Summary

Excerpt

Table Of Contents

- Cover

- Title

- Copyright

- About the author(s)/editor(s)

- About the book

- This eBook can be cited

- Foreword

- Contents

- An Empirical Research Study in the Textile Sector for the Relationship between Emotional Burnout and Anger

- Covert Marketing Strategy: An Alternative way to reach Consumers

- The Effects of Authentic Leadership Features on the Crisis Preparedness Levels of Organisations: A Case of Erdemli

- Relationship between Social Capital and Word of Mouth Marketing in Network Society: The Case of Silifke Vocational School

- The Perceptions of Health Personnel about Ethical Leadership Behaviour

- Developments Beginning From The Istanbul Stock Exchange To Borsa Istanbul

- The Effects of Organisational Capabilities on Innovative Performance: A Research Study at “Konya Teknokent”

- A Conceptual Study on Employer Branding at the intersection of Human Resources Management, Marketing and Communications

- Film-Induced Tourism: The Case of Rize, Turkey

- The Relationship Between type a Personality and Procrastination Tendency among Academics

- Relationship between Organisational Silence and Organisational Commitment: Moderating Role of Organisational Climate

- The Attitudes of Youth towards Brand: Is it Addiction or Loyalty?

- Relationship between Women Participation on Boards and Financial Performance: Evidence From Turkey

- Targeting Millennials in an Emerging Market: A Qualitative Study on the Value Systems of Generation Y in Turkey

- The Impact of Organisational Culture on Job Satisfaction: A Sectoral Research Study

- How does Strategic Staffing affect Innovation Performance of High-Tech Firms?

- Do Personality Traits have an Impact on Organisational Identification? A Field Survey

- Negative Income Tax as a Social Politics Instrument

- Study on the Socio-Economic Profile of Organic Food Consumers in Turkey

- Weber’s Pendulum: Perception of Authority at Work

- An Integrated Anp and Dea Approach for the Selection Problems

- The Relationship between the Corporate Social Responsibility Perception of Employees and Organisational Commitment: A Research Study in the Banking Industry

- Content Analysis of Job Advertisements in Newspapers Published in Ottoman Turkish

- The Effects of Nurses’ Mobbing Perceptions on their Working Performances

- An Application on Affecting of Institutionalisation Dimensions on Consumer Behaviours. An Accommodation Business Sample

- The Impacts of the Demographic Variances of Tourism Students on State-Trait Anxiety Levels

- Corporate Reputation and Marketing Activities

- Earth’s Struggle for Existence against Consumption Ghost

- The Impact of Privatisation on Earnings in Transition Countries

- Fascism and its Body Politics

- Why do we still need so many Human Resources Professionals?

- Impact of Tax Burden and Tax Responsibility on Assignment of Obligations

- Evaluation of Time Management and Academic Achievement: A Vocational School of Health Services Students’ Sample

- The Impact of Organisational Culture on the Two-Factor Model of Environmental and Psychological Empowerment: An Assessment of Behavioural and Motivational Approaches

- Should the “Grumpy” Cynical Stay or Leave?: An Empirical Study on the Relationship of Organisational Cynicism and Job Satisfaction

- Increasing Work Accidents in Turkey and their Socio-Economic Impact

- Gender-Based differences in Risk-Taking Behaviour: A Neuro Economics Approach

- Quality Costs and Reporting of Quality Costs: An Application in the Dyeing and Finishing Industry

- Relationships between Loan Usage and Growth in Turkey

- Overview of Public Administration Discipline in Turkey Specific to the Journal of Public Administration

- Students’ Perception of Accounting Information Systems: Hitit University Application

- The Change of Logistics Organisations Caused by Globalisation

- The Effects of Ethical Leadership on Mobbing: A Research Study on Healthcare Organisations

- The Level of Information Technologies in the Logistics Sector

- An Investigation of Unemployed University Graduates’ Depression Levels: The Case of Çanakkale Province

- Industrial Relations and Turkey Sample as a Function of Human Resources

- According to Macro Health Manpower Planning Distribution and Number of Health Manpower in Turkey for the Period of 2002–

- An Analysis of The Effect of Ramadan on Istanbul Stock Exchange

- A Study on the Investment Tendencies of Families by Different Stages of their Life Cycles

- A Survey of Managerial Perspective on Corporate Dividend Policy: Evidence from Turkish Listed Firms

- The Relationship between Exchange Rate and Foreign Trade in Turkey: A Cointegration Analysis

Introduction

Maslach and Jackson (1984) describe the term “burnout” as a psychological syndrome that is characterised by a negative emotional reaction to one’s job as a consequence of extended exposure to a stressful work environment (Maslach et al., 2001; Byrne et al., 2013). Historically, work-related burnout has been conceptualised as a three-dimensional construct, consisting of depersonalisation, diminished personal accomplishment, and emotional exhaustion (Purvanova and Muros, 2010). Depersonalisation captures how an individual relates to his or her job and describes the development of negative, cynical feelings and attitudes towards recipients (customers/clients) of one’s services (Maslach et al., 2001; Byrne et al., 2013). The second component of burnout (diminished personal accomplishment) entails low motivation, inefficiency, and reduced self-esteem and is associated with the belief that future efforts are not worthwhile as past efforts have repeatedly failed to produce desired results (Yavas et al., 2013). The third dimension, emotional exhaustion, is a key aspect of the burnout syndrome (Byrne et al., 2013). Emotional exhaustion is defined as “feelings of overextension and exhaustion caused by daily work pressure or emotional overload” (Whitaker, 1996).

Emotional exhaustion is a state of depletion of the energy of one’s emotional resources, an experience of being emotionally drained due to workplace stress factors (Gama et al., 2014). Also, anger is an emotional reaction to daily negative situations. If anger is not expressed in a healthy and restrained manner, it can lead to many psychological (depressive) and physical diseases such as hypertension, coronary arterial disease, and cancer. While anger causes hypertension, the incapability to express anger in an appropriate way leads to emotional and physical exhaustion (Pervichko, et al., 2013; Ahola et al., 2014; Leon et al., 2014; Jang et al., 2014; Tel, 2013; Scott, et al., 2013). In other words, if anger is not expressed in a healthy and restrained manner in the workplace, it may promote high blood pressure (hypertension) followed by physical and emotional exhaustion. Therefore, we assume that anger is related to emotional exhaustion. This research examines the levels of anger and emotional exhaustion (burnout) experienced by ← 15 | 16 → employees in the textile sector. This research also aims to explore the extent to which trait anger, anger expression-out, anger expression-in, and anger-control variables explain the variation in the levels of emotional exhaustion (burnout).

The trait anger scale measures the general disposition towards angry feelings and the tendency to express anger when one is criticised. Anger expression-out measures the expression of anger towards other people or objects in the environment, while anger expression-in assesses the holding in or suppression of angry feelings. Finally, the anger-control scale assesses the control of angry feelings by calming down or preventing the expression of anger towards other people or objects in the environment (Leon et al., 2014; Tel, 2013).

Methods

In this study, data were collected through a questionnaire composed of three parts. The first part is a demographic survey that includes six items. Also, seven items (Maslach Burnout Inventory) exist on the second part of the questionnaire to measure the emotional exhaustion (burnout) of employees. The last part consists of 34 items to measure trait anger and trait anger expression. The trait anger scale was developed by Spielberger et al. in 1983 and Turkish validity and reliability tests were performed by Özer in 1984 (Tel, 2013). Ten items of the inventory were developed to measure trait anger. Trait anger expression is clustered into three subscales: anger-in (eight items), anger-out (eight items), and anger control (eight items). PSS pc + version 20.0 was used for statistical analysis in the study. Correlation and regression analysis were used to test the relations between the research variables. In other words, correlation and regression analysis were used to test the following hypothesis (H):

H1: There is a positive relationship between employee trait anger and emotional exhaustion (burnout).

H2: There is a positive relationship between employee anger-in and emotional exhaustion (burnout).

H3: There is a positive relationship between employee anger-out and emotional exhaustion (burnout).

H4: There is a negative relationship between employee anger-control and emotional exhaustion (burnout).

Findings

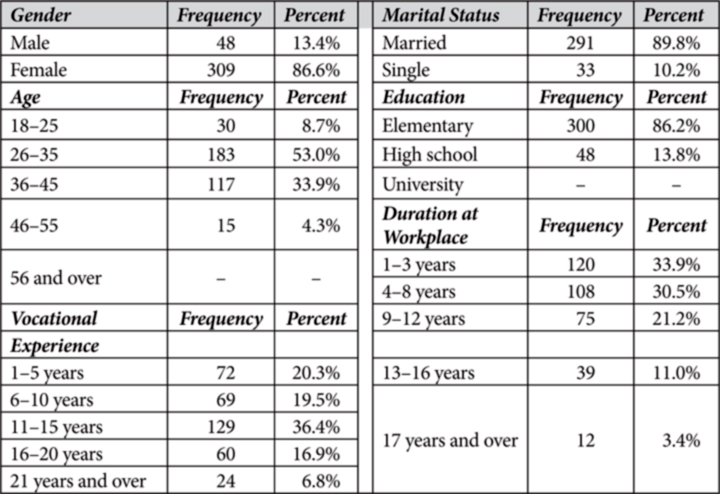

As is shown in Table 1, a total of 357 completed questionnaires were returned (59.5% response rate) from 600 employees of three textile firms which are producing towels and bathrobes in Denizli, a city in the Aegean Region of Turkey. The findings shown ← 16 | 17 → in Table 1 indicate that 13.4% were male and 86.6% were female. Also, 89.8% of employees were married and 10.2% were single. Employees were categorised by age: 18–25 years (8.7%), 26–35 years (53.0%), 36–45 years (33.9%), 46–55 years (4.3%), and 56 years and over (0%). Vocational experience was also assessed using categorical brackets; 20.3% of the employees had between one to five years of experience, 19.5% had between six to ten years of experience, 36.4% (majority) had between 11–15 years experience, 16.9% had between 16–20 years experience, and 6.8% had 21 or more years of experience. Employees were also categorised by workplace experience, as follows: one to three years (33.9%), four to eight years (30.5%), nine to twelve years (21.2%), 13–16 years (11.0%), and 17 years and over (3.4%). The majority (86.2%) of the employees held elementary school degrees, while only 13.8% had high school degrees and no one had a university degree.

Table 1: Demographic findings for employees

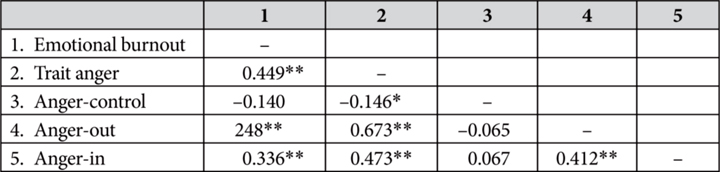

Intercorrelations among research variables are reported in Table 2. As is shown in Table 2, there was a significant positive relationship between emotional exhaustion (burnout) and trait anger (rs = 0.449, p< 0.01). Emotional exhaustion was also positively related to anger-out (rs = 0.248, p< 0.01) and anger-in (rs = 0.336, p< 0.01). The results in Table 2 indicate that emotional exhaustion was not related to anger-control. ← 17 | 18 →

Table 2: Correlation values for research variables

* Correlation (Spearman’s rho) is significant at the 0.05 level (two-tailed).

** Correlation (Spearman’s rho) is significant at the 0.01 level (two-tailed).

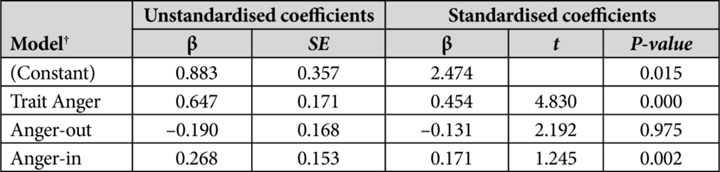

As is shown in Table 3 (adjusted R2 = 0.207), 20.7% of the variance in emotional exhaustion (burnout) could be explained by the set of independent variables trait anger, anger-out, and anger-in. Trait anger had the strongest influence on emotional exhaustion (burnout) (β = 0.454, p < 0.05), followed by anger-in (β = 0.171, p < 0.05) and anger-out (β = –0.131, p < 0.05).

Table 3: Model of emotional exhaustion (burnout)-simultaneous multiple regression

† R2 = 0.229, adjusted R2 = 0.207; dependent variable: emotional exhaustion (burnout).

* 0.05.

Consequently, all the results shown above indicate that all of our research hypotheses except for H4 were supported. Our first hypothesis (H1) expected a positive association between emotional exhaustion (burnout) and trait anger. Spearman correlation and regression analysis results confirmed that there was a significant positive association between emotional exhaustion and trait anger (p<0.05). Moreover, the results of regression analyses (presented in Table 3) indicate that anger-in was the second major determinant of emotional exhaustion. In other words, H2, which predicted a positive association between employee emotional exhaustion and anger-in, was supported (p<0.05). Additionally, Spearman correlation and regression analysis results indicated that there was a positive association between employee emotional exhaustion and anger-out (H3), but no association between employee emotional exhaustion and anger-control (H4). ← 18 | 19 →

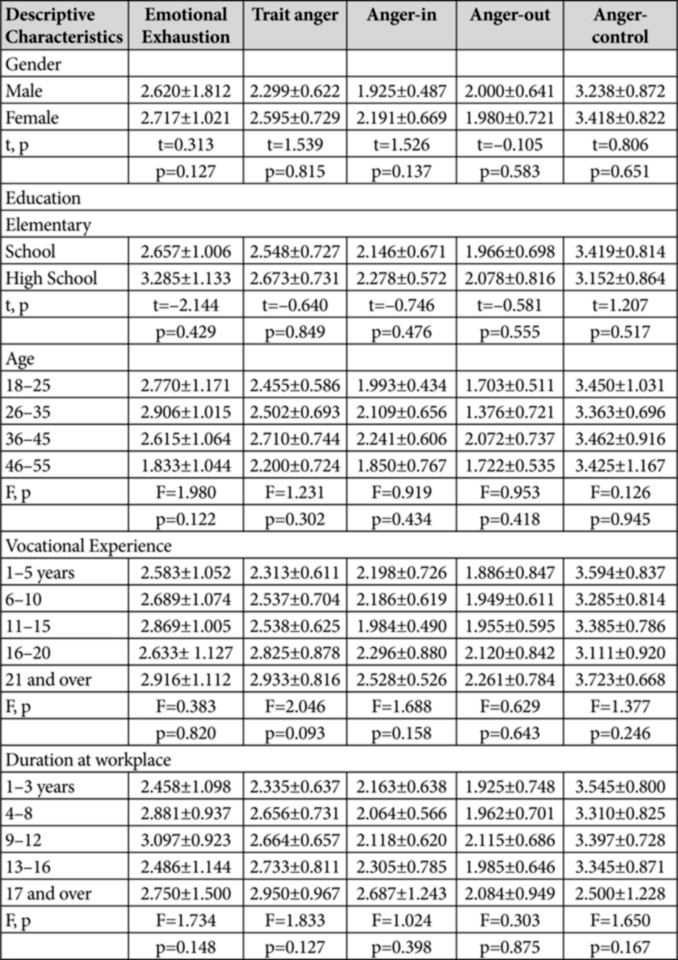

Table 4: Emotional exhaustion (burnout) and anger according to demographic characteristics of the employees

Table 4 shows the emotional exhaustion (burnout) and anger scores of the employees according to descriptive (demographic) characteristics. According to the test results (t-test and ANOVA) shown in Table 4, there were no statistically significant differences between emotional exhaustion scores of the employees in terms of gender, age, educational level, vocational experience, and duration at the workplace (p<0.05). Also, it was found that there were no statistically significant differences between anger scores and demographic characteristics of the employees in terms of gender, age, educational level, vocational experience, and duration at the workplace (p<0.05).

Discussion

Anger is one of the basic emotions and has deleterious consequences on physical and psychological health. Also, medical experts say that psychosocial and biological factors contribute to anger (Leon et al., 2014; Staicu and Cutov, 2010). For example, suppressed tendency to become irritated, being unsatisfied with career possibilities, and having high professional standards but a low level of freedom in decision-making processes are among the psychological factors promoting hypertension at work (Pervichko et al., 2013). In other words, people who work under emotional stress have high blood pressure (hypertension). Moreover, Pervichko and others (2013) found that patient’s blood pressures were statistically higher on working days compared to on days off.

Also, our study demonstrated that there was a significant positive relationship between employee anger and emotional exhaustion (burnout). All of our 357 participants (employees) were working in the manufacturing departments of the textile firms and facing work-stressors such as time-pressure (sewing-ironing a definite number of towels/bathrobes in a definite time), high quality standards (avoiding sewing/ironing mistakes), work accidents, etc. So, it is necessary to determine causes of anger, anger among employees, to express anger in a proper way, and to plan approaches that prevent anger. Also, in textile firms, further research is need to confirm the results of this study and to determine the relationship between employee anger and psychological-physical health problems.

References

Ahola, K., Hakanen, J., Perhoniemi, R. and Mutanen, P. (2014), Relationship between burnout and depressive symptoms: A study using the person-centred approach. Burnout Research, 1, pp. 29–37. ← 20 | 21 →

Byrne, M., Chughtai, A., Flood, B., Murphy, E. and Willis, P. (2013), Burnout among accounting and finance academics in Ireland. International Journal of Educational Management, 27(2), pp. 127–141.

Gama, G., Barbosa, F. and Vieira, M. (2014), Personal determinants of nurses’ burnout in end of life care. European Journal of Oncology Nursing, 30, pp. 1–7.

Jang, J. M., Park, J. I., Oh, K. Y, Lee, K. H., Kim, M. S., Yoon, M. S., Ko, S. H., Cho, H. C. and Chung, Y. C. (2014), Predictors of suicidal ideation in a community sample: Roles of anger, self-esteem, and depression. Psychiatry Research, 216, pp. 74–81.

Leon, J. B., Fontcuberta, A. L., Mitchell, A. J., Garcia, S. M. and Martin, P. M. (2014), Multiple sclerosis with high trait anger: A case-control study. Journal of the Neurological Sciences, 340, pp. 69–74.

Maslach, C. and Jacjson, S. (1984), Patterns of burnout among a national sample of public contact workers. Journal of Health and Human Resources Administration, 7(2), pp. 189–212.

Maslach, C., Schaufeli, W. B., and Leiter, M. P. (2001), Job burnout. Annual Review of Psychology, 52(1), pp. 397–422.

Özer, A. K. (1994), Pre-research of scales of trait anger and anger expression patterns. Turkish Psychology Journal, 9(31), pp. 26–35.

Pervichko, E., Zinchenko, Y. and Ostroumova, O. (2013), Personal factors of emotional burnout in patients with hypertension at work. Social and Behavioral Sciences, 86, pp. 407–412.

Purvanova, R. K. and Muros, J. P. (2010), Gender differences in burnout: A meta-analysis. Journal of Vocational Behavior, 77, pp. 168–185.

Scott, W., Trost, Z., Bernier, E. and Sullivan, M. J. L. (2013), Anger differentially mediates the relationship between perceived injustice and chronic pain outcomes. Pain, 154, pp. 1691–1698.

Staicu, M. I. and Cutov, M. (2010), Anger and health risk behaviors. Journal of Med Life, 3, pp. 372–375.

Tel, H. (2013), Anger and depression among the elderly people with hypertension. Neurology, Psychiatry and Brain Research, 19, pp. 109–113.

Whitaker, K. S. (1996), Exploring causes of principal burnout. Journal of Educational Administration, 34(1), pp. 60–71.

Yavas, U., Babakus, E. and Karatepe, O. M. (2013), Does hope moderate the impact of job burnout on frontline bank employees’ in-role and extra-role performances?. International Journal of Bank Marketing, 31(1), pp. 56–70.

Covert Marketing Strategy: An Alternative way to reach Consumers

Introduction

Nowadays, conditions of the social, economic, political, and cultural fields have changed more greatly than in the past; moreover, upheavals, wars and crises all over the world have led to large fluctuations in the economic sphere. However, due to technological advances, it is possible to operate a business and communicate on electronic media; thus, it has provided an important contribution to the ongoing process of change. By the acceleration of developments experienced in the field of science and technology, it has started the process of change and transformation which has never been worldwide in recent years. Especially, the reality that advances in mass communication technologies has minimised the huge sphere where human beings live cannot be ignored (Perşembe, 2005: 103–104). The concept of “postmodern” is frequently used to explain such change and transformation process like this (Odabaşı and Kılıçer, 2010: 32). Conditions and the sensitivity of the postmodern era has led to various changes of the modern era’s consumer and consumption perspectives. Understanding the modern marketing definition of the consumer as “they are conscious and informed consumers who have purchase willpower” is important; however, the postmodern marketing concept has completely changed this consumer definition. Instead of relying on a stable group of consumers, new consumers have now emerged that often alter decisions and have weak brand loyalty. Moreover, these consumers move on a slippery surface with instant purchase decisions and value the shopping experience rather than rational thought. (Babacan and Onat, 2002: 14). Faced with this situation, marketing executives have begun to lose their ability to predict the behaviour of consumers and gain control over them. Some concepts such as single voice and vision, coherence, and coordination only benefit firms to a limited ← 23 | 24 → extent against the fragmented, diversified, differentiated, and complex consumer base. Integrated applications for this audience can create resentment and may also reduce interest to the market presentation. (Odabaşı and Kılıçer, 2010: 42). Depending on whether the possibility to change the consumers that are located in the new order exists, firms should review their existing strategies.

This study, at a period of finding alternative ways for firms, handles a strategy which is conceptualised in recent literatüre as covert marketing. If the firms can use the “covert strategy” in the marketing communication process at the right time in a carefully implemented and subtle manner, it will provide a significant advantage to firms in competition. The covert marketing strategy is discussed theoretically in this study and it is an important issue that should be on the agenda in the marketing community. By examining many firms, it appears that this strategy is applied in many different ways and using different techniques, and because of that, this strategy must be handled more scientifically by academics. From this perspective, this study discusses how this strategy evolved from the past to the present and presents the reasons that affect the emergence of this strategy. Then, the strategy will be integrated into the marketing communication process. The study will be concluded by discussing the ethical dimensions and by giving some suggestions.

Methods

The first traces of any study on the covert marketing strategy are found in Vance Packard’s “The Hidden Persuaders” book published in 1957 (Roy & Chattopadhyay, 2010: 70). For a long time, the subject stayed away from the academic community’s attention and interest until an article published by Balasubramanian in 1994. After this date, scholars, practitioners, and journalists began to get interested in the subject.

In his article, Balasubramanian (1994) focused on the message to create a new message by combining the two different marketing application (ad and publicity) features. However, in articles published up to 2004, the subject is either handled as a fairly narrow range or is described by only focusing on the major applications, as it can be seen that the strategy sufficiently clarified (Nebenzahl & Jaffe, 1998; McAllister & Turow, 2002; Grazioli & Jarvenpaa, 2003). In Turkey, the covert marketing strategy is encountered in an explanation which was made for brand placement by Odabaşı & Oyman (2009: 377). Following this, Kaya (2010) gave an explanation for the concept in his book. In the literature, it can be said that the strategy has been defined for the first time in 2004 by Kaikati and Kaikati. Authors discussed the strategy as creating a positive word of mouth by getting the right ← 24 | 25 → people and whispering messages to them. Thus, instead of making marketing efforts to the overall market, selecting a few individuals and getting the commercial message to them will result in positive spreading. In the following years, studies conducted have continued to costantly expand the scope of the pioneering studies (i.e.Weisberg et al., 2007). One of them is Milne et al.’s (2008) study. They have improved the scope of the strategy by taking the strategy to the online environment and explaining how to implement it in the virtual world. Petty and Andrews (2008) have stated that the covert marketing strategy has three sub-types: masked, mole, and mental marketing. From the masked marketing perspective, they have recommended a typology to determine whether the techniques may be deceptive to consumers. To accomplish this, the authors applied the Federal Trade Commission’s three-part definition in the evaluation of the techniques. Another study was conducted by Roy and Chattopadhyay (2010). In their study, researchers were given a comprehensive definition and suggested a typology based on whether businesses or competitors were aware of the techniques and whether the techniques were visible to the targeted customers. They changed the viewpoint and the definition of the strategy and they also showed that the strategy can be used by marketing mixedelements. In recent literature, as well as the theoretical studies, we have encountered some practical studies that have been conducted to understand the strategy. In this respect, studies that are examining the ethical dimensions of the strategy (Crescenti, 2005; Goodman, 2006; Martin and Smith, 2008) with efforts to determine the attitudes of consumers towards the strategy (Campell et al., 2013) were conducted. However, these studies demonstrate that the evaluation and attitude towards the brand are not sufficient, so consumers’ attitudes towards these strategies need to be addressed with very different dimensions. Besides the academic field, some researchers, journalists, and marketing consultants have handled the covert marketing subject on their own sites or in magazine and journal columnists (Walker, 2004; Balter, Butman, 2006; Canşen, 2011).

With this study, in the line and basis of earlier studies, different from them, a number of common points are discussed. The first difference in this article is that covert marketing is considered as a new generation marketing strategy. Furthermore, we argue that at the beginning of the communication process, a decision is given about whether or not to disclose a firm’s real identity and the message is prepared according to this decision. In addition, at the second phase of the communication process, the decision of the cover level over the message is not only hiding the commercial intent but also hiding how the message would be transmitted (overt or covert). It seems that the usage of this strategy occurs in a very large ← 25 | 26 → range; because of this, the “cover” should be shown in the process of marketing communication which is highlighted and modeled with this study.

Today’s emerging consumers put the value offered by the firm above money and expect high quality goods and services (Roy and Chattopadhyay, 2010: 69). Therefore, the postmodern consumer tendency to switch between brands has greatly increased. Solomon (2003: 220) has claimed that consumers are skeptical towards commercials which they watch on television and many researchers have supported these claims through a scientific perspective (i.e. Darke & Ritchie, 2007; Petty & Andrews, 2008). New generation consumers have the power to prevent marketing messages through technology. By the proliferation of digital video recorders devices, caller ID systems, and pop-up and spam blocker softwares, consumers can easily avoid these messages (Martin and Smith, 2008: 46; Weisberg et al., 2007: 92). The last development against the firm is the addition of the increasing number of consumers with each passing day; this is a positive development and the number of products placed on the marketplace and the numbers of competitors are increasing simultaneously. As Roy and Chattopadhyay (2010: 69) stated, the marketplace continues to be crowded and marketers have to exceed this crowd. They have to struggle quite intensely to be seen and heard over the crowd. Because of all these developments, firms have become likely to apply methods that are implemented more subtly and can overcome consumer’s defensive shields to express themselves to consumer groups. In an era of crowded media and increased saturation, diminishing of the prestige and credibility, in some cases where the marketing efforts couldn’t be isolated from the activities, will be more successful (Kaya, 2010: 329–330). Contrary to this situation, covert marketing is an alternative strategy that conveys the messages to consumers by catching them at their most vulnerable spots and penetrating at these points (Kaikati and Kaikati, 2004: 6). The basic principle of the strategy is that the consumer shouldn’t perceive the message’s commercial intent as much as possible (Roy, Chattopadhyay, 2010: 70); even if they perceived the intent, they shouldn’t realise the company sponsorship behind the message (Milne et al., 2007). While using the cover over the real source, consumer’s persuasion knowledge shouldn’t be activated so that it can be possible to avoid consumer skepticism to the message (Darke & Ritchie, 2007).

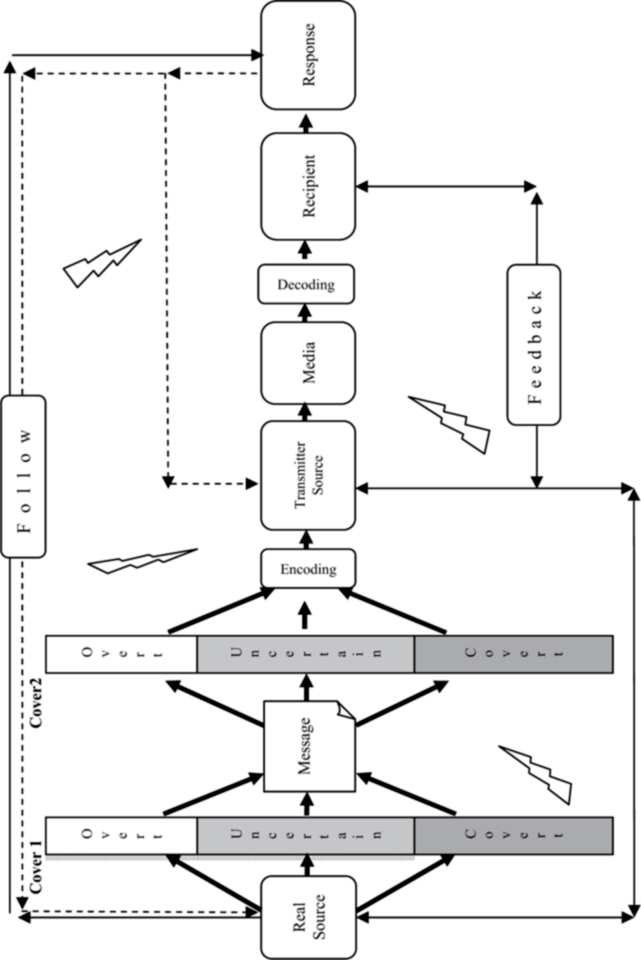

There are some definitions of covert marketing strategy included at this point. Scanlon and Hearn (2006: 1) defined the concept as a type of marketing where product promotion is made without revealing the existing connection between the advertiser and the message. In another definition, covert strategy is a deliberate act of entering, operating in, or exiting a market in a imperceptible manner ← 26 | 27 → (Roy and Chattopadhyay, 2010: 71). In line with the descriptions mentioned in the literature, covert marketing is a strategy that aims to transmit the message to consumers by using a specific level (overt, uncertain, covert) of cover on the message which is prepared in accordance with the ethical values of the real source which is the owner of the message. The main objective of this strategy is to catch the consumers at an unexpected time and place, to deliver commercial messages without arousing any suspicion, to ensure awareness of the product, and to initiate positive word of mouth about the product (Kaikati and Kaikati, 2004: 6). Therefore, we can say that the covert marketing strategy premises on the spirit of the guerilla marketing strategies and the power of word of mouth. This strategy has the possibility to be applied in a wide area. The limit is the imagination of marketers. Therefore, integrating this cover to the marketing communication process is required. When creating this new generation marketing communication model, we were inspired by Lazarsfeld two-stepflow communication model which was mentioned in the 1940s; the process of this model is built-on the traditional marketing communication model. It is shown in Figure 1.

At the beginning of the process, the item named “Real Source” is the owner and creator of the message. In the model, the first cover is located on this item. The aim of using a cover here is to determine at what level the real source identity will be disclosed to the recipient. After deciding what level of cover will be used on this item, the message is prepared with commercial intent. Here, marketers are determining what information will be in the message on one hand, and on the other hand, how the message will be perceived by the receiver and on what level this message will be open to the recipient. For this purpose, a second cover is used in this section. Once they have decided the level of cover on the message, they then start the encoding process. The encoding process is performed according to the level of cover. Then, a secondary source, which will reach the message to the recipient, is determined. Due to the transmitter of the message to the recipient, we named this source as the “Transmitter Source.” The prepared message is directly delivered to this source because the transmitter source has been identified consciously by the real source. The transmitter source can be quite a variety things. For instance, the product itself, the other marketing mix tools, or the advertising agencies can be this source. ← 27 | 28 →

Figure 1: New generation marketing communication model

Apart from that, applying the technique of choice film producers, artists, writers, clerics, doctors, or educators, as well as youths, politicians, athletes, celebrities, or characters may be the source of the transmitter. The transmitter source conveys the message to the recipient in the preferred medium (virtual or real) by using a communication type (mass or interpersonal communication). The medium can be quite a variety things and is affected by the preferred transmitter source. For instance, the medium can include: television, radio, newspaper, magazines, billboards, concerts, social environments, places of worship, theaters, cinemas, books, poems, lyrics, arts, etc. After this stage, the message conveyed to recipient begins the process of decoding the message in line with their personal values, information processing style, experiences, and other personal characteristics. However, this decoding operation cannot always take place at that time because messages may be forwarded to be activated later. In a way that the recipient applied the decoding process, two factors will be revealed. The first can be found in the feedback. In such a case, it is considered that the recipient needed additional information to complete the missing data or in order to understand the message. This feedback is usually the first step to the transmitter source. If the recipient needs more detailed information or is concerned directly with the company and the real source can be determined, then the feedback can be returned to the real source. The second factor is the response. This response can currently be detected by the transmitter source and also be accessed to the real source. This response is about the recipient’s positive, negative, or neutral attitude towards the message. The recipient may not respond frankly. For this reason, to learn this response, the real source has to follow the recipient. Therefore, the control element of the process is the follow-up mechanism. One of the responsibilities incumbent upon the real source is to constantly activate the follow mechanism and keep it up to date. At the end of the process, the recipient gives three types of responses to the message: positive, negative, or neutral. In the case of a neutral response, it should be understood that the techniques have not shown the desired effect. Therefore, the message should be repeated or a different covert technique should be preferred otherwise the communication process will end. The second response is that a negative response is an undesirable condition. If the consumer has a negative attitude, it may cause irreparable wounds. In this respect, the situation must be treated quickly. If there is a possible misunderstanding for the recipient, it should be corrected and the conditions that cause adverse reactions should be abolished. Finally, the third response may be positive; this is the desired and targeted state. The process reaches success. The potential of starting positive word of mouth is quite high. It is expected that the recipient has become a transmitter source and will continue the process. But the issue to be considered here is that the control of ← 29 | 30 → the process leaves the firm. The last item of the model is the noise. This factor must be kept under control since it continuously affects the process from beginning to end. For this control, the follow-up function must be activated and solutions for noise which may cause deterioration in the process should be provided.

Since messages are involuntarily delivered to consumers, the ethical dimensions of the strategy can be inherent in the implementation of covert marketing strategies that are bringing ethical concerns together. The ethical dimensions of the strategy can be discussed within the framework from the perspectives of teleological and deontological approaches, of which theoretical approaches to ethics that have been mentioned utilitarianism, rights and justice approaches. To show the consumer as if they were not the property of the product, to promote the product by deliberately disregarding adverse effect or caused damage that may arise as a result of product use (i.e. not to specify the loss and information of slimming drugs), and to violate the consumer’s privacy and freedom are unacceptable by any discipline including from a marketing point of view. Considering the issue from the manufacturer’s perspective, as Branscum (2004) stated, professionals who are preparing and implementing covert campaigns do not accept that people were deceived and lied to; with this strategy, only the attention of people is trying to be attracted. Thus, a company that pays taxes in the country and contributes to employment and the economy, legally without any inconveniences to produce the product acting in accordance with ethical values (honesty, integrity), should promote its products. Otherwise, the firm’s legal rights are taken away. If the firms do not act according to ethical values, the strategy will become completely deceptive.

Discussion

Consumers of the twenty-first century are exposed to hundreds of commercial messages which are planned and crafted in an expert manner in order to influence and persuade them in the course of their daily lives. Most of these messages cannot be detected in the level of consciousness against those perceived messages by consumers that have developed a defense mechanism to avoid these messages and so they know very well how to deal with those messages. Consumers managed to overcome this issue with the help of technological developments. Hence, firms were compelled to explore or to create and implement alternative strategies and methods. Because of the difficulty of market conditions, it can be seen that firms sometimes enter into fields where ethical concerns are higher. With the scope of this study, an alternative strategy which companies have applied or may apply in order to overcome the insensitivity of the consumers against commercial messages is discussed. On the basis of the strategy, conveying the message directly ← 30 | 31 → to potential consumers or implicitly without disclosing the real identity of the firms is a lie. After receiving the message, consumer sales are not expected to happen. In fact, the goal is to create the infrastructure for future purchase, giving information about the product and ensuring consumer’s positive speech about the product in social, family, and friend environments. The success of the covert marketing strategy and achievement of results depends on several considerations. This strategy is used in conjunction with company’s pricing, distribution, and product policies. With the promotion of mixed elements that work in harmony and by creating a synergistic effect, company’s can achieve success. The strategy must be implemented in any form whatsoever within the frame of ethical issues, values, and limits. Immoral situations should not be included such as to deceive consumers, to deliberately misinform and manipulate them, or to violate privacy. Another important point is that markerting researchers should consistently monitor the response of consumers. In the future, the covert marketing strategy will find a large range of applications; the issue should be considered more widely. In addition, the implementations of the strategy’s impact on consumer attitudes and behaviour and acceptability by consumers should be dealt with through practical studies.

References

Babacan, M., & Onat, F. (2002), Postmodern Pazarlama Perspektifi. Ege Academic Review, v.2, issue 1, 11–20.

Balasubramanian, S. K. (1994), Beyond Advertising and Publicity: Hybrid Messages and Public Policy Issues, Journal of Advertising, 23: 29–46.

Balter, D., Butman, J. (2006), Clutter Cutter. Marketing Management, 15(4), 49–50.

Branscum, D., (2004), Marketing Under the Radar, www.corpwatch.org.

Details

- Pages

- 624

- Publication Year

- 2016

- ISBN (Softcover)

- 9783631666081

- ISBN (PDF)

- 9783653059656

- ISBN (MOBI)

- 9783653951998

- ISBN (ePUB)

- 9783653952001

- DOI

- 10.3726/978-3-653-05965-6

- Language

- English

- Publication date

- 2015 (October)

- Keywords

- Education Research Social Science

- Published

- Frankfurt am Main, Berlin, Bern, Bruxelles, New York, Oxford, Wien, 2015. 624 pp., 4 b/w fig., 161 tables, 41 graphs

- Product Safety

- Peter Lang Group AG