Handbook of Energy and Environment Policy

Summary

Excerpt

Table Of Contents

- Cover

- Title Page

- Copyright Page

- Preface and Acknowledgements

- About the editors

- About the book

- Citability of the eBook

- Contents

- List of Contributors

- Section 1 Energy Policy

- 1 Energy Demand

- 2 Volatility Spillover and Hedging Effectiveness

- 3 Energy Efficiency in the Turkish Health Sector

- 4 Energy Consumption and Economic Growth: An Econometric Analysis for OECD Countries

- 5 The Concept of Energy Security from Different Aspects and Turkey’s Energy Security Understanding

- 6 Oil and Oil Market as Energy Source1

- 7 The Effect of Oil Prices on Firms’ Performances: The Case of Turkey1

- 8 Dynamics of Crude Oil Import Demand of Turkish Economy

- 9 Performance Analysis of the Companies in the Electricity Index of Borsa Istanbul

- 10 Compliance with Corporate Governance Principles: An Analysis of the Companies in the Electricity Index of Borsa Istanbul

- 11 Collaborative Supply Chain Structures for Distributed Generation

- Section 2 Environment Policy

- 12 Sustainable Energy Future: The Turkish Path for Responding to Climate Change

- 13 Economic Development as a Driver of Environmental Pollution in Net Energy-importing Countries? New Evidence from a PSTR Model

- 14 An Institutional Overview of Climate Change

- 15 The Rise of Environmental Consciousness in Islamic Finance: Green Sukuk

- 16 A Panel Causality Analysis on Countries Attracting Most Tourists on the Basis of Carbon Emissions, Renewable Energy, Tourism Revenues, and Trade Openness

- List of Figures

- List of Tables

Vasıf Abioğlu

Assistant Prof. Dr., Aksaray University, Aksaray, Turkey vabiyev@aksaray.edu.tr

Celil Aydın

Associate Prof. Dr., Bandırma Onyedi Eylül University, Balıkesir, Turkey, caydin@bandirma.edu.tr

Haşim Bağcı

Assistant Prof. Dr., Aksaray University, Aksaray, Turkey hasimbagci1907@hotmail.com

İbrahim Müjdat Başaran

Assistant Prof. Dr, Zonguldak Bülent Ecevit University, Zonguldak, Turkey imbasaran@beun.edu.tr

Kurtuluş Bozkurt

Assistant Prof. Dr., Adnan Menderes University, Aydın, Turkey, kurtulus.bozkurt@adu.edu.tr

Efe Büken

Research Assistant, Cukurova University, Adana, Turkey ebuken@cu.edu.tr

Mehtap Çakmak Barsbay

Assistant Prof. Dr., Karamanoğlu Mehmetbey University, Karaman, Turkey. mehtapcakmak@kmu.edu.tr

Füsun Çelebi Boz

Assistant Prof. Dr., Bayburt University, Bayburt, Turkey, fcelebi@bayburt.edu.tr

Meltem Ece Çokmutlu

Dr., Karabük University, Karabük, Turkey meltemece@karabuk.edu.tr

Ömer Esen

Associate Prof. Dr., Namık Kemal University, Tekirdağ, Turkey omeresen81@yahoo.com

Fatih Güçlü

Dr., Karabük University, Karabük, Turkey fatihguclu@karabuk.edu.tr

S. Hilmi Kal

Economist, Research and Monetary Policy Department, Central Bank of the Republic of Turkey, Ankara, Turkey Suleyman.Kal@tcmb.gov.tr

Erdal T. Karagöl

Prof. Dr., Ankara Yıldırım Beyazıt University, Ankara, Turkey erdalkaragol@hotmail.com

İsmail Kavaz

Dr., Bingöl University, Bingöl, Turkey i_kavaz@hotmail.com

Metin Kılıç

Assistant Prof. Dr., Bandırma Onyedi Eylül University, Balıkesir, Turkey, metinkilic@bandirma.edu.tr

Elif Korkmaz

Research Assistant Dr., Ege University, İzmir, Turkey, elif.korkmaz@ege.edu.tr

Dilek Özçoban

Graduate Student, Bandırma Onyedi Eylül University, Balıkesir, Turkey dilekozcbn@gmail.com

Şerife Özkan Nesimioğlu

Assistant Prof. Dr., KTO Karatay University, Konya, Turkey, serife.ozkan.nesimioglu@karatay.edu.tr

Aytaç Pekmezci

Assistant Prof. Dr., Muğla Sıtkı Koçman Üniversity, Muğla, Turkey aytac0803@yahoo.com

M. Kenan Terzioğlu

Associate Prof. Dr., Trakya University, Edirne, Turkey, kenanterzioglu@trakya.edu.tr

Erol Türker Tümer

Research Assistant Dr., Dokuz Eylül University, İzmir, Turkey, turker.tumer@deu.edu.tr

Sırrı Uyanık

Dr., KTO Karatay University, Konya, Turkey Sirriuyanik@yahoo.com

Zeynep Zaimoğlu

Prof. Dr., Cukurova University, Adana, Turkey zeynepz@cu.edu.tr

İsmail Kavaz and Erdal T. Karagöl

Introduction

Energy is crucial for modern economies. Especially in the industrialized countries, energy is needed for sustainable economic growth. For this reason, secure and continuous energy supply should be provided. In the case of insufficient generation of energy, economic activities would slow down, and life quality would reduce. In this context, it is necessary to produce sufficient energy resources to obtain economic and social development. Therefore, actors in the energy markets want to know the amount of energy that would be consumed. In other words, estimating the quantity of energy demanded is very important for countries, institutions, and individuals.

Energy demand is the quantity of energy required by individuals and institutions for the realization of consumption and economic activities. Bhattacharyya and Timilsina (2009) define energy as a derived demand. That is, energy is not demanded for its own sake. It is demanded for the services it provides like heating, lighting, and power. When considered from this point of view, energy is a demand for the services it generates with the capital stock at a certain period.

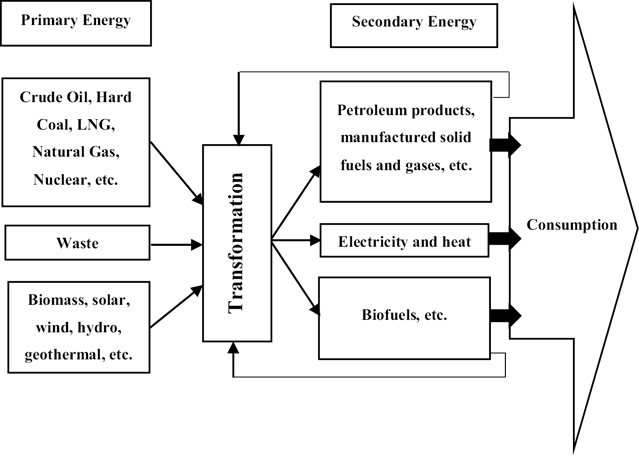

Indeed, energy demand is a wide concept that needs to be revealed before analysing the models used for demand estimation and prediction. In general terms, energy demand can be classified under two headings: the primary energy demand and the secondary energy demand.

The primary energy demand represents the country’s total energy demand (such as the total quantity of gas, oil, coal, lignite, biomass, hydro and other primary energy sources used in the country). The primary energy demand is estimated as the final energy demand plus the demand for energy transformations, mainly for power generation (IEA, 2004).

The secondary energy demand is defined as the demand coming from end-use sectors, such as industry, transport, residential, services (public and commercial) and agriculture. The secondary energy demand includes the demand for electricity, natural gas, oil products, coal, biomass and so forth (European Environmental Agency, 2019). This energy demand depends on the economic structure, lifestyles and technological improvements in terms of energy efficiency.

←19 | 20→The difference between the primary and secondary energy is summarized in Fig 1.1.

The most important difference between primary and secondary energy is the transformation process which means changing the energy from one form to another. A primary energy source is obtained directly from natural resources. On the other hand, secondary or final energy source is captured from a primary energy source via the transformation process. For instance, natural gas, coal or renewable energy sources are classified as primary energy, which can be used for producing electricity or heat as secondary energy. After the transformation and secondary energy production operation finish then the consumption process can start.

As it is mentioned above, energy is an indirect demand, and it is demanded for providing benefits from its consumption. In terms of energy demand, individuals consume the secondary energy resources. In this regard, it can be said that individuals or institutions want to use the energy sources which they will utilize in terms of heating, transportation, production, etc. Therefore, the transformation process is very significant in the energy sector and without this process energy cannot be used in the daily life.

←20 | 21→Like all kinds of demand for goods and services, there are factors, elasticities, and determinants that are affecting the energy demand in short and long terms. The most important ones of these determinants are price and income levels. In addition to this, technological improvements, the efficient usage of energy, and weather conditions have significant effects on energy demand (Bhattacharyya and Timilsina, 2009).

In this study, after briefly introducing the types of energy, determinants of energy demand are explained in detail in the context of price and income. After that, the energy demand modelling methods and the theoretical background related to this issue are given. Lastly, the summary and conclusion section is presented.

1 Determinants of the Energy Demand

The traditional economic theory states that the demand for goods and services with given budget constraint and determined price can be generated by two reasons; minimize the costs and/or maximise the utilities. In terms of energy, while households demand it to maximize their utility, for producers it is an important factor for cost minimizing or profit maximizing. In fact, both cases (minimizing the costs and maximizing the utility) are interrelated in energy demand process. On the other hand, Jones (1994) indicates that even though the price and income variables affect the cost and utility (profit), there are other factors that determine the quantity of energy demanded, such as regulations, technology, efficiency standards, air conditions, consumer behaviours, population, expectations, etc.

Analysing the energy demand depends on historical consumption trend and the connection of this trend with other indicators, such as economic, demographic, climatic, etc. (Egelioglu et al., 2001). In parallel with this argument, there are mainly two determinants of energy demand. First one is the price. Price of one good or service certainly affects the quantity of consumption. Therefore, the demand for energy sources responds to the price changes as well as all economic products. The second one, on the other hand, is income. Income is an important factor that determines the quantity of demand. Although other factors are affecting the consumption such as consumer behaviour, air temperature, and efficiency, the price and income are considered as the most significant variables of energy demand pattern.

It must be known that energy is a necessity good and it is compulsory to consume the energy in today’s world. Because of this characteristic of energy, the price, income, and other factors on energy demand should be analysed in detail. The energy demand theory claims that price and income are two major ←21 | 22→determinants (Bohi, 2013). Therefore, in the next sections of the study, price and income variables of energy demand and the factors that are affecting these two determinants are introduced in detail.

1.1 Price

In economic theory, it is expected that an increase of one commodity’s price decreases the demand of this commodity, ceteris paribus. The sensitivity in demand against the price changes is defined as the price elasticity of demand. In other words, assuming all factors on demand remain constant, the own-price elasticity of demand can be defined as the percentage change in quantity demanded in response to the change in the percentage of related product’s price. In general, it can be said that there is an inverse proportional relationship between price and demand (Uddin and Sano, 2012).

The estimated elasticities can be classified into three categories (Mankiw, 2012). The price elasticity of demand is defined as inelastic if it is less than one in absolute term, as unit elastic if it is one and as elastic if it is greater than one. This classification reflects the demand behaviour of consumers on a good related to the price changes. For instance, if the demand elasticity is found as inelastic then the expenditure will be affected negatively to the price variations, or if the demand elasticity is elastic, then the expenditure will be influenced positively to the price changes.

On the other hand, cross-price elasticity can be identified as the estimation of the consumer reactions to the changes of the related commodity’s price. In terms of the energy demand, the cross-price elasticity is considerably significant in determining the difference between substitutes and complements since various resources can be utilized for the same objective in the energy market (Mansfield, 1997). For example, the electricity can be produced by using natural gas, coal or renewable energy sources in the electricity generation sector. For this reason, the cross-price elasticity estimation is vital for the energy sector to decide which sources would be used or consumed.

Energy is a commodity and individuals change their attitudes based on the price signals. Hasanov (2015) argues that the price elasticities of energy sources affect the economy in many ways such as consumption trends and tax rates. Furthermore, the price elasticity is fundamental for arranging ideal tax rates on energy demand. Under this circumstance, it is expected that some economic parameters such as tariffs and incentives can have impacts on energy using behaviour and energy investments. Therefore, estimating reliable price elasticities of energy demand is crucial for all actors in energy markets. These actors ←22 | 23→take their position in response to price variations and want to maximize their utility. In this sense, developing an efficient energy market system is necessary to ensure the price stability and foreseeability. As a result, since price affects the energy demand, designing a properly arranged price mechanism is one of the major factors to create a reliable energy market.

On the other hand, there are also some other factors that affect the price changes in energy markets. For instance, technological changes have an important effect on the price. Energy efficient devices decrease the costs of energy and the usage of these kinds of devices increases in parallel with the technological developments. Therefore, the use of energy as efficiently affects the energy consumption and hence the relative prices of energy can change.

In addition, the sectoral differences have important impacts on energy prices. As it is well known, the price of energy differs from one sector to another. For instance, the price of electricity in the industry may be lesser than residential. Furthermore, the prices are sometimes transferred to the final consumer, such as in the electricity generation sector. The cost-pass-through principle is used in this sector, and the price is directly reflected in final tariffs. Therefore, when modelling the energy demand, sectoral differences should be considered carefully.

Moreover, the price elasticities can be different among sectors. Consumers in the residential sector may be more sensitive to the price changes than that of the other sectors, such as industrial and commercial. In addition, the type of energy can be a significant determinant in terms of price variations. For example, the price elasticity of electricity demand may differ than that of the natural gas. For these reasons, the outcomes of the demand models are interpreted by taking account of the sectoral structures and the types of energy that used.

Details

- Pages

- 288

- Publication Year

- 2019

- ISBN (PDF)

- 9783631802526

- ISBN (Softcover)

- 9783631803325

- ISBN (ePUB)

- 9783631804209

- ISBN (MOBI)

- 9783631804216

- DOI

- 10.3726/b16350

- Language

- English

- Publication date

- 2019 (November)

- Keywords

- Energy Demand Energy Efficiency Energy Consumption Energy Security Energy Source Climate Change Sustainable Energy Environmental Pollution Renewable Energy

- Published

- Berlin, Bern, Bruxelles, New York, Oxford, Warszawa, Wien, 2019. 288 pp., 26 fig. b/w, 52 tables.

- Product Safety

- Peter Lang Group AG