Relational degrees are formed according to the matrix obtained by calculating the grey relational coefficients. Grey relational grades are obtained by the average grey relational coefficient of each alternative to be decided as a result of the analysis. Grey relational degrees are calculated by two different methods. Equation (9) is used if the criteria are of equal importance, and equation (10) is used if they have different levels of importance.←22 | 23→

(9)

(9) (10)

(10)Among the alternatives, the closest series to the reference series specified in the matrix is the decision point with the highest grey relational degree which determines the alternative to be chosen (Yıldırım et al., 2020; Yıldırım, 2015; Kuo, Yang and Huang, 2008; Wu, 2006; Morán et al., 2006; Tsai et al., 2003).

3.2 Analysis and Findings

In the realization of the grey relational analysis method, firstly, the decision matrix, which contains alternative decision points and evaluation criteria, is created. It is shown by adding a reference series to the created decision matrix in Tab. 2.

K1 |

K2 |

K3 |

K4 |

K5 |

K6 |

K7 |

K8 | |

|---|---|---|---|---|---|---|---|---|

2010 |

8.487 |

1.500 |

-5.777 |

8.570 |

-0.038 |

78104.013 |

9.000 |

11.127 |

2011 |

11.113 |

1.670 |

-8.946 |

6.470 |

-0.053 |

78857.432 |

12.500 |

9.096 |

2012 |

4.790 |

1.793 |

-5,506 |

8.890 |

-0.031 |

82129.003 |

9.000 |

8.432 |

2013 |

8.491 |

1.901 |

-5.878 |

Details

- Pages

- 458

- Publication Year

- 2021

- ISBN (PDF)

- 9783631860526

- ISBN (ePUB)

- 9783631860533

- ISBN (MOBI)

- 9783631860540

- ISBN (Softcover)

- 9783631849323

- DOI

- 10.3726/b19055

- Language

- English

- Publication date

- 2021 (September)

- Keywords

- Business Economics Panel Data Analysis Public Finance Time Series Analysis

- Published

- Berlin, Bern, Bruxelles, New York, Oxford, Warszawa, Wien, 2021. 458 pp., 32 fig. b/w, 76 tables.

- Product Safety

- Peter Lang Group AG