Recalling the Celtic Tiger

Summary

While clearly not all aspects of the period could realistically be covered, the book does contain essential information about the central actors, events, themes, and economic trends, which are discussed in a readable and accessible manner. Each entry is linked to the overall Celtic Tiger phenomenon and its immediate aftermath.

The book also provides a comprehensive account of what happened in this period and will be a factual resource for anyone anxious to discover information on the areas most commonly connected to it. All entries are written by experts in the area. The contributors include broadcasters, economists, cultural theorists, sociologists, literary critics, journalists, politicians and writers, each of whom brings particular insights to some aspect of the Celtic Tiger.

Excerpt

Table Of Contents

- Cover

- Title

- Copyright

- About the editors

- About the book

- This eBook can be cited

- Contents

- Acknowledgements

- Introduction (Brian Lucey / Eamon Maher / Eugene O’Brien)

- 100% mortgages (Constantin Gurdgiev)

- Accidental Landlords (Karl Deeter)

- Advertising (Patricia Medcalf)

- Ahern, Bertie (Sean Barrett)

- Anglo Irish Tapes (Constantin Gurdgiev)

- Ansbacher Accounts (Constantin Gurdgiev)

- Auditors (Neil Dunne)

- Bailout (Charles Larkin)

- Balanced Regional Development (Lorcan Sirr)

- Bank Lending Policies in the 2004– 2010 Period (Joe Brennan)

- Bank Regulation (Frances Coppola)

- Bank Solvency Crisis (Frances Coppola)

- Banking Culture (Stephen Kinsella)

- Banville, John (Eoghan Smith)

- Barrett, Sean (Charles Larkin)

- Black Economy (Seamus Coffey)

- Bondholders (Brian Lucey)

- Bord Snip Nua (Charles Larkin)

- Browne, Vincent (Eugene O’Brien)

- Buy-to-lets (Karl Deeter)

- Cardiff, Kevin (Charles Larkin)

- Chopra, Ajai (Charles Larkin)

- Cinema and the Celtic Tiger (Ruth Barton)

- Coffee Culture (Brian Murphy)

- Commission on the Private Rented Sector (Lorcan Sirr)

- Communications (Brian O’Neill)

- Contracts for Difference (CFD) (Shaen Corbet)

- Craft Beer (Susan Boyle)

- Credit Crunch (Stephen Kinsella)

- Credit Default Swaps (Stephen Kinsella)

- Credit Rating Agencies (Shaen Corbet)

- Cross, Dorothy (Sarah Kelleher)

- Debt (Eoin Flannery)

- Design and the Celtic Tiger (John O’Connor)

- Dining Out (Máirtín Mac Con Iomaire)

- Divorce: ‘Till Debt Do Us Part’ (Finola Kennedy)

- ECB (Megan Greene)

- Economists (Megan Greene)

- Electric Gates in the Celtic Tiger (John McDonagh)

- Emergency Liquidity Assistance (ELA) (Megan Greene)

- Entrepreneurship (Constantin Gurdgiev)

- ESRI (Darragh Flannery)

- Euro (David Begg)

- Euro: Cause and Consequences (Stephen Kinsella)

- Fianna Fáil (Eugene O’Brien)

- Fianna Fáil and Social Partnership: The Boom (Maura Adshead)

- Fianna Fáil and Social Partnership: The Bust (Maura Adshead)

- Fine Gael–Labour Government 2011–2016 (Eugene O’Brien)

- Free Market (Stephen Kinsella)

- Gastro-tourism (John Mulcahy)

- Ghost Estates (Rob Kitchin)

- Golf Clubs (Eamon Maher)

- Harney, Mary (Martina Fitzgerald)

- Higgins, Michael D. (Vic Merriman)

- Hillen, Sean (Sarah Kelleher)

- Honohan, Patrick (Megan Greene)

- Howard, Paul (Eugene O’Brien)

- Human Resource Management (Na Fu)

- IAS 39 (Neil Dunne)

- IMMA (Sarah Kelleher)

- Independent Politicians (Charles Larkin)

- International Context (David Begg)

- International Monetary Fund (Charles Larkin)

- Internet (Catherine Maignant)

- Irish Fiscal Advisory Council (Seamus Coffey)

- The Irish Pub (Aoife Carrigy)

- Kelly, Morgan (Brian Lucey)

- Liquidity Crisis (Stephen Kinsella)

- Media and the Celtic Tiger: The Watchdog that Didn’t Bark (Kate Shanahan)

- Merkel, Angela (Martina Fitzgerald)

- Mobile Technology (Eugene O’Brien)

- Mortgages (Karl Deeter)

- Murphy Report (John Littleton)

- National Accounts (Seamus Coffey)

- National Treasury Management Agency (NTMA) (Constantin Gurdgiev)

- Neary, Patrick (Darragh Flannery)

- Negative Equity (Darragh Flannery)

- Neoliberalism (Lorcan Sirr)

- Novels of the Celtic Tiger (Derek Hand)

- Nyberg Report (Sean Barrett)

- Oireachtas Joint Committee Report (Sean Barrett)

- Peace Process: A French Perspective (Fabrice Mourlon)

- Peace Process and Anglo-Irish Relations (Mick Fealty)

- Photography (Justin Carville)

- PIIGS Countries (Shaen Corbet)

- Poetry (Eoin Flannery)

- Political Economy (Charles Larkin)

- Professional Service Firms (Na Fu)

- Progressive Democrats (Constantin Gurdgiev)

- Property Boom (Constantin Gurdgiev)

- Public Finances in the Celtic Tiger (Paschal Donohue)

- Publishing (Brian Langan)

- Quinn, Sean (Charles Larkin)

- Referendums (Deirdre Flynn)

- Regling-Watson Report (Constantin Gurdgiev)

- Repossessions (Karl Deeter)

- Riverdance (Harry White)

- Ryan, Donal: The Spinning Heart (Eamon Maher)

- Ryan Report (Catherine Maignant)

- Saint Patrick’s Day Massacre of Shares (Shaen Corbet)

- Second Houses (Constantin Gurdgiev)

- Shopping Trips to New York (Ida Milne)

- Short Selling (Shaen Corbet)

- Single Currency (Constantin Gurdgiev)

- Social Housing (Lorcan Sirr)

- Sports (Shaen Corbet)

- SSIA (Constantin Gurdgiev)

- Suburban Literature (Eoghan Smith)

- Target2 Balances (Frances Coppola)

- Texting and the Celtic Tiger (Eimear Nolan)

- Theatre of the Celtic Tiger (Vic Merriman)

- Tourism (Raymond Kearney)

- Trade Unions (Na Fu)

- Troika (Charles Larkin)

- U2 (Eugene O’Brien)

- Unemployment (Constantin Gurdgiev)

- Unfinished Estates (Lorcan Sirr)

- Universities (Paddy Prendergast)

- ‘We all partied’ (Constantin Gurdgiev)

- Wine Culture (Brian Murphy)

- Women and the Church (Sharon Tighe-Mooney)

- Women in the Celtic Tiger (Deirdre Flynn)

- Women Writers (Mary O’Donnell)

- Notes on Contributors

- Series index

Brian Lucey, Eamon Maher

and Eugene O’Brien (eds)

Recalling the Celtic Tiger

PETER LANG

Oxford • Bern • Berlin • Bruxelles • New York • Wien

Bibliographic information published by Die Deutsche Nationalbibliothek.

Die Deutsche Nationalbibliothek lists this publication in the Deutsche National-bibliografie; detailed bibliographic data is available on the Internet at http://dnb.d-nb.de.

A catalogue record for this book is available from the British Library.

A CIP catalog record for this book has been applied for at the Library of Congress.

Library of Congress Cataloging-in-Publication Data

ISSN 1662-9094

ISBN 978-1-78997-286-3 (print) • eISBN 978-1-78997-287-0 (ePDF)

eISBN 978-1-78997-288-7 (ePub) • eISBN 978-1-78997-289-4 (Mobi)

DOI 10.3726/b16190

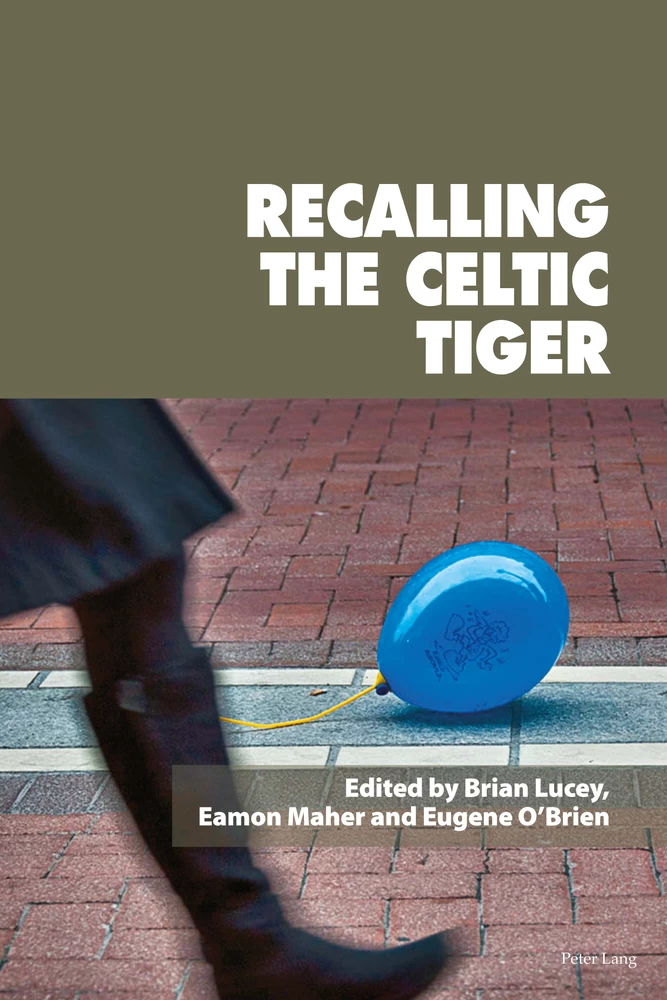

Cover image: Copyright Paul Butler

Cover design by Peter Lang Ltd.

© Peter Lang AG 2019

Published by Peter Lang Ltd, International Academic Publishers,

52 St Giles, Oxford, OX1 3LU, United Kingdom

oxford@peterlang.com, www.peterlang.com

Brian Lucey, Eamon Maher and Eugene O’Brien (eds) have asserted there right under the Copyright, Designs and Patents Act, 1988, to be identified as Editors of this Work.

All rights reserved.

All parts of this publication are protected by copyright.

Any utilisation outside the strict limits of the copyright law, without the permission of the publisher, is forbidden and liable to prosecution.

This applies in particular to reproductions, translations, microfilming, and storage and processing in electronic retrieval systems.

This publication has been peer reviewed.

Brian Lucey (Trinity College Dublin and University of Sydney)

Eamon Maher (TU Dublin)

Eugene O’Brien (Mary Immaculate College, University of Limerick)

About the book

Recalling the Celtic Tiger looks at various effects, symptoms and consequences of what was a seismic period in Irish society. It traces the critical pathway from boom to bust – and up to the current beginnings of a similar, smaller boom – through events, personalities and products. The short entries, written by experts, offer a sense of the lived experience of this transformative event. Each entry is linked to the overall Celtic Tiger phenomenon and its immediate aftermath. The book also provides a revealing account of what happened during these years in the economic, social and cultural realms and will be a factual resource for anyone anxious to discover more about the wide-ranging ramifications and legacy left in its wake.

This eBook can be cited

This edition of the eBook can be cited. To enable this we have marked the start and end of a page. In cases where a word straddles a page break, the marker is placed inside the word at exactly the same position as in the physical book. This means that occasionally a word might be bifurcated by this marker.

Details

- Pages

- XX, 368

- Publication Year

- 2019

- ISBN (Softcover)

- 9781789972863

- ISBN (PDF)

- 9781789972870

- ISBN (ePUB)

- 9781789972887

- ISBN (MOBI)

- 9781789972894

- DOI

- 10.3726/b15391

- Language

- English

- Publication date

- 2019 (October)

- Keywords

- Celtic Tiger boom and bust austerity globalisation Recalling the Celtic Tiger Eamon Maher Brian Lucey Eugene O'Brien

- Published

- Oxford, Bern, Berlin, Bruxelles, New York, Wien, 2019. XX, 368 pp., 2 fig. col.

- Product Safety

- Peter Lang Group AG