Economic Dynamics and Sustainable Development – Resources, Factors, Structures and Policies

Proceedings ESPERA 2015 – Part 1 and Part 2

Summary

For ordering the hardcover version of this book, please contact order@peterlang.com. (Retail Price: £126.00, $185.90).

The book is dedicated to the 150th anniversary of the Romanian Academy. It contains the most valuable 100 papers presented at the International Conference «Economic Scientific Research – Theoretical, Empirical and Practical Approaches» (ESPERA 2015). The event is initiated annually by the National Institute for Economic Research «Costin C. Kiritescu» of the Romanian Academy. ESPERA aim to present and evaluate the economic scientific research portfolio as well as to argue and substantiate development strategies, including European and global best practices. ESPERA intend to become a scientific support for the conceptualization and the establishment of policies and strategies and to provide a systematic, permanent, wide and challenging dialogue within the European area of economic and social research.

Excerpt

Table Of Contents

- Cover

- Title

- Copyright

- About the editors

- About the book

- This eBook can be cited

- Contents

- Foreword

- New Development: From Linear to Nonlinear Economy. Challenges from the Perspective of Sustainable Development (Ioan I. Gâf-Deac, Otilia Teodora Ciutacu, Maria Gâf-Deac & Cristina Monica Valeca)

- From Millennium Development Goals to Sustainable Development Goals – Results and Future Developments (Marian Cătălin Voica, Mirela Panait & Irina Rădulescu)

- Nation, Communitarism, Peace and Globalisation: A Vulnerable Relationship (Dan Popescu)

- The Dark Side of Globalisation (Napoleon Pop & Valeriu Ioan-Franc)

- Managing Globalization: What Coordination in Europe for Trade and Migration Policies? (Stéphane Callens, Sofiane Cherfi & Philippe Duez)

- Romania and the Four Economic Freedoms: From Theory to Practice (Luminiţa Chivu & Constantin Ciutacu)

- Is Optimal Immigration Possible? An Analysis of a Southern European Sample (Jaime Gil-Lafuente)

- The Challenges of the Long-Term Development of Romania: The Dilemmas of Convergence Versus Divergence (Gheorghe Zaman & Valentina Vasile)

- Features of Long Cycles of Romania’s Economy Evolution (Florin Marius Pavelescu)

- Heavy Tail Smooth and Application to Long-Memory Time Series (Daniel Ciuiu)

- Austerity and Growth in the EU Countries (Dan Olteanu)

- The Minimal Weighted Kaniadakis Entropy Martingale Measure for Valuation Problems in Financial Markets (Muhammad Sheraz, Vasile Preda & Silvia Dedu)

- Sustainable Management of Primary Energy Resources – What We Leave to Future Generations (Mihai-Sabin Muscalu, Marius Bulearca & Cornelia Neagu)

- Efficient Use of Natural Resources: Mathematical Methods and Tools (Mihai Sabin Muscalu & Mihaela Mateescu)

- Evaluation of Patrimony Natural Resources. Economic and Mathematical Assessment Methods and Models (Stelian Stancu, Constanta Nicoleta Bodea & Mihai Sabin Muscalu)

- Characteristics of Sustainable Development in Extractive Industry from Romania (Marius Bulearcă, Cornelia Neagu, Cristian Sima & Daniel Mărguş)

- Mining Industry in Romania – Tradition, Social Responsibility and Environmental Protection (Cristian Sima, Marius Bulearcă & Cornelia Neagu)

- Problems of Ecosystem Services and Natural Capital Evaluation (Olja Munitlak Ivanović, Јovan Zubović & Petar Mitić)

- Circular Economy and Ethics of Profit Sharing (Ioan I. Gâf-Deac, Ilie Ionel Ciuclea, Otilia Teodora Ciutacu, Maria Gâf-Deac, Cristina Monica Valeca & Ioana Andreea Marinescu, Alexandru T. Bogdan, Cicerone Nicolae Marinescu)

- China’s Strategy to Enhance Energetic Security – the Malacca Dilemma (Simona Moagăr-Poladian, Andreea-Emanuela Drăgoi, George Cornel Dumitrescu & Alexandru Tănase)

- Strategic Issues of Public Perceptions on Wind Turbines Placement. Case Study: The Netherlands and Romania (Tanţău Adrian Dumitru, Cârlea Filip & Maria Alexandra Nichifor)

- Wind Energy in Romania – Sustainable Option Between the Variants of the Future (Georgiana Chiţiga & Silvia Elena Isachi)

- Evolution of Energy Consumption in Chemical Industry in Romania (Raluca Elisabeta Bozga & Daniela Nicoleta Băleanu)

- Progress Directions of the Human Capital Within the Sustainable Economy Context in Romania (Violeta Sima, Mostafa A.R. Ibrahim & Ileana Georgiana Gheorghe)

- Education Respiritualization in the Context of Wise Human Self-Government (Constantin Popescu & Vasile Miltiade Stanciu)

- Creating Competencies in the Romanian Higher Education: An Exploratory Research (Adela Coman & Cătălina Bonciu)

- Remodeling the Role of Universities in the Context of Sustainable Development (Mirela Panait, Marius Gabriel Petrescu & Raluca Podaşcă)

- A Mathematical Study of Connections Between Early Leavers from Education and People Living at Risk of Poverty and Social Exclusion in Romania (Carmen Adriana C. Gheorghe & Elena - Corina Cipu)

- On Cumulated Mean Income Curve (COMIC). New Theoretical Results Outlined On Romania’s Income Data (Vasile Preda & Carmen Adriana Gheorghe)

- Human Resources Motivation – A Biblical Perspective (Dan Constantinescu)

- The Progressive Agreement and the Regressive Distribution of Material Costs – Fundamentals of Meritocracy (Ioan Done)

- Rural Women’s Inequalities and Household Disparities (Mohammad Asaduzzaman, Shajahan Kabir, Mirjana Radović-Markovic, Radmila Grozdanic & Predrag Vukadinovic)

- Vulnerabilities and Potential of Households Towards Sustainable Development (Mihail Dimitriu)

- Effects of Alternative Development in Colombia: An Analysis of the Macarena Consolidation Plan from Working with People (Carlos Alberto Ávila Cerón, Ignacio De Los Ríos-Carmenado & Susana Martín)

- Regional Emigration Drivers in Romania. Comparative Analysis of Short- and Long-Term Emigration (Zizi Goschin)

- Vulnerable Population Groups in Romania (Adina Mihăilescu)

- Pension Systems in a Competitive Economy, in Terms of Equality Between Women and Men (Mirela Cristea, Andreea Dănciulescu, Nicea Mergeani & Ioan Hurјui)

- Underrepresentation of Women in Top Political Decisions in Post-December Romania: Causes, Conditions and Consequences (Elena Zamfir)

- Written Press Reflecting Social Problems: A Research on the Libertatea Daily Newspaper (Mona Simu)

- Consumer Behaviour in Mobile Telecommunications Services – Internet of Things (Nicu Marcu & Georgeta-Mădălina Meghisan)

- Analyzing the Evolution of the Health Status of Romanian People with Sah Data From 1990 to 2010 (Maria Livia Ştefănescu & Ştefan Ştefănescu)

- Reflection of Climate Change Risk in Risk Culture (Andreea Constantinescu)

- Competitiveness and Smart Specialization in the Romanian Regions – Foundations of the Progress Towards Reaching the Europe 2020 Targets (Mihaela-Nona Chilian, Carmen Beatrice Păuna & Marioara Iordan)

- Fostering Innovation and Knowledge Transfer in Renewable Energy: Historical Experiences in Rural Development (Gabriela Black Aguayo, Ignacio De Los Ríos Carmenado, Susana Sastre Merino & Fraunhofer Umsicht)

- Challenges for Increasing the Innovativeness of Romanian Firms (Steliana Sandu & Irina Anghel)

- Domains and Indicators of Innovation at Company Level within Regional Frame (Florin-Marian Buhociu, Rodica Hîncu, Adrian Turek Rahoveanu, Valentin Marian Antoh & Dragoş-Horia Buhociu)

- Change Management in Romanian SMEs (Cristian Bișa, Cristina Chiriță & Liviu Tudor)

- Using Mobile Technologies to Promote and Valorize the Cultural Heritage in the Knowledge Based Society (Cristian Ciurea & Florin Gheorghe Filip)

- The Smart City: An Ecosystem Built on Innovation (Maria Moldoveanu & Valeriu Ioan-Franc)

- Smart Specialization in Romania: Specific Objective of the National Strategy for Research, Development and Innovation 2014–2020 (Cornel Ionescu)

- A Qualitative Approach to Architecture as a Creative Industry (Marta-Christina Suciu & Mina Fanea-Ivanovici)

- Creative Cities − A Model of Sustainable City Planning (Maria Moldoveanu & Valeriu Ioan-Franc)

- Modeling of it Processes Expenses (Jovan Zivadinovic, Zorica Medic, Boris Jevtić, Milos Vucekovic & Predrag Vukadinovic)

- Transformations of the Romanian Economic Structures and the Competitiveness Criteria: An EU-28 Perspective (Jean Vasile Andrei, Diego Begalli & Alexandra Alecu)

- Sectoral Industrial Specialization in Romania (Corneliu Russu)

- Sectoral Developments in Romanian Manufacturing Industry. Directions and Solutions for Industrial Reconstruction (Nicoleta Hornianschi)

- Triple Bottom Line Clustering of the Romanian Economic Sectors (Florian Colceag & Andrei Silviu Dospinescu)

- Change Management in Romanian SMEs (Cristian Bișa, Cristina Chiriță & Liviu Tudor)

- Real and Structural Convergence Dynamics at Subregional Level in Romania (Marioara Iordan & Mihaela-Nona Chilian)

- The Mutualistic Relationships between Transport and some Scientific and Economic Models as the Main Support for the Progress of Mankind (Frantz Daniel Fistung, Laurentiu David & Teodor Popescu)

- Hazard Risks and Their Impact on Critical Infrastructures (Case Analysis − Natural Gas Networks of Italy and Romania) (Ionut Purica)

- Model of the Qualitative and Quantitative Analysis of the Growth Poles (Edith Mihaela Dobre & Emilian M. Dobrescu)

- Poland: The Pillars of Economic Growth (Alina Ligia Dumitrescu & Lucia Iordache)

- Geographies of Food Sharing. An Exploratory Study (Donatella Privitera)

- The Tram, a Viable Alternative for Car Transport in the Suburban Area of Bucharest (Teodor Popescu & Daniel Frantz Fistung)

- Aspects Regarding the Implementation of Electric Vehicles in Romania and Serbia (Dorel Dusmanescu, Jonel Subic & Marko Jelocnick)

- The Individual Agricultural Holding − An Entity With Great Potential for Growth in Romanian Agriculture (Valentin-Mihai Bohatereţ, Ioan-Sebastian Brumă & Lucian Tanasă)

- Dairy Cooperatives in Romania and Poland (Alexandru Sin & Czeslaw Nowak)

- Fiscal Union in EU: A Plausible Reality or a too Distant Dream? (Petre Prisecaru)

- Romania’s Fiscal Policy in the Period of 2008–2015, an Instrument of Economic Recovery? (Crina Raluca Bucur)

- Budgetary Performance Analysis (Raluca Antoneac & Oana Valentina Cercelaru)

- Insights on the Central Banks Global Financial Crisis Management (Adina Criste & Iulia Lupu)

- Fiscal − Budgetary Implications of Applying Value Added Tax at National Level During 2011–2014 (Ionel Leonida)

- Performance Barometer (Raluca Mihaela Drăcea, Constanţa Iacob & Mirela Simona Cristea)

- Economic Sustainability and Green Taxes (George Enescu & Carmen Zefinescu)

- FDI Trends at the European Level (Alina Georgeta Ailincă)

- Prospects of Romania’s International Investment Position and Financial Stability Risks (George Georgescu)

- Monetary Aggregates in a Real Business Cycle (Elena Pelinescu & Mihaela Simionescu)

- Micro-Financing Support to Entrepreneurship Development-Evidences from Serbia (Radmila Grozdanic, Mirjana Radovic-Markovic & Boris Jevtic)

- The Impact of the Financial Crisis on the Real Convergence Process in Eastern and Central Europe (Ionuț Bușega & Stefan Ciucu)

- Volatility Analysis of Shanghai Composite Index and Financial Crises (Muhammad Sheraz, Silvia Dedu & Vasile Preda)

- The Potential of The Sharing Economy Becoming a Significant Contributor to Sustainable Economic Growth (Florin Bonciu & Ana-Cristina Bâlgăr)

- Impact of the Global Economic and Financial Crisis on the Romanian Agriculture in the European Framework (Virginia Câmpeanu)

- Confrontation and Competition: Challanges in Terms of Integration / Networking of Value Chains (Maria Gâf-Deac, Ioan I. Gâf-Deac, Otilia Teodora Ciutacu, Cristina Monica Valeca, Ioana Andreea Marinescu & Cicerone Nicolae Marinescu)

- Multifaceted Relations Between Bio-Economy and Biomedicine Based on Legal Anthropology and “One Health” (Andrei Kozma, Alexandru T. Bogdan, Leonard George Tobă & George Florea Tobă)

- Food Typological Polyvalence, Paradigm for a New Gastronomy (Romulus Gruia, Alexandru T. Bogdan & George Florea Toba)

- A Multiple Attribute Decision Making Analysis of the Economic Performances for the Romanian Water Public Services (Marina Badileanu, Daniel Ciuiu, Izabell Luminita Georgescu & Svetlana Ciumac)

- A Proposal for a New Model of Environmental Tax (Gabriela-Cornelia Piciu, Iudith Ipate & Alexandru Bogdan)

- State and Outlook of Agriculture’s Pollution with Greenhouse Gases in Romania (Mirela-Adriana Rusali)

- Economic Study on Carp Breeding in the Context of Development of the Bio-Economy Projects within the Danubian Programs (Marcel Matiuti, anos Tossenber & Ioan Huțu)

- Structural Changes in International Trade in Food: Competitive Growth Models for Economies in Transition (Vasily Erokhin)

- Economic Integration of the Central and Eastern European Countries at the Regional and Global Level: An Analysis of International Trade Flows (Vilma Deltuvaitė)

- The Pattern of Regional and Local Foreign Trade Specialization in Romania (Daniela Antonescu)

- Intra-Industry Trade in the Motor Vehicles Parts and Accessories Sector: The Relationships Between Romania and Some Countries from CIS and CEE (Marius-Răzvan Surugiu & Camelia Surugiu)

- Demand for Food Diversity in Romania: Purchased Food Quantities vs. Actual Food Consumption (Cecilia Alexandri, Bianca Pauna & Lucian Luca)

- Tourism Industry in EU Member States − A Multidimensional Analysis (Daniel Bulin, Sarmiza Pencea & Ana-Cristina Bâlgăr)

- Evaluation of the Potential of Balneal Tourism in Romania (Adrian Tuluca & Catalina Tuluca)

- Mountain Agri-Tourism Efficiency by the Control of QS Procedures Concerning Cheese (Romulus Gruia, Gheorghe Puchianu & Radu Rey)

- Research on the Entrepreneurial Potential Assessment of Romania’s Mountain Areas and Tourism Development (Maria Magdalena Turek Rahoveanu, Ionica Soare, Adrian Gheorghe Zugravu & Feng Jianying)

- The Importance of Mountain Tourism to the Economic Development of Prahova County (Adrian Ungureanu & Teodor Sedlarski)

The present book is dedicated to the 150th anniversary of the Romanian Academy and contains the most valuable 100 papers presented at the international conference “Economic Scientific Research - Theoretical, Empirical and Practical Approaches” (ESPERA 2015).

The National Institute for Economic Research “Costin C. Kirițescu” (NIER) is an academic public institution for fundamental, socio-economic scientific research, developing also applied research projects, financed from public or private internal and external sources, according to the research strategy of the Romanian Academy and the national and European strategies and policies in the field of research and development.

The NIER network includes: a) five institutes with legal personality: Institute of National Economy; Institute for Agricultural Economics; Research Institute for the Quality of Life; Institute for Economic Forecasting; Institute of World Economy; b) four centres with legal personality: Centre for Industry and Services Economics; Centre for Financial and Monetary Research; Centre for Studies and Researches of Agroforestry Biodiversity; Centre for Economic Information and Documentation; c) six centres without legal personality: Romanian Centre for Comparative Economy and Consensus; Centre for Macroeconomic Modelling; Centre for Demographic Research; Centre for IT Assistance of Decision; Centre for Promotion of Renewable Energy and Energy Effectiveness; Centre for Mountain Economy.

ESPERA is an annual event initiated by NIER in partnership with the National Bank of Romania and the Centre for Economic Information and Documentation. Since 2015 the event has also included, the Romanian Cultural Institute, the Faculty of Economics and Business Administration, as well as the “St. Kliment Ohridski” University in Sofia, Bulgaria, and the Institute of Agricultural Economics in Belgrade, Serbia. The ESPERA 2015 edition attracted more than 350 participants in the plenary session and parallel workshops, more than 40 of which were foreign guests from Luxembourg, France, Spain, Italy, the Republic of Moldova, Hungary, Bulgaria, Poland, Serbia, Egypt and Turkey.

The aim of ESPERA is to present and evaluate the economic scientific research portfolio and to argue and substantiate development strategies, including European and global best practices. ESPERA intends to become a scientific support for the conceptualisation and establishment of policies and strategies and to provide a multifaceted, systematic, permanent, wide and challenging dialogue within the European area of economic and social research.

This volume contains researchers’ scientific opinions and ideas focused on a diverse, sometimes divergent, sometimes convergent panoply of subjects: sustainable development; natural resources; smart development and human capital; migration; the labour market; economic structures; trends and possible responses to globalisation and European integration challenges; models, scenarios and evaluations. ← 11 | 12 →

A comprehensive analysis of the papers reveals that a great majority of them are convergent to three core subjects: transition to market economy, accession to the European Union, financial and economic crises and globalisation.

The Editors

Bucharest, Romania, April 2016

← 12 | 13 →

Ioan I. Gâf-Deac1*1, Otilia Teodora Ciutacu2, Maria Gâf-Deac3 & Cristina Monica Valeca4

Abstract: The theoretical and practical purpose of development science in the new knowledge based world is to find at least one model that can show a history network, or a network of history. The construction of development models should be dominated by rationality. All elements of the model should be given the chance to be treated equally and be subject to indiscriminate validation. This article shows the logic behind an economic model which links directly to a universality dominated by a non-linear approach to support conscious decision-making for contemporary economic processes.

Keywords: new development, linear economy, nonlinear economy, sustainable development

Introduction

In today’s world (2015) the fact that countries lack an acquired, structured and validated experience is generally accepted in terms of sustainable development.

For this reason diversified strategic development exercises show varying results.

“Following the publication of Our Common Future (WCED, 1987) the idea of sustainable development came to provide a conceptual anchor for, … strategic exercises.” [14] In our opinion, economic linearity seems to be a phrase which is only conceptually and operationally known in certain economies of the world. On this basis, we can speak of an “economic peace operation” as being a conventional mastering of the dynamics of development balance.

Many countries have no practical commitment to sustainable development, as they continue, in comparable terms, to be working on the necessary gap reductions to achieve acceptable levels of subsistence and overcome national poverty. ← 13 | 14 →

We agree that the conceptually articulated need and the operational plan to overcome this “current economic calm” related to a linear economy will require „guidelines continuities and contrast”. [14] (p. 4)

1. Literature review

The beginnings of conclusive studies in the field belongs to Georgescu Roegen N., [8] (1975), by topic on dynamic models and economic growth.

Fernandez-Villaverde, J., - Rubio-Ramirez JF (2005), [6] estimates dynamic equilibrium economies, linear versus nonlinear likelihood, and Crépin, A.-S., Folke, C., (2015) [4] shows aspects relating to the economy, the biosphere and planetary boundaries: towards biosphere economics.

Farah, PD, and Rossi, P., (2015), studies energy: policy, legal and social-economic issues under the dimensions of sustainability and security [5].

Fiskel, J., (2006), [7], describes sustainability and resilience: toward a system approach, and Barlas, Y., (2007), [3], system feedback modeling for policy analysis.

The future of sustainability: re-thinking environment and development in the twenty-first century (Adams, W.M., 2006), [1], measuring economic policy uncertainty (Baker, S., Bloom N., Davis, S., 2013), [2], transition management: a reflexive governance approach (Kemp, R., Loorbach, D., 2006), [12], are other important topics in the field.

Kastenhofer, K., Rammel, C. (2005) [13], presents obstacles to and potentials of the societal implementation of sustainable development, and Holling, C.S., (2001), [11], talks about understanding the complexity of economic, ecological, and social systems.

A meta-review and some suggestions for future research belongs to Heal, G. (2014), [10], plus the theme of the development of social complexity: models of collapse, resiliency, and sustainability, Tainter, J.A., (2003), [17], and interpreting sustainability in economic terms: dynamic efficiency plus intergenerational equity (Stavins, R., Wagner, A., Wagner, G., 2013), [16].

The problem of the future: sustainability science and scenario analysis (Swart R.J., Raskin, P., Robinson, J., 2006), [15], is continued in the Prototype Global Sustainable Development Report (UN, 2014) [18], by the consequences described in the National sustainable development strategies: features, challanges, and reflexivity (Meadowcroft, J., 2007), [14].

A modern synthesis work in the field is the one that refers to the Basics of doxastic management (Gâf-Deac, I., 2013), [9].

2. Premise of the area of the linear operate economy relative to the nonlinear

Increased business volume for the firm is the result of a process in which the subjected organization and management hold potential for development. ← 14 | 15 →

With classical and neoclassical vision, coupled with proportional law, we mainly expect a possible increase in turnover of a company which is proportional to its present size.

On the other hand, the number of firms is increasing in the general business environment, which helps to mitigate the extent of their growth locationally and allows them to become operational in a more concentrated, respectively intensive way.

For a company size unit to meet substantial increases in the volume of business, which is no longer justified concerns for the physical dimensional extensibility (tangible or intangible) in entities.

The overall rate of a “growing company” is currently characterized by articulating a) firm size with b) registered growth size and c) realized production / products.

Therefore, evolutionary explanations can be merged firms considering growth mechanisms.

Aggregation of indicators between micro and macro-economic returns of systemic articulation of the economic elements of businesses being created are prerequisites for such predictions used in managerial decision-making documents.

It is estimated that the productive-economic environment leads to increased size companies limited to the phenomenon of self-saturation.

In these circumstances it is possible to loosen requirements increased by the emergence of other new companies that enrich existing generations.

It follows that the management company’s growth is closely linked to decisions aimed at appearance / disappearance and increase / decrease entities in distinct classes (I, II, III…) and companies are subject to variability in size relative to productive opportunities-economic and business dominated by knowledge.

Nonlinear economy is part of a general deterministic nonlinear process, often considered random.

Currently (2015) we believe that the global economy (with national and regional economic sub-systems) is still in a stable conventional balance.

We believe, however, that this stability / type of stability, if that absolute restriction or absolute value (mode) is assumed, reduces nonlinear dynamics and reduces its real economy potential to self-generate.

In other words, presently the “quiet economy, functional master” seems to settle political and economic decision-makers as long as it “works”.

Therefore, we consider the expressed view of “observed development / provided by operating” (whatever works is “good”).

Contemporary economic organization processes supports conscious decisions in relation to the pursued objectives, taking into account the analysis of correlations between factors of development, the values of variables, function as intended, the conditions of non-negativity, nature unknowns coefficients, etc.

On this basis we can now speak about an unified approach to linear programming problems.

Same thing cannot be said for non-linear programming, in which case it may be decided even use irrational numbers In this context, however, we found data, information and new laws about 1) the linear economic stability/probability (certainly, ← 15 | 16 →the maximum linear probability=1), versus 2) nonlinear economic probability (nonlinear likelihood) [6].

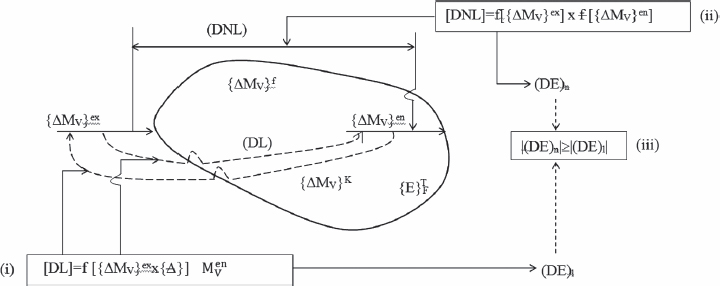

Advancing on this alignment of logic dichotomy evaluation “linear-nonlinear” economy (economic development), a complex of physical economics / intangible physical ![]() (local, national, regional, global), identified a lot of physical state variables {ΔMv}f, or intangibile state variables {ΔMv}f (Figure 1).

(local, national, regional, global), identified a lot of physical state variables {ΔMv}f, or intangibile state variables {ΔMv}f (Figure 1).

Fig. 1: Confirming the existence of the conceptual and operational area of higher economic growth compared with the nonlinear economic development/ linear economic development

Source: Orig. Ioan I. Gâf-Deac, et al., 2015

We note that among the multitude of variables the exogenous state {ΔMv}ex and endogenous state {ΔMv}en records linear [DL] and nonlinear [DNL] dependencies and thus expressed linear (DE)e and nonlinear (DE)n economic development.

As always the complex nonlinear problem is resolved by reducing to linearization and we conclude that the equation system {(i);(ii)} confirms the conceptual and operational area has a greater linear economic development in relation to the nonlinear (iii).

All this is found under “…the neoclassical growth model,…, is nearly linear, (…) the effect of linearization on point estimates is small, the impact on the moments of the model is of first-order importance,…, because quantitative models are widely judged by their ability to match data moments”.[6]

We note, too, that linearization is the order I (primary) economically process and de-linearization, if called as an equal “state” with linearization, would order II process, as operational, but be a freer structural and comprehensive model within the global economy.

The development based on dynamic balance is assumed, frequently, as a conventional phrase in Quantitative Economics.

Instead, linearization should be the result of reducing the nonlinear quality models. ← 16 | 17 →

3. Scheme solving of economic linear / nonlinear development models

Modern macroeconomics might appeal to stochastic canons and supervised database for free “advance” to sustainability horizons.

Therefore, we believe that it is not without interest to resort to de-linearization development priorities since humankind because contemporary society has not a very well-defined horizon to be attained from the economic point of view, when and how fast to move forward so as to achieve an alignment of the general and final state of sustainability.

Rational economic science does not speak of a certain “saturation / economic self-saturation” as having happened, for example, electromechanical systems, maximized performance measurement by maximized level of consumption, etc.

Fiskel J. (2006) [7] shows the need for „short-term continuity and long-term ecological integrity”.

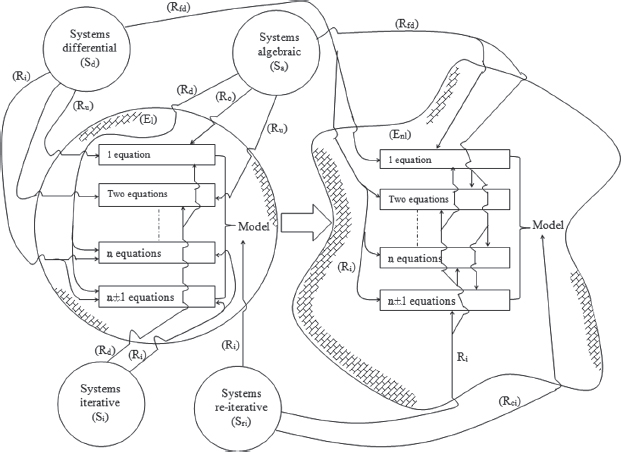

In this context, considering a complex linear development model (Ee) and other economic nonlinear development of economy (Ene), allocating coefficients / weights of importance to developing (Ro = average, trivial; Ru = light; Rd = difficult; Ri = impossible, and Rci = completely impossible) can formalize a scheme of equation systems and levels of difficulty to solve the linear transformation of economic development by nonlinear economic development (Figure 2).

Fig. 2: Equation systems and levels of difficulty to solve linear / nonlinear economic development models

Solving the complex rational above should be based on achieving linear, sequential solutions, that “make” practical nonlinearity development, operational modules.

Moreover, “we do not build models of systems, but build models of selected aspects of systems to study specific problems”. [3]

In the future, economic development can be reached by establishing rules on the self-determination of the rules. [9]

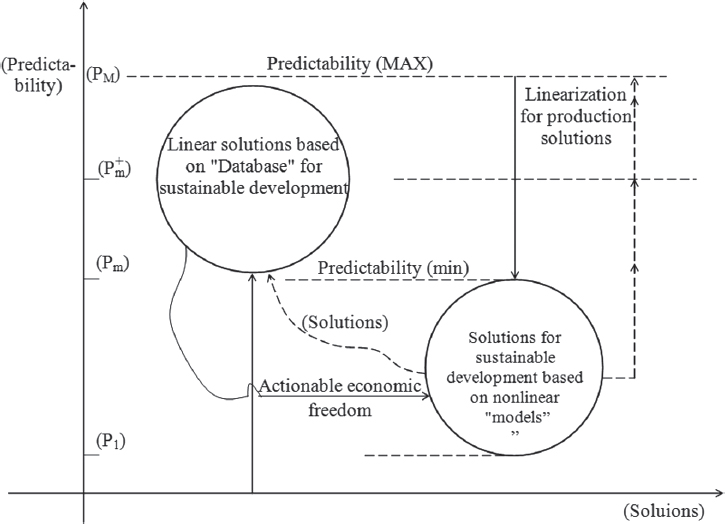

The most important step in this area relates, however, to establishing a logic correlation (based on coherence) between the solutions undertaken by developing a nonlinear economy and their predictability (Figure 3), so as to register and confirm concerned realism process.

Fig. 3: Freedom act of nonlinear economic development and formalizing the use of linearization solutions for high realism development

Source: Orig. Ioan I. Gâf-Deac, et al., 2015

The crucial challenge in the field is that we are dealing rather with stairs and hierarchies, solutions and predictability, leading to chaos and fractal studies aiming towards overall and final sustainability. ← 18 | 19 →

Conclusions

Those who elaborated development strategy, under certain conditions and circumstances, can have static projective attitudes. The circulation of information about the organization and leadership development is sufficiently dependent on management attitudes.

The drafter’s development strategies should be dynamic on nonlinear projective commitments attitudes.

A register of internal priorities in a modern economy do not reflect availability of all action to ensure the overall sustainability and definitive development, respectively designed historic progress.

Therefore, domestic economic synergisms tend to have connections with some foreign economic synergism, through complementary relationships, leading to a cosynergism project of sustainable development. The latter is accompanied by managerial co-synergism.

We believe that joining contemporary linear economy with nonlinear in the future provides an opportunity for available economic development; the resolutions with high difficulty can be obtained by linearization because the capability makers collection is clearer and “more powerful”, “…focusing on solutions type „points and points”, not necessarily on „model systems”.

We note that the potential / conceptual and operational valences of nonlinear economic development, in absolute size and higher quality, records linear economic development, precisely through the concepts and operational liberalization of the global economy.

Parametric key solution is studied in the context of articulation / content correlation in maximum harmonization / logical coherence between solutions (scenarios, variants, alternative development etc.) and their predictability to the overall and final sustainability.

References

Adams, W.M.,- The future of sustainability: re-thinking environment and development in the twenty-first century. Report of the IUCN Renowned Thinkers Meeting, 29–31 January 2006.

Baker, S., Bloom N., Davis, S., - Measuring economic policy uncertainty. Chicago Booth Research Paper, 13-02., 2013.

Barlas, Y., - System dynamics: System feedback modeling for policy analysis, Encyclopedia of Life Support Systems; UNESCO – Eolls, p. 4., 2007.

Crépin, A.-S., Folke, C.,- The Economy, the Biosphere and Planetary Boundaries: Towards Biosphere Economics., International Review of Environmental and Resource Economics, 8(1): 57–100, 2015. ← 19 | 20 →

Farah, P.D., Rossi, P.,- “Energy: Policy, Legal and Social-Economic Issues Under the Dimensions of Sustainability and Security”. World Scientific Reference on Globalization in Eurasia and the Pacific Rim, 26 November 2015.

Fernandez–Villaverdea, J., - Rubio-Ramirez J.F., - Estimating dynamic equilibrium economies; linear versus nonlinear likelihood, Journal of Applied Economics, p. 891, J.Appl.Econ. 20: 891–910, 2005.

Fiskel, J., - Sustainability and resilience: toward a system approach; Sustainability: Science, Practice & policy, 2(2): 14–21, September 2006.

Georgescu Roegen N., - Dynamic Models and Economic Growth. World Development, 11, 1975, pp. 765–783.

Gâf-Deac, I., – Bazele managementului doxastic, Ed. FMP, Bucharest, 2013.

Heal, G.,- Climate Economics: A Meta-Review and Some Suggestions for Future Research”, Review of Environmental Economics and Policy (Oxford Journals) 3: 4–April 8, 2014.

Holling, C.S., - Understanding the complexity of economic, ecological, and social systems. Ecosystems 4(5): 390–405, 2001.

Kemp, R., Loorbach, D., - Transition Management: A Reflexive Governance Approach., Pages 103–130 in J. Voss, D. Bauknecht, and R. Kemp, (eds.), Reflexive Governance for Sustainable Development, Edward Elgar, Northhampton, Massachusetts, 2006.

Kastenhofer, K., Rammel, C., - Obstacles to and potentials of the societal implementation of sustainable development: a comparative analysis of two case studies. Sustain Sci. Pract. Policy 1(2): 5–13, 2005.

Meadowcroft, J., - National sustainable development strategies: features, challanges, and reflexivity, European Environment, May 2007, p. 1.

Swart R.J., Raskin, P., Robinson, J., - The problem of the future: sustainability science and scenario analysis. Glob Environ Chang 14: 137–146, 2006.

Stavins, R., Wagner, A., Wagner, G., - Interpreting Sustainability in Economic Terms: Dynamic Efficiency Plus Intergenerational Equity”. Economic Letters 79 (3): 339–343, 2013.

Tainter, J.A.,- The Development of Social Complexity: Models of Collapse, Resiliency, and Sustainability., Presented at The Stockholm Seminars: Frontiers in Sustainability Science and Policy, The Royal Swedish Academy of Sciences, Stockholm, 24 September, 2003. ← 20 | 21 →

1* Senior Lecturer PhD., SH University of Bucharest, 13, I. Ghica St., District 3, MC 030045, Bucharest, Romania, editurafmp@gmail.com.

2 PhD., RNP Romsilva, 9A, Petricani St., MC 023841, Bucharest, Romania, otilia. ciutacu@yahoo.com.

3 Senior Lecturer, PhD., SH University, M.F.A. Faculty Bucharest, 13, I. Ghica St., District 3, Bucharest, MC 030045, Romania, gafdeac@yahoo.com.

4 PhD., University of Pitești, Institute for Nuclear Research, (ICN), Câmpului St., No. 1, MC 115400, Pitești-Mioveni, Romania, monica.valeca@nuclear.ro.

Marian Catalin Voica1, Mirela Panait2 & Irina Radulescu3

From Millennium Development Goals to Sustainable Development Goals – Results and Future Developments

Abstract: Millennium Development Goals (MDGs) represent one of the boldest initiatives of our time to promote sustainable development. Now, at the end of the time span for these goals to be accomplished, we can evaluate their fulfillment and the challenges that had to be overcome in order to get the intended results. We have to evaluate the results and the fulfillment of MDGs in the context of economic, social and geopolitical evolutions throughout the implementation period. As a result of the accomplishment of the MDGs, by leading the world to resolve a few punctual, but extremely important, problems, we can see that development is at hand when all the parties concentrate on the same problems. Our study aims to see what the goals were, if they were fully or partially achieved and what the main causes of the results were. We also explore the new Sustainable Development Goals (SDGs) and their role in guiding the world’s development for the next fifteen years until 2030.

Keywords: sustainable development, MDGs, SDGs

Introduction

Nowadays, the international community searches for suitable ways to fight some of the most important problems that humanity has. The first noticeable action in the search for a sustainable way to continue development was made in 1980 when, for the first time, the term “sustainable development” was used at the World Conservation Strategy under the International Union for Conservation of Nature and Natural Resources (IUCN) (IUCN, United Nations Environment Programme, UNEP, World Wide Fund for Nature, WWF, 1980). At this meeting, the need for a common future development was acknowledged and it needed to go in three directions (social, environmental and economic). This has been followed by Our Common Future Report (World Commission on Environment and Development, WCED, 1987) where it is stated that sustainable development “meets the needs of the present generation without compromising the ability of future generations to meet their own needs”. The Earth Summit in 1992 (United Nations, UN, 1992) produced a lot of discussion among members of the UN on the subject of sustainable development.

On September 8th 2000, the General Assembly of the United Nations adopted the 55/2 United Nations Millennium Declaration also known as the Millennium ← 21 | 22 → Development Goals (MDGs) with the goal of pooling available resources to tackle some of the most important problems of international sustainable development like poverty, hunger, and climate related disasters.

There is an internal relation between the MDGs. The achievement of one goal generates progress towards the achievement of another. For example, access to safe drinking water impacts positively upon health related outcomes; the attainment of universal primary education would ensure greater gender equality as girls are enrolled in school (Akinboade & Kinfack, 2015).

There is a correlation between MDGs and sustainable economic development because they represent ends in themselves because of their capability to drive people to achieve better standards of living and capital inputs, as they push productivity up and generate sustainable economic growth (Sachs, 2005).

Now, after 15 years, we are able to evaluate the role of these goals in development and advances registered by humanity in this time span and how they contribute to the concentration of resources to tackle the goals.

In our paper we try to evaluate the impact of the Millennium Development Goals on sustainable development from 2000 to 2015, to see what the most important aspects that influenced the path to the completion of these goals were, the influence of the international financial crisis and the new Sustainable Development Goals from the perspective of sustainable development between 2015 and 2030.

The Millennium Development Goals: content, evolution and results

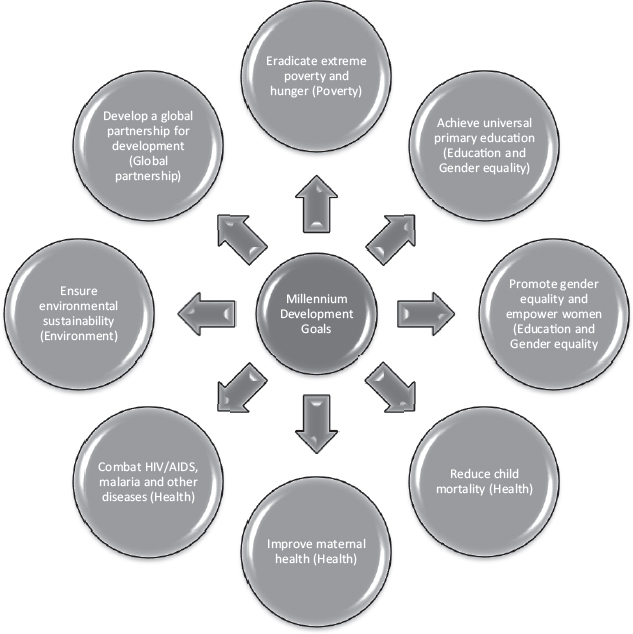

The Millennium Development Goals are a set of eight global development goals and 21 targets (60 official indicators)which need to be accomplished by the end of 2015 (Millennium Declaration, 2000). The base for the measurement of these goals has been considered the year 1990. The main reason for these goals was to guide economic and social development at a national level in the context of political actions of UN members and development politics, economic and operational decision making accounting for economics, development and management. ← 22 | 23 →

Fig. 1: The Millennium Development Goals and themes

Source: Millennium Declaration, 2000

In scientific literature we find important links between the MDGs, economic growth and capital accumulation (Sachs, 2005). Disease reduction, sanitation, clean water provision and proper housing, all to be found between the MDGs’ targets, have an impact on the development of human capital and infrastructure. MDG goal 8 promotes the innovation and diffusion of technology in order to harness the power of development generated by knowledge capital. MDG goal 1 promotes the reduction of poverty through the increase of household income. The environmental and ecological aspects from MDGs have an important impact on maintaining the fauna and flora intact. As a result, it seems that meeting the MDGs for health, education, hunger, and gender equality has a vital importance for economic growth and sustainable development (Sachs, 2005).

In order to work towards the completion of these goals the UN realized a collection of 60 indicators in order to monitor progress, which is effective from the 15th of January 2010. These indicators have been under criticism mainly because the reports ← 23 | 24 → published by the UN (MDGs Report, 2010) follows the indicators in a separate way like many other researchers (Easterly, 2009, Gwatkin, 2009, Hogan, 2010, Sachs&McArthur, 2005, Sahn& Stifel, 2003) which will not show us the overall performance of a country towards meeting the MDGs targets.

There have been also different indicators proposed by researchers like Kakwani (1993) to research improvements in living standards further developed by Majumder and Chakravarty (1996) and by Tsui (1996). All these indicators are based on progress function and success function.

Another problem of these indicators is the availability of exact data from the poorest countries, like the Sub-Saharan countries, where the indicators have the worst values. Also, if we look at the world as a whole, we might see an improvement of the indicators generated by the developed and developing countries, while the poorest countries might register low development or no development at all.

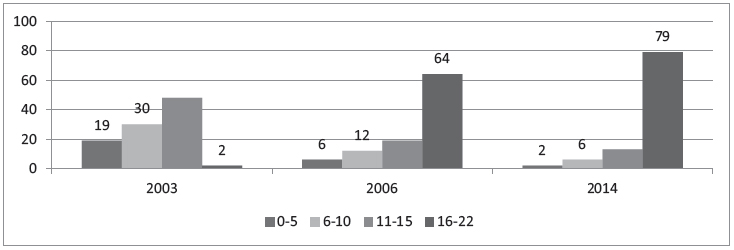

Fig. 2: Number of indicator series with at least two data points in developing regions for 22 selected MDG indicators

Source: The Millennium Development Goals Report 2015

In Figure 2, we can observe how the data availability increased through the entire period. There are some large data gaps in several development areas. The major challenges are the availability of quality data, time data series and the availability of disaggregated data on important topics. According to the World Bank more than half of the 155 member states lack adequate data and in Sub-Saharan Africa 61% of countries don’t have adequate poverty data, whereas in these countries the poverty is the highest of all. The lack of civil registration systems in some countries generates serious data gaps because of partial coverage.

Further we will explore the results and completion of MDGs, identifying their influence on sustainable development.

The first goal is to eradicate extreme poverty and hunger. According to the latest data available, a big portion of world population has been lifted out of extreme poverty, more than one billion people. We notice that even if at the global level the proportion of people living on less than 1,25USD/day dropped by 68% from 36% in 1990 to 12% in 2015, in Sub-Saharan Africa the evolution has been slow, only 28% drop ← 24 | 25 → from 57% in 1990 to 41% in 2015. The projected number for 2015 of people living on less than 1,25 USD/day is 836 million, so there is a lot more work to do in the next period. About 80% of them live in Southern Asia and Sub-Saharan Africa. The proportion of people who suffer from hunger registered a steady decline almost achieving the target to halve this proportion. Even with this decrease there are still around 795 million people that are undernourished around the world. We must acknowledge that this reduction has been gained under high pressure from challenges of the last decade such as environmental aspects, commodity price volatility, unemployment and economic recessions. The reduction of hunger is not uniform and we observe high variations from region to region, most of them failing to achieve the target by far like Sub-Saharan Africa, Southern Asia, Caribbean and Oceania. In Western Asia we even see an increase of hunger caused by war, civil unrest and a growing number of refugees. As a result of these conflicts there have been almost 60 million people recorded to be forcibly displaced worldwide, one of the highest numbers since the Second World War.

The second goal is to achieve universal primary education. We observe an important evolution in the case of net enrolment around the world and especially in the developing areas where the proportion of enrolment recorded showed an increase from 80% in 1990 to 91% in 2015. Also, in developing countries we notice that the number of out-of-school children has been cut in half since 2000. For universal enrolment in primary education the threshold used is 97% and based on this threshold education is almost universal in almost all regions excepting Sub-Saharan Africa. Even if the results are encouraging we notice that there are some disparities between rich and poor households, rural and urban households and children with disabilities.

The third goal is to promote gender equality and empower women. Studies showed that there is a positive impact on development of the increased level of education of women and girls. In this context MDGs drive the efforts of member countries to get more girls in education. Gender disparity has decreased since 2000 at all levels of education. The gender parity index has been used to measure the evolution to achieve this goal. The goal is to achieve a gender parity index between 0.97 and 1.03, and we observe that the figures for 2015 are 0.98 for primary and secondary education and 1.01 for tertiary education. The largest gender disparities are in tertiary education, as a result only Western Asia has achieved this target. The proportion of women employed registered a continuous expansion from 35% in 1990 to 41% in 2015. Still there are significant gaps between women and men in the labor market because only 50% of women are participating in the labor force compared to 76% of men. Another important advancement was recorded in the political representation of women as the proportion of seats held by them in single or lower houses of national parliaments increased from 14% in 2000 to 22% in 2015. Even if the results are encouraging the evolution must continue in order the achieve gender equality.

The fourth goal is to reduce child mortality. Child mortality rate declines as is shown by the under-five mortality rate with 53% from 90 deaths at 1000 live births in 1990 to 43 deaths at 1000 live births in 2015, which means around six million deaths of children in 2015. Even if the evolution is important, studies show that at the actual ← 25 | 26 → rate it will take another 10 years to reach the goal of 2015. Around 16 000 children will die daily in 2015 from causes that can be prevented like diarrhea, pneumonia and malaria. Statistical data shows that the most dangerous time for a newborn is the first day after birth. In 2015 almost one million children will die in the day they are born, another million in the first week after birth and 2.8 million will lose their lives in the first 28 days after birth. Even though the rate of children that die in the first month after birth is in decline, the rate of decline is much slower than the rate of death for children under five years and the majority of these deaths take place between one and 28 days after birth. This situation is generated by the lack of proper medical assistance at birth and after birth in some of the developing regions. Data reveals that there are a number of socioeconomic disparities such as rural/urban, rich/poor and educated/ uneducated that concentrates the number of deaths in the vulnerable areas. The most important determinant of child survival inequality is generated by the mother’s education which can increase the chances of survival by 2.8 times.

The fifth goal is to improve maternal health. The maternal mortality ratio has decreased to about half the value of 1990 from 380 maternal deaths per 100 000 live births in 1990 to 210 maternal deaths per 100 000 live births in 2015, with an important decrease since the year 2000. This is far from the proposed target and is generated by a lack of skilled care at birth. Around the world the proportion of deliveries attended by skilled health personnel grew from 59% in 1990 to 71% in 2015. The highest concentration of maternal deaths is in Sub-Saharan Africa and Southern Asia with a share of 86% of all global maternal deaths in 2013. Here we find again a disparity between rural and urban coverage of births with skilled health personnel at almost 31%. There are high disparities between different regions of the world regarding the improvements obtained in increasing the number of births under skilled care. Also there is a lack of basic data on births and deaths and health hampers effective policymaking because worldwide only 51% of countries has data on maternal causes of death.

The sixth goal is to combat HIV/AIDS, malaria and other diseases. The number of new HIV infections fell in developing regions from 3.34 million in 1990 to 1.94 million in 2015. Southern, Eastern and West Africa are the regions with the highest number of new infections. The number of children orphaned by AIDS is decreasing after reaching its highest in 2009, with around 19 million worldwide aged under 18 that had lost at least one parent due to AIDS. This decrease has been possibly because of the increasing number of people who receive antiretroviral therapy. The rate of malaria related infections and deaths registered a decreasing trend throughout the entire period with an estimate decrease of 37% for the incidence of malaria and 58% for the mortality rate caused by malaria. This evolution has been catalysed by the massive international financing for malaria since 2000.

The seventh goal is to ensure environmental sustainability. The area covered by forests is around 30% worldwide. The rate of deforestation has slowed down, but it still threatens the wildlife and livelihoods of people. South America and Africa registered the largest losses of forest area in the first decade of the new millennium. About 0.5 gigatonnes of carbon that could be held in forests was lost every year in the period of 2005 and 2010. Emissions of carbon dioxide registered an increase ← 26 | 27 → from 21.6 billion metric tons in 1990 to 33 billion metric tons in 2015, especially after the year 2000. Ozone-depleting substances have been almost eliminated through a global effort and the ozone layer is expected to recover by the mid-century. Almost 40% of the world population is affected by scarcity of water. Now 12% of total freshwater withdrawn goes to municipalities, 19% goes to industries and 69% goes to agriculture mainly through irrigation. Globally the percent of freshwater withdrawn represents only 9%, which is below the 25% threshold that marks the start of physical water stress. There has been an increase of terrestrial areas protected; their percentage in 1990 was 8.7% while now we have reached 15.2%. The extinction of animals and plants continues to affect the wildlife. Species’ risk of extinction is measured by the Red List Index which shows a decline in all the groups examined. The target to halve the proportion of people without sustainable access to drinking water has been met five years ahead of schedule, while the access to proper sanitation did not meet the goal, even though important improvements have been made.

The eighth goal is to develop a global partnership for development. The official development assistance from developed countries increased by 66% between 2000 and 2004. This assistance was concentrated in the least developed countries, which received 25 billion USD last year. The level of imports from developing countries registered an ascending trend, especially for the least developed countries. This was driven by the reduction of tariffs for the least developed countries especially between 1996 and 2005. Between 2000 and 2015 we observed a radical fall of debt especially in the first decade, for the least developed countries. Information and communications technologies transformed the way we work, live and communicate; and continue to expand worldwide helped by the new technologies’ falling prices and content. The number of mobile subscriptions grew from 738 million in 2000 to over seven billion in 2015. We have to acknowledge that this development is not equally dispersed between different regions of the world, only 21% of the Sub-Saharan Africa population used the internet while 82% of the population does in developed world.

Taking in account the data presented below, we observe some progress, but achievements are not made in a linear manner all over the world. Many disparities are among regions, countries and people. People who are vulnerable in terms of disability, ethnicity, geographic location and even sex or age need additional attention in the future. The major problems that are not solved and require targeted efforts are: poverty and hunger, conflicts, gender inequality, gaps between the poorest and richest households, gaps between rural and urban areas, climate change and environmental degradation (UN 2015).

Future developments: the adoption of sustainable development goals

Taking in account the achievements after the implementation of the Millennium Development Goals, the political leaders established bolder objectives, their purpose being “to free the human race from the tyranny of poverty” and “to heal and secure ← 27 | 28 → our planet” (UN 2015 Agenda). In September 2015, The General Assembly of United Nations adopted the Agenda 2030 and set up 17 Sustainable Development Goals (SDGs) and 169 targets.

Tab. 1: The main topics and purposes of SDGs

| The main topics | The main purpose |

| People | end poverty and hunger; dignity and equality for human beings |

| Planet | protection from degradation (including through sustainable consumption and production) and urgent actions on climate change |

| Prosperity | prosperous and fulfilling lives |

| Peace | foster peaceful environment |

| Partnership | strengthen global solidarity, revitalization of Global Partnership for Sustainable Development |

Source: UN 2015 Transforming our world: the 2030 Agenda for Sustainable Development

The SDGs are built on the Millennium Development Goals (MDGs) and the objective is to meet these goals that were not being achieved. Despite international efforts to achieve the Millennium Development Goals, they were not met completely. This fact imposed a reason to mobilize broader and establish more intensive cooperation between developing countries and developed countries. For example, after 15 years of implementations of measures relative to the Millennium Development Goals, we notice that in some fields and regions, the progress has been modest and uneven. The main lack of progress has been registered in Africa, especially in landlocked developing countries, the least developed countries, and small island developing states. In the case of the Millennium Development Goals related to newborn and child health, maternal and reproductive health recorded the most modest results in these areas.

The SDGs are a continuation of the MDGs which intend to meet the previously partly achieved goals and they are focused on the most vulnerable problems facing humanity. The SDGs have a more ambitious agenda, with additional issues compared with MDGs (like sustainable consumption, innovation, climate change, importance of peace and justice for all) or more ambitious targets like elimination of rather than decrease of poverty or more demanding targets on topics like health, gender equality and education. A novelty compared to the MDGs is that SDGs address both developed countries and developing countries.

Through these goals, the immense challenges to sustainable development facing humanity such as gender inequality, global health threats, unemployment, natural disasters, violent extremism, terrorism, natural resource depletion and climate change could be resolved. The result would be a world free of poverty, hunger, disease, fear and violence. ← 28 | 29 →

Tab. 2: MDGs and SDGs

| MDGs | SDGs |

|

1. Eradicate extreme poverty and hunger 2. Achieve universal primary education 3. Promote gender equality and empower women 4. Reduce child mortality 5. Improve maternal health 6. Combat HIV/ AIDS, malaria and other diseases 7. Ensure environmental sustainability 8. Develop a global partnership for development |

Goal 1: End poverty in all its forms everywhere Goal 2: End hunger, achieve food security and improved nutrition, and promote sustainable agriculture Goal 3: Ensure healthy lives and promote well-being for all at all ages Goal 4: Ensure inclusive and equitable quality education and promote life-long learning opportunities for all Goal 5: Achieve gender equality and empower all women and girls Goal 6: Ensure availability and sustainable management of water and sanitation for all Goal 7: Ensure access to affordable, reliable, sustainable, and modern energy for all Goal 8: Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all Goal 9: Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation Goal 10: Reduce inequality within and among countries Goal 11: Make cities and human settlements inclusive, safe, resilient and sustainable Goal 12: Ensure sustainable consumption and production patterns Goal 13: Take urgent action to combat climate change and its impacts Goal 14: Conserve and sustainably use the oceans, seas and marine resources for sustainable development Goal 15: Protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss Goal 16: Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels Goal 17: Strengthen the means of implementation and revitalize the global partnership for sustainable development |

Source: United Nations

The implementation of ambitious and wide-ranging SDGs requires spending important financial funds and supposes the use of different sources or mechanisms like official development assistance, mobilization of domestic financial resources and implementation of various public-private partnerships. Officially the UN acknowledges the importance of public authorities, especially national parliaments that must create the legal framework for the implementation of SDGs and international financial ← 29 | 30 → institutions that have to offer financial support to developing countries in order to meet their commitments.

Taking in account the magnitude of these goals, the Global Partnership for Sustainable Development must be revitalized through intense cooperation between governments, private sector and civil society. In this sense, additional reforms are needed at the international level because the asymmetric levels of development and resources between different countries need to be eliminated or reduced.

Conclusions

The Millennium Development Goals have been one of the most important initiatives with the role to concentrate the international forces towards the accomplishment of eight specific goals. Their endeavour made it possible to demonstrate that if the international community has a specific goal, they can achieve it by concentrating the resources on these goals only and not losing the scope of their action by trying to accomplish too many targets at the same time.

The results obtained by the Millennium Development Goals showed the international community that a fifteen-year goal is feasible and proves that in this way they can get palpable results and the happiness generated by the accomplishment of one goal drives forward the movement.

We must acknowledge that there are some regions, especially in Africa, that find it hard to achieve good results, but as the world goes forward these regions will receive help from other countries that have had a better evolution.

As they assessed the results of implementing MDGs, the experts have noted some problems that occurred as a result of lower discussions on the implementation of these objectives and the low role played by local authorities. Because of this reason, at the 2010 UN Global Forum in Uganda, the importance of intergovernmental partnership was emphasized. Moreover, in 2013, a communication was developed by the European Commission (called Empowering Local Authorities in Partner Countries for Enhanced Governance and more effective Development Outcomes) which recognized the role played by these authorities for achieving sustainable development. In addition, the analysis reveals the important role which should be played by local authorities in specific areas such as infrastructure or supply of drinking water and the existence of local resources for each.

The metrics of the new Sustainable Development Goals needs to be more accurate than those of the Millennium Development Goals and for this the collection of suitable data must be developed, especially in the least developed countries and regions of the world. ← 30 | 31 →

References

Akinboade, Oludele Akinloye / Emilie, Chanceline Kinfack: “Financial development, economic growth and millennium development goals in South Africa: is there a link?” International Journal of Social Economics 42, no. 5, 2015: 459–479.

Bodea, Constanţa-Nicoleta / Cetin, Elmas /Ana, Tanasescu / Maria, Dascalu.: “An ontological-based model for competences in sustainable development projects: a case study for project’s commercial activities.” Amfiteatru economic 27, 2010: 177–189.

Easterly, William: “How the millennium development goals are unfair to Africa.” World Development 37, no. 1, 2009: 26–35.

Gwatkin, Davidson R.: “How much would poor people gain from faster progress towards the Millennium Development Goals for health?.” The Lancet 365, no. 9461 (2005): 813–817.

Haines, Andy /Andrew, Cassels: “Can the millennium development goals be attained?.” BMJ: British medical journal 329, no. 7462, 2004: 394.

Hogan, Margaret C. / Kyle, J. Foreman / Mohsen, Naghavi / Stephanie, Y. Ahn / Mengru, Wang / Susanna, M. Makela / Alan, D. Lopez / Rafael, Lozano / Christopher, JL Murray: “Maternal mortality for 181 countries, 1980–2008: a systematic analysis of progress towards Millennium Development Goal 5.” The lancet 375, no. 9726, 2010: 1609–1623.

Kakwani, Nanak: “Performance in living standards: An international comparison.” Journal of development economics 41, no. 2, 1993: 307–336.

Lazăr, Cornel / Mirela, Lazăr.: “Quantifying Progress within Sustainable Development.” Petroleum-Gas University of Ploiesti Bulletin, Economic Sciences Series 61, no. 1, 2009.

Majumder, Amita / Satya, R. Chakravarty: “Achievement and improvement in living standards.” Journal of Development Economics 50, no. 1, 1996: 189–195.

Mieilă, Mihai / Valerica, Toplicianu: “Sustainable Development Indicators: A Review of Paradigms.” Sustainable Technologies, Policies, and Constraints in the Green Economy, 2013: 312.

Radu, Ioan / Raluca, Podasca: “Study of the interdependence between sustainable development and competitiveness.” Calitatea 15, no. S1, 2014: 98–102.

Sahn, David E. / David, C. Stifel: “Progress toward the millennium development goals in Africa.” World Development 31, no. 1, 2003: 23–52.

Sachs, Jeffrey D. “Investing in Development: A Practical Plan to Achieve the Millennium Development Goals”, UN Millennium Project, New York, 2005.

Sachs, Jeffrey D. / John, W. McArthur: “The millennium project: a plan for meeting the millennium development goals.” The Lancet 365, no. 945, 2005, 347–353.

Slack, Lucy: “The post-2015 Global Agenda – a role for local Government”, Commonwealth Journal of Local Governance, Issue 16/17: June, 2015. ← 31 | 32 →

Tănăsescu, Ana / Pătraşcu, Aurelia / Oprea, Cristina: Environmental Protection Domain Modelling, Proceedings of the 11th IBIMA Conference, Innovation and Knowledge Management in Twin Track Economies, Cairo, Egypt, 4–6 January, 2009, 1164–1170.

Tsui, Kai-yuen: “Improvement indices of well-being.” Social Choice and Welfare, vol 13, no. 3, 1996, 291–303.

Vasile, Valentina / Gheorghe, Zaman: “Dezvoltarea durabila.” Editura Expert, Bucureşti, 2005.

United Nations: The Millennium Development Goals Report 2010, 2010.

United Nations: The Millennium Development Goals Report 2015, 2015.

UN 2015 Transforming our world: the 2030 Agenda for Sustainable Development. ← 32 | 33 →

1 Petroleum-Gas University of Ploiesti, ec_voicamariancatalin@yahoo.com.

2 Petroleum-Gas University of Ploiesti, mirematei@yahoo.com.

3 Petroleum-Gas University of Ploiesti, iri_radulescu@yahoo.com.

Nation, Communitarism, Peace and Globalisation: A Vulnerable Relationship

Abstract: Nations are mainly evolutive categories rather than natural creations. National movements, determined by invoking common past ideals, produced a national conscience which, in turn, shaped the nation further. The nation-state principle was imposed for a long period in the 20th century along with “decolonisation”. A social and solidary economy (not excluding profit) was increasingly accepted. Education and the economy became essential factors of peace. Soon problems occurred. In extreme conditions, nationalist parties received more and more votes. Therefore, “nationals” came up against “globalists?”But we can hardly accept this adversity. Globalisation should be beneficial to the whole world, and we should avoid considering it as a synonym for a lack of patriotism. It is a dynamic process that indicates the direction of the world’s evolution.

Keywords: General Economics, International Economics General, Globalisation, Economic Systems, Cultural Economics, National Government, Public Economics.

“It is true that the world was created by

two hands – not God’s hands, but man’s hands”

Tudor Muşatescu

(Romanian humourist

and dramatist, 1903–1970)

Introduction

In general, man’s progress is made by gradual accumulation, from simple to complex. Nations emerged and developed on their own, then communities emerged, often stimulated by peace, and that is why the transition to globalization seems to be a natural process. This is for several reasons including economic ones: globalization of the markets (capital, labour, goods, etc.), need of easy circulation, etc. What are the favourable factors and the hindering ones? How are the evolutions and the realities perceived? Here is the topic of my research dealing with some very complex horizons: nation, peace, war, integration, and globalization.

1. Literature

It is a vast literature of Anglo-Saxon, European, Latin, Asian origins, which you examine, understand, and use in your own works, especially when you made a great effort to achieve that by studying hundreds and hundreds of works. As for me, I mention among others the papers I have written: Cataclismele economice care zguduie ← 33 | 34 → lumea (“Economic cataclysms that shatter the world”) (2010), Criza indecentă (“The shameful crisis”) (2012), Amenințări pentru secolul XXI (“Threats to the 21st century”) (2014). I mention several of my internationally recognized studies on “The Fall of Rome and the decay of the present civilization” or “Social market economy – The opportunes of Charles Gide and Leon Bourgeois, both for Elsevier publishing company (Elsevier) “The German Model of the Social Market Economy. From Fr. List to present” (Research Papers in Economics, RePEc, EBSCO Information Services, EBSCO, etc.), “David Ricardo, a contemporary economist” (RePEc), “Personalities of the world’s economic thought. Jean Jaurès – A peace supporter” (abstract and citation database of peer-reviewed literature, SCOPUS), “Peronism – A biography of a doctrine” (SCOPUS), etc. Also, my significant participation in prestigious international economic congresses on topics such as industrialization, the liberalism-protectionism relation, national development-community development, etc. (See the World Congresses of Economic History under the aegis of the International Economic History Association, IEHA and the Academies of the member countries, Milan, 1994, Madrid, 1998, section chief in Buenos Aires 2002, Helsinki, 2006, Utrecht, 2009, Stellenbosch, South Africa, 2012, etc.). Then, the Eurasia Business and Economics Society, (EBES) International Conference, Venice, 2015, etc.

Of course, for preparing this paper I have read and re-read recent volumes and studies of Michel Winock, Eduard Venson, Jonathan Hugues, Friederich List, Ludwing Erhard, Walter Eucken, Mark Blaug, Michel Beaud, Mihail Manoilescu, papers on the history of the two World Wars in the 20th century, papers of the League of Nations, United Nations Organization (UNO), European Union, papers of the American Administration, etc.

2. Research Methodology

I focused my whole research work on some basic coordinates of the time and space evaluation of nation, integration, peace, and globalization.

3. Nation, Communitarism, Peace and Globalisation: A Vulnerable Relationship

In 2015, the week after Easter, while reading L’Histoire’s January 2015 issue, especially “Les racines du nationalisme” – containing studies written by remarkable authors such as Michel Winock (“1789–1920: comment s’est desinée la carte de l’Europe”), Pap Ndiaye (“Les nations africaines existent-elles?”), Yves Saint Geours (“Amérique Latine. Des nations filles de l’independence”), Valerie Igounet (“Français d’abord”), Eduard Vernon (“L’explosion des nations”), Benoît Pelistrandi, etc. – I remembered my exchange of ideas in the 1980s with professor Mircea Babeş2* on a then fundamental issue of our ← 34 | 35 → time, of our century and, probably, of the following one: the relations between nation, community, peace and world, between nations, community and globalism. Therefore where do we go: Do we become global or do we return to the national? Are we two “areas” opposed or can they co-exist? Does the global win? What after globalisation? More questions can be derived from such issues, not only theoretical, but also practical, pragmatic, economic and political, social, which should be answered by us, the present people, and by the future ones.

Details

- Pages

- 688

- Publication Year

- 2016

- ISBN (Hardcover)

- 9783631673300

- ISBN (ePUB)

- 9783631696644

- ISBN (MOBI)

- 9783631696651

- ISBN (PDF)

- 9783653065718

- ISBN (Hardcover)

- 9783631787403

- DOI

- 10.3726/978-3-653-06571-8

- Language

- English

- Publication date

- 2017 (March)

- Keywords

- development strategies best practices sustainable development globalisation Romania

- Published

- Frankfurt am Main, Bern, Bruxelles, New York, Oxford, Warsawa, Wien, 2016. 688 pp., 137 fig. b/w, 154 tables, 5 graphs

- Product Safety

- Peter Lang Group AG